China's leading shopping center operators shift focus to operational efficiency

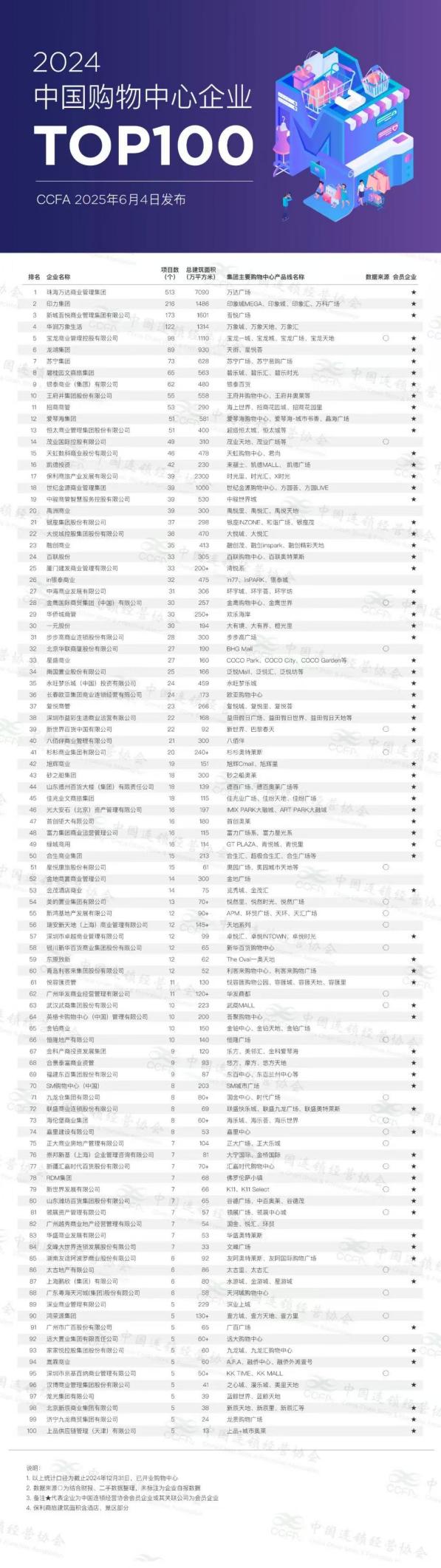

The China Chain Store & Franchise Association has released the 2024 China Shopping Center Enterprise TOP100 list, showing leading shopping center operators focusing on operational efficiency to increase growth.

Based on data from the 2024 Shopping Center Enterprise Survey, as of Dec 31, 2024, the top 100 shopping center operators collectively managed 3,067 shopping centers—each with a construction area exceeding 30,000 square meters.

These projects together span about 339.06 million square meters, with an average project size of around 105,000 square meters.

Market concentration among leading players continues to rise. The top four operators—each managing over 100 centers—collectively run 1,024 shopping centers, accounting for 33.4 percent of all projects within the TOP100 list.

Despite the large overall footprint, the pace of new developments has slowed. In 2024, more than 400 new shopping centers were launched nationwide, indicating a shift in industry focus from development-led expansion to operation-driven growth.

In terms of new project launches in 2024, the top five companies by number of openings were Zhuhai Wanda Commercial Management Group – 25 centers, China Resources Mixc Lifestyle – 21 centers, Seazen Holdings Co Ltd – 15 centers, Longfor Group – 10 centers, and China Merchants Commercial Management – 10 centers.

Looking ahead to 2025, leading the pipeline is Zhuhai Wanda Commercial Management Group, with 30 new centers scheduled to open. It is followed by Aegean Group – 13 centers, Longfor Group – 12 centers, China Merchants Commercial Management – 10 centers, and SCPG – 9 centers.