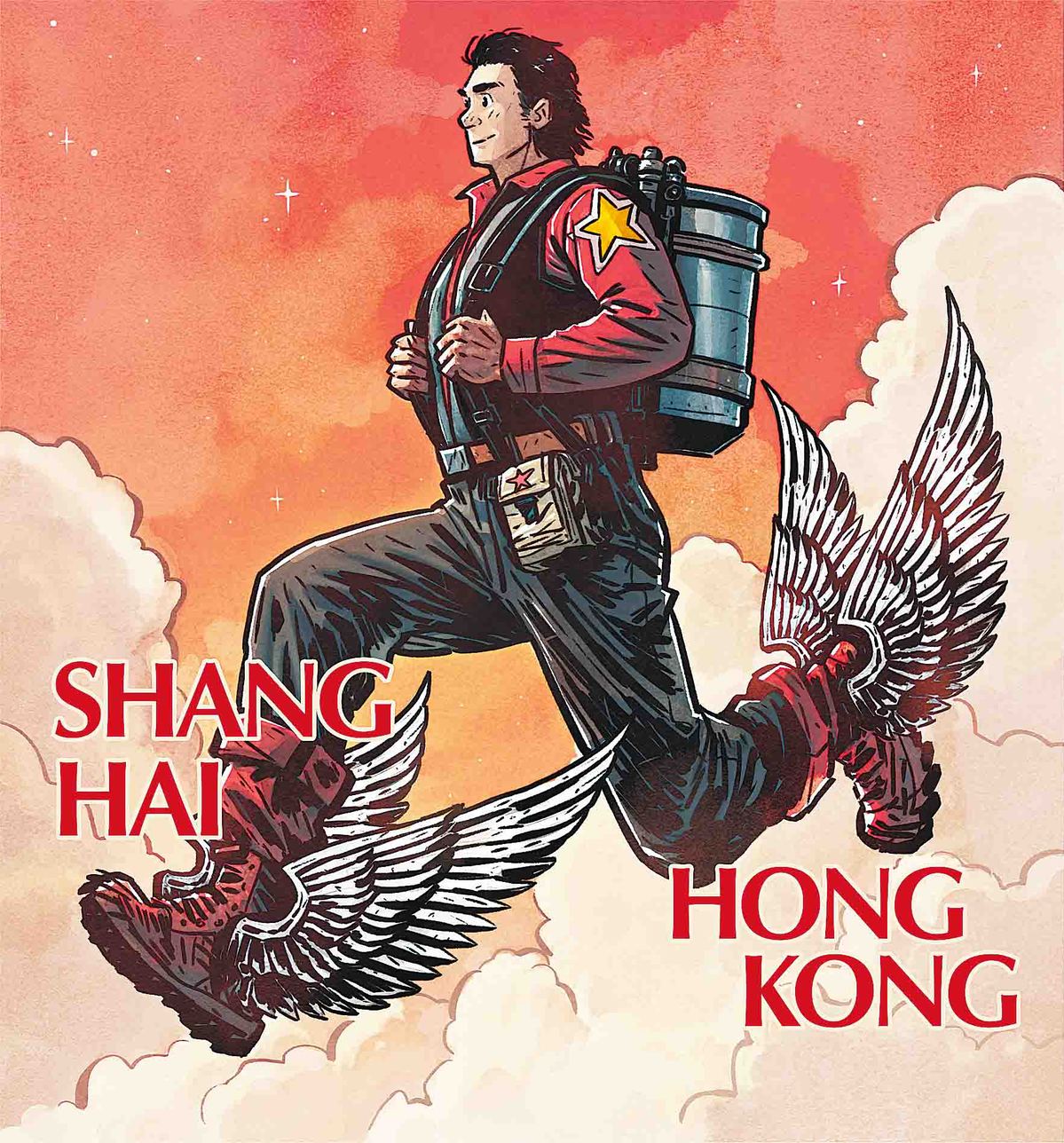

Shanghai, HK twin engines of financial strength

As the nation's two financial centers, Shanghai and Hong Kong both shoulder the responsibility of leading China's financial opening-up and innovation.

Through coordinated institutional opening-up, the two cities should serve the country's strategic safety while providing a "China plan" for the global market. By giving full play to both cities' strengths, China's financial internationalization will be advanced, as they serve as the onshore and offshore drivers.

Shanghai has largely succeeded in growing into a financial center reflecting China's economic strength and the renminbi's international status, covering major financial markets including stocks, bonds, foreign exchange, futures, insurance, gold, notes and carbon.

In 2024, the total transaction value of all the financial trading venues in Shanghai exceeded 3,650 trillion yuan ($509 trillion), up 8.2 percent year-on-year.

Shanghai Stock Exchange was the world's third-largest in terms of market capitalization and the fifth-largest if measured by transaction volume. The scale of crude oil futures trading at the Shanghai Futures Exchange ranked third globally.

The Shanghai International Reinsurance Exchange and the International Monetary Fund's Shanghai regional center were established last year. A total of 1,782 licensed financial institutions have set up operations in the city. Shanghai accounted for nearly half of the cross-border RMB settlements completed in China last year.

