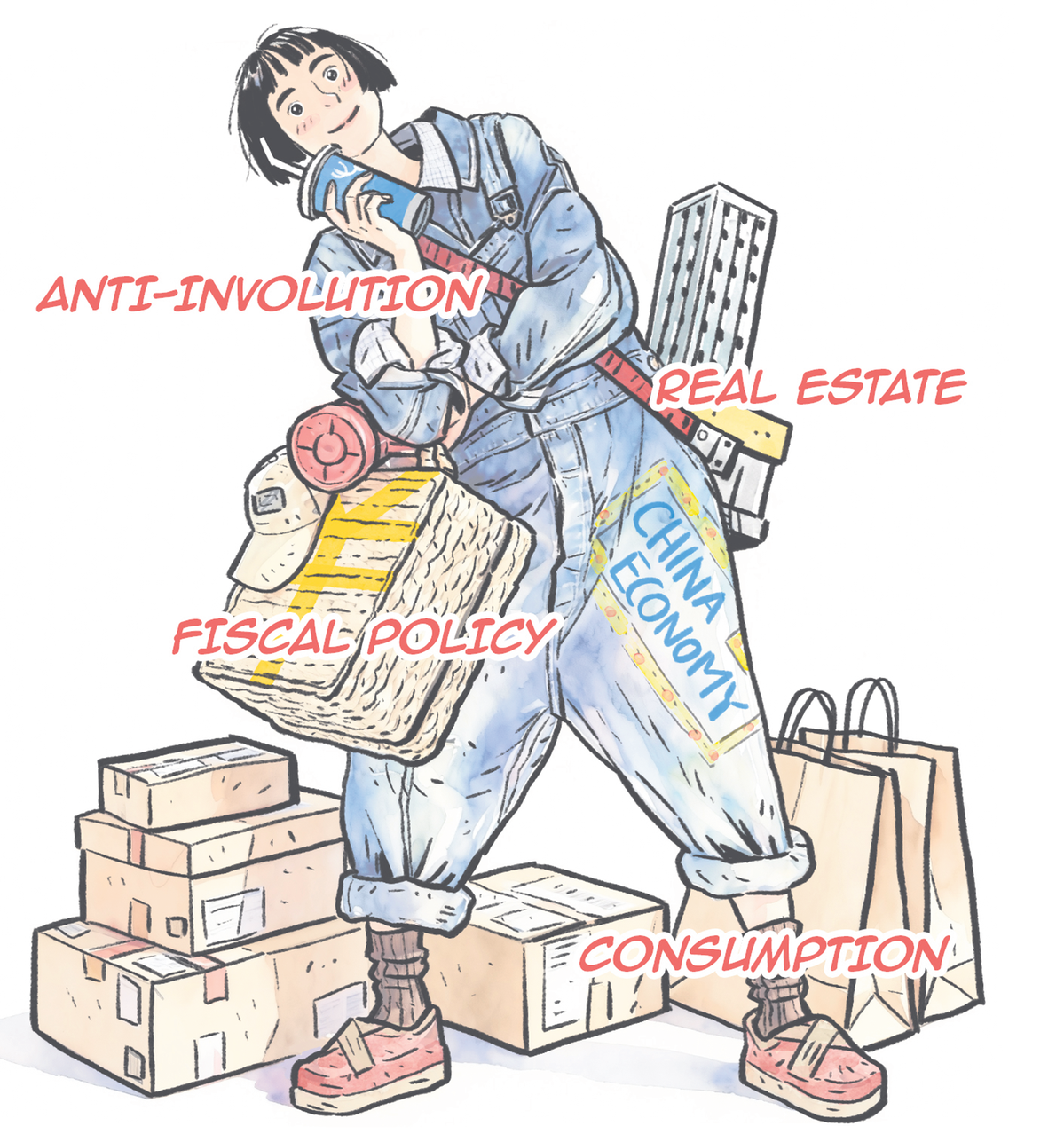

Greater policy emphasis on growth anticipated

The upcoming annual Central Economic Work Conference is garnering close attention because it sets the direction for next year's economic policy. With last year's high base in the fourth quarter and fading policy stimulus effects, the economy faces downward pressure in the final quarter of this year, which adds uncertainty to whether 2026 can begin with a strong start.

I expect the upcoming conference to place heavier emphasis on economic growth and roll out targeted measures in areas such as sustained fiscal support, boosting consumption, stabilizing the property market and addressing excessive competition.

Thanks to two major shifts in macro policy — namely stronger fiscal support and a shift in policy focus toward consumption, combined with better-than-expected exports — the economy grew solidly in the first half, showing strong resilience.

