Chinese investors focus on UAE property market

With China's real estate sector undergoing a complex transition toward high-quality development amid an uncertain global economic outlook, countries involved in the Belt and Road Initiative are offering new opportunities for both individual and institutional investors, industry experts said at the 2025 Middle East Real Estate Investment Summit Forum in Shanghai on Tuesday.

China's 2025 Government Work Report called for advancing the BRI in greater depth, bringing more opportunities for both businesses and individuals. Against this backdrop, the forum served as both a bridge and an experiment, offering new perspectives for enterprises seeking transformation and market expansion, while also presenting opportunities for individual overseas property purchases and investments.

As the forum's host, China Real Estate Information Corporation released a report on the trends in the United Arab Emirates' residential market for the first half of 2025 during the event.

The report focuses on the fundamentals of the UAE's residential market, with Dubai and Abu Dhabi as the primary areas of analysis. Examining a wide range of factors such as trade performance, urban planning and real estate transaction patterns, the report looks to offer practical, data-driven insights for global investors, enterprises and researchers.

"Overseas property investment should concentrate on regional hub cities. In the Middle East, Dubai and Abu Dhabi stand out as the key destinations," said Ding Zuyu, chairman of China Real Estate Information Corporation.

Leading cities in mature markets, such as New York, London and Singapore, have long been magnets for real estate investment, said Ding. Similarly, as the UAE has established itself as a regional leader, its core cities of Dubai and Abu Dhabi function not just as national centers, but also as financial and economic hubs for the wider Middle East.

The report outlines three major strengths that underpin the UAE's property market: steady economic growth, strong demographic momentum and favorable policy support.

"There is a growing appetite from investors in China for Abu Dhabi. Therefore, we see that opportunity increasing as we invest more time here and build brand awareness," said Jonathan Emery, CEO of Aldar Development.

"With bilateral trade now approaching $100 billion, the scope for deeper cooperation is substantial," said Emery.

This overall momentum is being felt in the real estate market. As the capital's largest developer, investor and manager, Aldar's figures tell the story clearly: in 2024, overseas and expatriate buyers accounted for 78 percent of its UAE sales, up from just 21 percent in 2021.

According to Emery, a combined investment of $700 million has been made by Chinese investors in the UAE to date this year, "a demand not only from individuals but also from institutional investors".

"We would hope that the opportunity is to grow ... we are investing time in communication and working with partners," Emery added.

Nevertheless, experts cautioned that investors should closely monitor the sustainability of economic, demographic and policy trends in the UAE, while also remaining alert to geopolitical risks in the wider Middle East.