With a highly international financial market, Hong Kong is home to a large number of foreign banks and a free flow of capital, making it the world's largest offshore RMB hub. By the end of 2024, the total amount of RMB deposits in Hong Kong, including certificates of deposit, reached about 1.1 trillion yuan, providing liquidity support for global offshore RMB transactions and financial activities.

The RMB real-time payment settlement system in Hong Kong continues to grow, with an average daily transaction amount of nearly 3.1 trillion yuan in 2024, a year-on-year increase of 50 percent. Hong Kong handled about 75 percent of the world's offshore RMB payment transaction volume. It owns the world's largest offshore RMB capital pool, offshore RMB foreign exchange market, and over-the-counter interest rate derivatives market.

The international environment has become increasingly complex and capricious, facing the restructuring of global value chains, technological progress and the booming digital economy. All these have raised higher demands on China's deep participation in the international division of labor and global governance, as well as on financial support for the outbound reaches of enterprises. By the end of 2024, RMB had risen to become the fourth-largest payment currency and the third-largest trade financing currency globally.

Developing the RMB offshore market, strengthening the role of currency swaps and RMB clearing banks, enhancing cross-border payment, pricing and investment functions, and facilitating trade and investment financing, are key tasks proposed by China's central bank at the beginning of this year.

Against that backdrop, Shanghai and Hong Kong serving as the onshore and offshore drivers have become the inevitable choice to elevate China's comprehensive financial strength.

In the first place, the pricing mechanism for onshore and offshore RMB assets should be further completed. This way, the pricing efficiency of the onshore financial market can be enhanced, and the transmission of pricing from the onshore market to the offshore market can be smoother.

As the center of the onshore RMB market, Shanghai plays a crucial role in the pricing of RMB assets. The deeper connectivity between Shanghai and Hong Kong helps to form a more reasonable and transparent RMB exchange rate formation mechanism.

Second, regulatory communication and cooperation between Shanghai and Hong Kong should be strengthened, exploring institutional innovations that are more compatible with the international market.

As the forefront of China's financial opening-up, Shanghai and Hong Kong can jointly seek financial innovation and regulatory models that suit China's national conditions, especially in areas such as cross-border financial regulation, financial technology application and green finance development.

Third, closer ties should be built between the two cities to nurture more innovation in financial products and services, meet the diverse needs of investors and improve market liquidity and activity.

The integration of the two markets will attract more international financial institutions and investors. This is conducive to expanding the international usage of RMB and enhancing the currency's international influence, which in turn helps to accelerate the internationalization process of China's financial development.

The dual circulation jointly built by Shanghai and Hong Kong as the country's two currency hubs is especially important in light of the periodic fluctuations of the US dollar's credit cycle. This will facilitate RMB's internationalization and enhance China's influence in the global financial system.

Coordinated development of Shanghai and Hong Kong may refer to the experiences of London and New York.

With the formation of the Eurodollar market in Europe since the 1950s, US banks have massively entered London, progressively constructing a dollar circulation system of "New York capital outflow — London offshore cycle".

The regulatory systems of the UK and the US have formed differences in risk tolerance. This has led to differentiated market functions, with London focusing on creating offshore dollar liquidity, while New York dominating the pricing of equity assets. The two markets achieved cross-market risk hedging through the LIBOR-SOFR interest rate transmission mechanism.

After the 2008 global financial crisis, the UK and the US jointly participated in the establishment of the global regulatory framework and coordinated mechanisms for cross-border bank risk disposal, reducing risk transmission between the two markets. Central banks in both countries thus established a regular communication mechanism to exchange liquidity management strategies and stress test results periodically.

Furthermore, financial regulatory agencies in both cities closely cooperated in the regulation of stock markets, bond markets and financial derivatives markets, enhancing the security and compliance of cross-border financial transactions.

In terms of complementary strengths, New York leads financial product innovation thanks to its large and highly liquid domestic market, top-notch financial engineering talent, and risk capital aggregation advantages. US banks' London branches localize innovations such as quantitative trading models and structured product design, and then radiate globally through the European money market network.

Therefore, a three-dimensional collaboration model made up of mutual recognition of rules, data sharing and joint risk prevention should be built between Shanghai and Hong Kong, while Shanghai should seek more institutional innovation by making more first attempts.

Offshore financial pilot projects can be first experimented with in the China (Shanghai) Pilot Free Trade Zone, exploring the management model of RMB "external circulation" in the Shanghai-Hong Kong linkage.

The "sandbox" nature of financial technology accounts and the free convertibility of both domestic and foreign currencies provide a foundation for piloting and innovating offshore financial businesses at the Shanghai FTZ. With the continued expansion of the dual circulation of RMB domestically and internationally, China's monetary policy toolbox will be further enriched.

Meanwhile, it is necessary to strengthen regulatory cooperation between Shanghai and Hong Kong to safeguard financial security, reduce risks, and fully assess the differences in financial policies, taxation, and regulation between the two markets. This will buoy liquidity, effectively strengthen market stability and improve risk prevention capabilities.

The writer is a former counselor and former director-general of the statistics and analysis department of the People's Bank of China.

The views do not necessarily reflect those of China Daily.