Single-market integration and reforms help revive EU market

The euro's recent rally against the dollar has caught global markets off guard, but for European Central Bank President Christine Lagarde it is a "justified" and even opportune shift given that the US government has lately changed the state of play in three key pillars of international cooperation — the economy, politics and defense.

In an interview with French media La Tribune Dimanche published on Saturday, she attributed the currency's strength to the "uncertainty" of US policies, a thinly veiled critique of Washington's erratic fiscal and trade maneuvers.

Lagarde and other ECB policymakers believe that with the United States grappling with political uncertainty and inflationary missteps, the eurozone is emerging as a bastion of stability. This shift is not merely about exchange rates, it is a geopolitical signal. Europe, long overshadowed by the dollar's dominance, now has a chance to recalibrate its global financial influence.

However, while the euro's strength enhances purchasing power for imports, it risks stifling exports — a critical lifeline for Europe's industrial economies. The European economy remains fragile, with the eurozone's growth forecast for 2025, based on the ECB's prediction in March, hovering at a meager 0.9 percent. Growth will then accelerate to 1.2 percent in 2026. The economy grew by 0.3 percent in both the eurozone and the EU in the first quarter of 2025, slightly below the preliminary estimate of 0.4 percent, according to a second estimate from Eurostat released on Thursday.

The looming threat of failed EU-US trade talks adds urgency to Lagarde's message. The EU needs to "have a strong hand" should tariff negotiations with the US fail, she warned. The European Commission's outreach to other nations, a clear nod to diversifying alliances, hints at a strategic pivot away from overreliance on US markets.

Beyond trade, Europe's deeper malaise lies in its dwindling competitiveness. Once a leader in automotive and pharmaceutical innovation, the continent now lags in tech. Analysts have warned that Europe risks becoming a "beautiful but indebted open-air museum" without urgent reforms.

Political fragmentation further complicates recovery. Germany and France, the eurozone's traditional engines, are mired in economic stagnation and fiscal disputes, while southern economies such as Spain and Portugal offer rare bright spots. The ECB's Transmission Protection Instrument aims to stabilize borrowing costs across the bloc, but skepticism remains over its effectiveness in bridging the divide between core and peripheral economies.

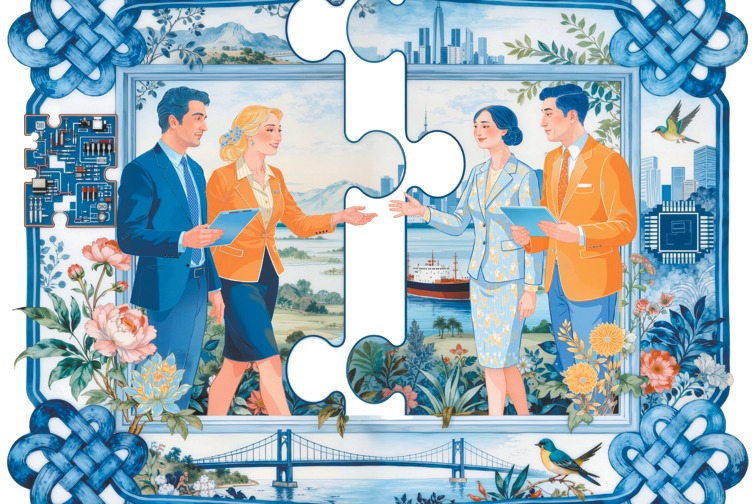

The EU should deepen its trade integration with global partners to mitigate these risks. This is particularly important, given that in 2024, China and the EU remained each other's second-largest trading partner.

Notably, the EU is exploring alternative alliances, including with China, as seen during Danish Foreign Minister Lars Lokke Rasmussen's visit to the country. During the four-day visit that started on Saturday, the two sides reaffirmed their commitment to deepen cooperation across a wide range of fields, creating new momentum for the development of bilateral ties.

A Foreign Ministry spokesperson said China stands ready to work with Denmark to consolidate political mutual trust, deepen practical cooperation, and promote the sustained, sound and steady development of China-Denmark comprehensive strategic partnership.

For China and other trading partners, Europe's maneuvering presents both risks and opportunities. The ECB may cut rates further to counter trade headwinds, but monetary policy alone cannot revive growth. The EU must accelerate structural reforms, deepen single-market integration and forge stronger global partnerships.