Today's Top News

- Foreign ministers of China, Egypt call for Gaza progress

- Shield machine achieves Yangtze tunnel milestone

- Expanding domestic demand a strategic move to sustain high-quality development

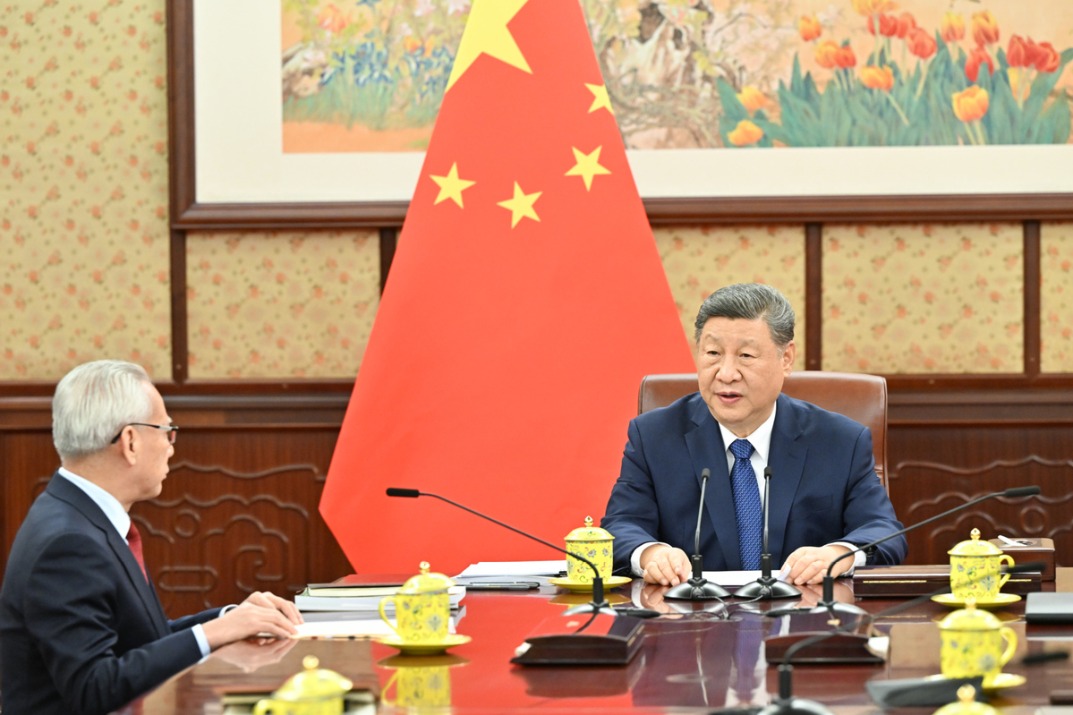

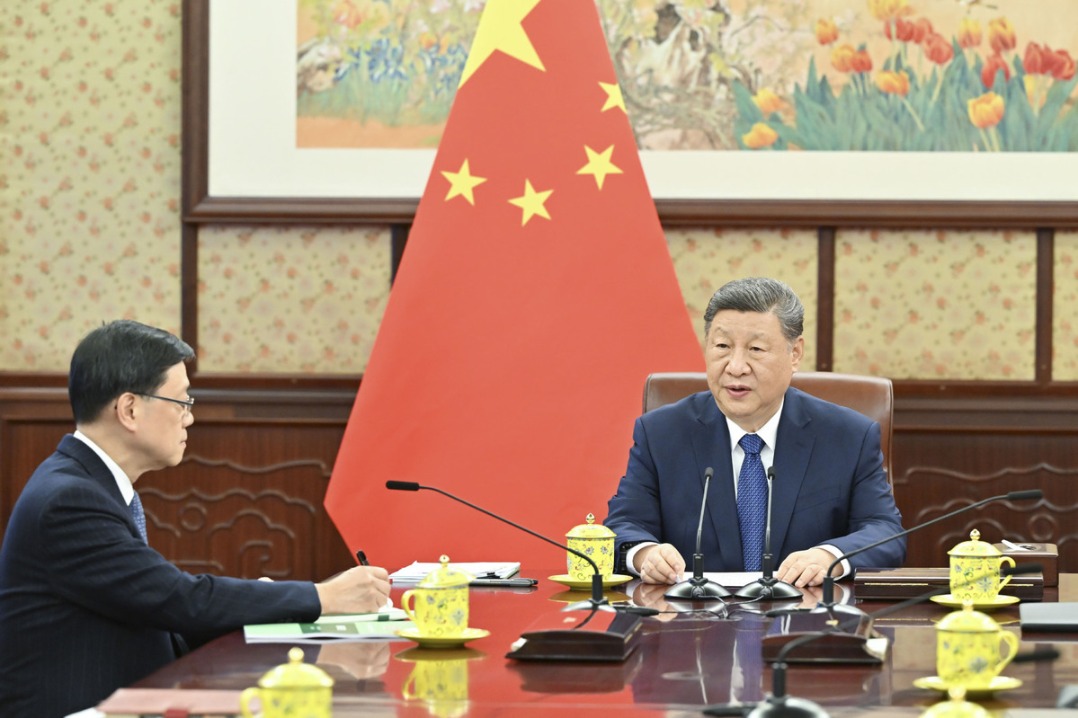

- Xi hears report from Macao SAR chief executive

- Xi hears report from HKSAR chief executive

- UN envoy calls on Japan to retract Taiwan comments