China targets disguised illicit gains

Judicial authorities issue guidance on handling money laundering cases

Chinese judicial authorities will step up efforts to curb the concealment or disguise of criminal proceeds, with a focus on adopting more precise and cautious measures, officials said on Monday.

The Supreme People's Court and the Supreme People's Procuratorate jointly released a judicial interpretation on handling criminal cases related to money laundering.

"Among offenses related to money laundering, the concealment or disguising of illicit gains is the most frequent crime in legal practice. It is also closely associated with crimes such as telecom fraud and online gambling," Luo Guoliang, chief judge of the top court's Fourth Criminal Division, told a news conference.

From 2020 to 2024, Chinese prosecutors initiated more than 230,000 cases in which criminal proceeds were concealed or disguised. Courts across the country concluded more than 220,000 such cases in the same period, according to official data.

"These numbers not only show the firm determination of judicial authorities to deter upstream crimes such as telecom scams and gambling, but also indicate our increasingly intensified strength in combating money laundering," Luo said.

He stressed the importance of recovering criminal proceeds, saying it contributes to maintaining judicial order, ensuring financial security and protecting people's property.

Luo noted that with socioeconomic development, methods used to conceal or disguise criminal proceeds have become more sophisticated and often involve organized groups. Issuing the judicial interpretation, he said, will help prosecutors and judges nationwide recover illicit gains more effectively and combat upstream crimes more precisely.

The 12-article interpretation, which takes effect on Tuesday, encourages people involved in concealing or disguising criminal proceeds to cooperate in tracing upstream crimes and to actively return illicit gains, as cooperation may lead to more lenient treatment.

The legal document also requires a comprehensive assessment to determine whether the crime has been constituted, rather than basing punishment solely on the amount of money involved.

"For example, judicial workers should be more prudent when dealing with cases where people use bank cards to conceal or transfer illicit proceeds, as some cardholders or card suppliers have little connection to upstream criminals and cannot control the scale or destination of the funds," said Wang Lei, a judge with the Supreme People's Court.

In March 2023, two people, surnamed Huang and Lin, were instructed by others to use bank cards to receive and transfer 1.65 million yuan ($230,744) in telecom fraud funds in Jiaxing, Zhejiang province.

The two were found guilty of concealing criminal proceeds and initially faced a sentence ranging from three to seven years, given the amount of money involved, according to a local court. But because they acted under the direction of scam ringleaders and had no control over the funds, earning less than 10,000 yuan in profits, the court showed leniency, sentencing each to two years in prison and fining them 10,000 yuan apiece.

The top court praised the ruling, noting that in the fast-developing digital era, many offenders who handle transfers and withdrawals with bank cards may be far removed from upstream criminals. Organizers of gambling operations or leaders of scams, it said, should bear the primary criminal liability.

"Judicial authorities should comprehensively and accurately assess each individual's role and involvement in a crime and impose appropriate penalties, instead of mechanically or blindly determining punishment based solely on the sum of their criminal proceeds," the court said.

Today's Top News

- A misjudgment of situation in the first place, destabilizing AUKUS deal may bite the dust: China Daily editorial

- Welcome would be welcomed if sincere: China Daily editorial

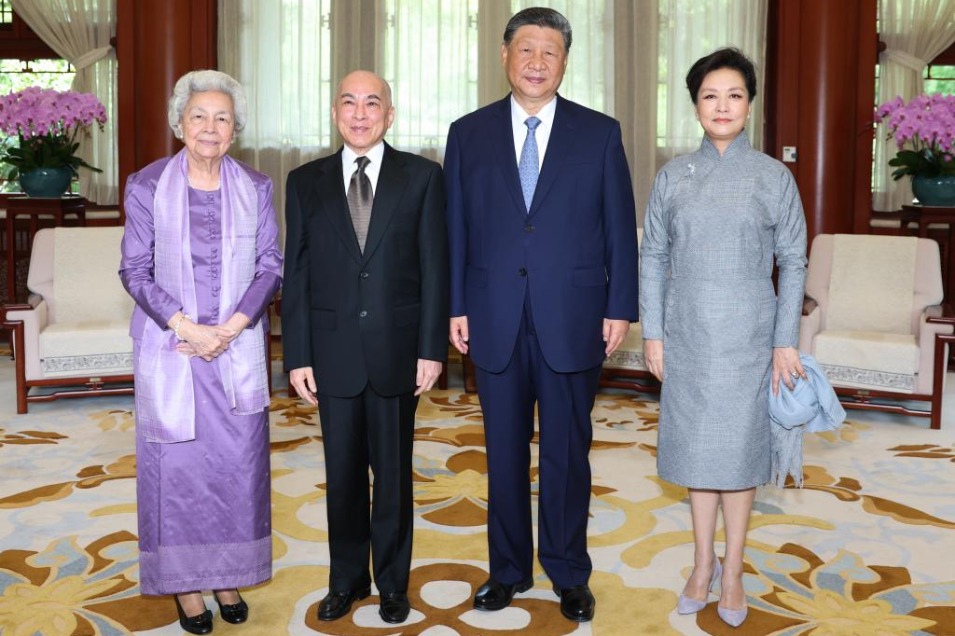

- Xi and his wife meet Cambodian King, Queen Mother

- Xi meets Russian State Duma chairman

- Parade a tribute to Chinese people's sacrifices in WWII

- SCO will strongly uphold multilateralism