However, since the third quarter, growth momentum has weakened. The latest data show a broad slowdown in October in retail sales, investment and industrial output, revealing a clear softening of domestic demand. Given the high base in the fourth quarter of last year and the reduced effect of earlier policies, the economy faces significant downward pressure in the current quarter.

Seen from the fourth plenary session of the 20th Central Committee of the Communist Party of China, the authorities fully recognize the current downward pressure and are paying close attention to aligning long term development goals with the urgent need to stabilize growth.

Against this backdrop, and given that 2026 is the opening year of the 15th Five-Year Plan (2026-30), I expect the Central Economic Work Conference to give economic growth a higher priority and introduce targeted measures in the following areas.

First, fiscal policy will continue to play a strong role. Since the start of this year, fiscal policy has expanded in scale and moved quickly. This active fiscal stance has played a key role in supporting growth and reducing risks.

Looking ahead to next year, with monetary policy constrained by weak credit demand and shrinking bank margins, fiscal policy will remain the primary tool for supporting growth.

The deficit ratio in 2026 is expected to remain around 4 percent, with possible increases in the issuance of ultra-long-term special treasury bonds and local government special bonds.

Second, fiscal spending will be further optimized. Since the second half of this year, local governments have rolled out policies such as childcare subsidies, gradual expansion of free preschool education, and eldercare consumption subsidies for seniors with disabilities.

These moves show greater fiscal attention being paid to social well-being, with more resources invested directly in the citizenry.

Third, the authorities will continue to guard against local debt risks. Given the still heavy local debt burden, preventing and mitigating such risks will remain a major priority next year.

Thanks to policies such as trade-in programs for durable goods and special consumption promotion activities, household spending improved significantly from last year's fourth quarter to the first half of this year.

But as the base rose and the impact of trade in programs weakened, consumption momentum slowed in the third quarter. In October, retail sales growth eased to 2.9 percent year-on-year, and retail growth fell to 2.8 percent, marking the fifth straight month of decline.

With the high base, shifting subsidy policies and the impact of earlier demand, consumption growth is likely to slow further. In the first half of next year, consumption will continue to face considerable downward pressure.

Given the high priority placed on expanding domestic demand and boosting consumption in the 15th Five-Year Plan, policymakers may introduce more short-term measures that complement longer-term reforms and social spending.

Possible steps include expanding subsidy programs to cover categories such as maternity products and health-related goods, increasing fiscal support for services consumption, rolling out nationwide service vouchers or consumption subsidies, reducing unreasonable restrictions on consumption, and encouraging new areas such as leisure boat purchases.

Also, it is necessary to stabilize the property market as soon as possible. In recent months, the property market has weakened at a faster pace, with both sales volumes and prices declining.

As last September's property easing package created a high base, new home sales and sales value in October fell 19 percent and 24.2 percent year-on-year, respectively. Data showed that in the first 16 days of November, new home sales in 30 major cities dropped 37.6 percent year-on-year.

If the downturn persists, it will continue to weigh heavily on investment, consumption, local fiscal revenue and prices. It is, therefore, urgent for macro policy to halt the decline.

One approach would be to fully remove purchase restrictions in the biggest cities and further lower homebuying costs, including mortgage rates, down payment ratios and transaction taxes.

Another option is to consider creating a central government-funded stabilization facility that acquires land and unsold housing in major cities for public housing, easing inventory pressure and improving liquidity for developers while addressing public needs.

Structural reforms are also critical. A former finance minister said the most important structural reform for real estate transformation lies in reforming the household registration and land systems.

As the 15th Five-Year Plan places more emphasis on strengthening domestic circulation, building a unified national market becomes essential.

The plan's recommendations call for comprehensive action to curb excessive competition and establish a market environment characterized by quality, fair pricing and healthy competition.

They also call for regulating local government intervention, dismantling local protectionism and eliminating market fragmentation.

This marks a shift from the 2015-18 supply-side structural reforms, which focused mainly on upstream industries and administrative capacity cuts.

The current efforts target more downstream emerging industries such as solar power and new energy vehicles, with a policy focus on regulating the behavior of local governments and companies rather than administrative capacity cuts.

From my point of view, the root cause of excessive competition among local governments and enterprises lies in the fiscal system and performance evaluation mechanisms.

If this round of reforms can reduce excess capacity while strengthening a unified fiscal system, improving statistical and credit systems, and revising evaluation systems for high quality development and government performance, it would help reduce dependence on supply side measures and fundamentally curb excessive competition.

The writer is chief economist at Chinese e-commerce giant JD. This article was originally published on www.ftchinese.com.

The views do not necessarily reflect those of China Daily.