Streaming tops the charts for global recorded music revenue

Global recorded music revenue increased by 10.2 percent in 2023, driven largely by growth in streaming subscribers, according to the annual report of the International Federation of the Phonographic Industry, which was released on Thursday.

Total trade revenue reached $28.6 billion in 2023, the ninth consecutive year of growth, the report shows.

Subscription streaming revenues alone grew by 11.2 percent and made up almost half (48.9 percent) of the global market. In 2023, the number of paid subscriptions to music streaming services passed 500 million for the first time and there are now more than 667 million users of paid subscription accounts, with household penetration varying greatly by country.

The report also notes that a strong growth in other formats with an increase in physical revenues (up by 13.4 percent) and gains in income from performance rights (up by 9.5 percent). This is the third consecutive year in which both digital and physical revenues have increased simultaneously.

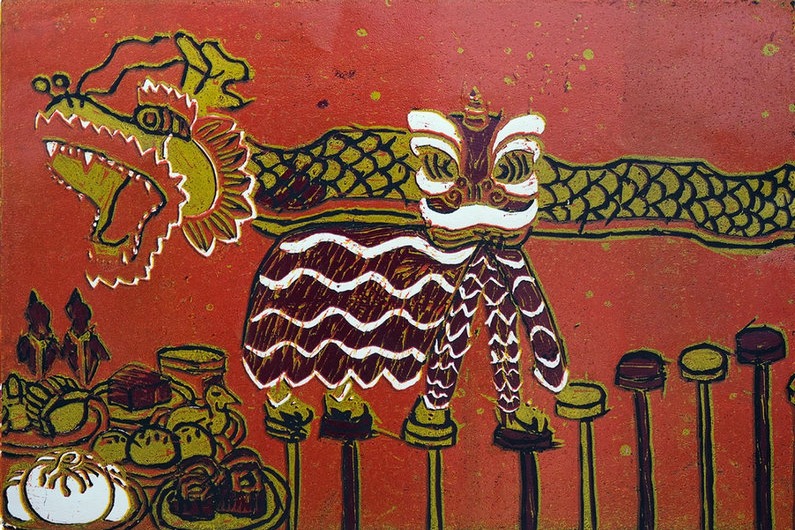

The recorded music market in Asia rose by 14.9 percent in 2023, according to the IFPI. The two largest Asian markets saw healthy growth: revenues from Japan, the world's second-biggest market, were up by 7.6 percent and there was steep growth in China (the fifth-largest market in the world) of 25.9 percent, the fastest rate of increase in any top 10 market.

"I am very glad to see the encouraging growth in China … maintaining its place as a top five market,'' comments Guo Biao, IFPI regional director Greater China.

"China's music market continues to develop in its unique way but the role of record companies in terms of investing in artists' creative and commercial success and in making sure music's value is properly recognized never changes and has become even more important than ever. As China's dynamic recorded music market continues to develop, we will also see Chinese language artists and repertoire growing in influence from the Greater China region and on the global stage."

Timothy Xu, chairman and CEO, Universal Music, Greater China says that "there's a whole generation of new artists here in China with different ambitions from previous artists — they're increasingly familiar with international music and markets and are eager to tap into them. They need, and what we strive to offer, is professional support and understanding."

As an insider of China's music industry, whose career in China started in 1992, Xu also points out that he has seen the changes that have taken place across 30 years, which "have been really fantastic".

"With the market's influence on the rise, the cultural influence of Chinese music is poised to amplify globally — a vision that has never been more attainable than now," says Xu, adding that there were over 1,000 music festival shows and more than 900 arena and stadium concert shows in China last year, representing 80 percent growth from 2019 in terms of ticket sales revenue.

"There is also increased diversity in terms of music genre than ever before. Local hip-hop, for example, is becoming really popular. To cater to this landscape, we now have adopted a multi-label strategy here, with names like Capitol, EMI, Republic and PolyGram to support different artists. This approach enables us to meet more diverse needs and promote a broader spectrum of artists and music genres," he says.