Optimism key to achieving rebound in growth

China's economic activity witnessed a strong yet brief rebound in the first few months of the year as the authorities optimized COVID-19 response measures, fueling optimism in financial markets for a well-anticipated economic recovery for the whole year.

However, in the second quarter, various economic indicators posted weaker-than-expected growth, with pessimism seeping into the equity markets. Despite a flurry of policy adjustments in late July, market performance still remains subdued.

Some gloomy views suggest that, weighed down by the rapidly aging population, sluggish property market, faltering private firms and rising geopolitical tensions, households and businesses have begun to lower their expectations of China's long-term growth prospects and adjusted their economic behavior accordingly.

As a result, households and businesses cut down on spending, scale back debt and slash investments. A Japanese-style balance sheet recession is taking shape. Behind these changes are structural contradictions that have been accumulating for years and are still unfolding. It might be difficult to turn things around anytime soon.

These insights are undoubtedly worthy of attention and deliberation. Furthermore, a closer look at the overall situation reveals greater complexity of the overall problems.

For instance, investment has remained relatively stable for a long time in the manufacturing sector, in which the proportion of private enterprises is also rising. After deducting the impact of the real estate industry, private investment has sustained a normal growth, and even posted robust performance in certain emerging sectors.

The reduction in mortgage borrowing by households has been accompanied by a significant increase in their cash-based assets, indicating their risk-averse behavior; meanwhile, credit and investment in the corporate sector have grown at a normal clip, which is very different from what was seen during Japan's balance sheet recession.

In terms of the labor market, the labor force participation rate, as determined by anecdotal data, has risen. Survey-based data show a general lengthening of working hours, and unemployment has tumbled deeper in small and medium-sized cities compared to larger urban areas.

Furthermore, the unemployment rate of people over 25 years of age is at record lows.

All these phenomena in the labor market are difficult to explain under the context of a balance sheet recession.

Given the aforementioned observations and close looks at developments in China's financial markets, it can be said that the current difficulties facing the Chinese economy are a result of scarring effects induced by the pandemic and far-flung liquidity pressures in the property sector.

The scarring effects are twofold — damage to balance sheets of microeconomic entities caused by COVID-19 restrictions, and the psychological trauma that the contagion has inflicted on the public. This makes them more risk-averse, at least for a while, with more conservative behavior and a greater tendency to save more.

The shifting dynamics in China's real estate market reflect the conflict between government policy regulation and developers' business models, which were supposed to evolve without the interruption of COVID-19.

The outbreak of the pandemic, along with its scarring effects, has exacerbated liquidity pressure in the property sector. The real estate market coming under substantial liquidity pressure has accelerated adjustments in financial markets, which worsens the balance sheets of microeconomic entities.

At the beginning of the year, when pandemic prevention and control measures were eased, many economic entities held very optimistic expectations about what would happen next, believing that the difficulties of the past few years were mainly caused by the contagion and would soon disappear. This has proved to be an obvious underestimation of the ongoing impact of the scarring effects.

In April, as pent-up demand was fully released, it was widely recognized that sluggish demand existed across sectors and thus economic expectations were lowered, which enhanced the mutual reinforcement between the scarring effects and liquidity pressures in the real estate market.

Some pessimistic investors even began to doubt the soundness of the fiscal and financial systems. In the midst of capital outflows, the renminbi exchange rate depreciated markedly and fell below the lows seen in October of last year.

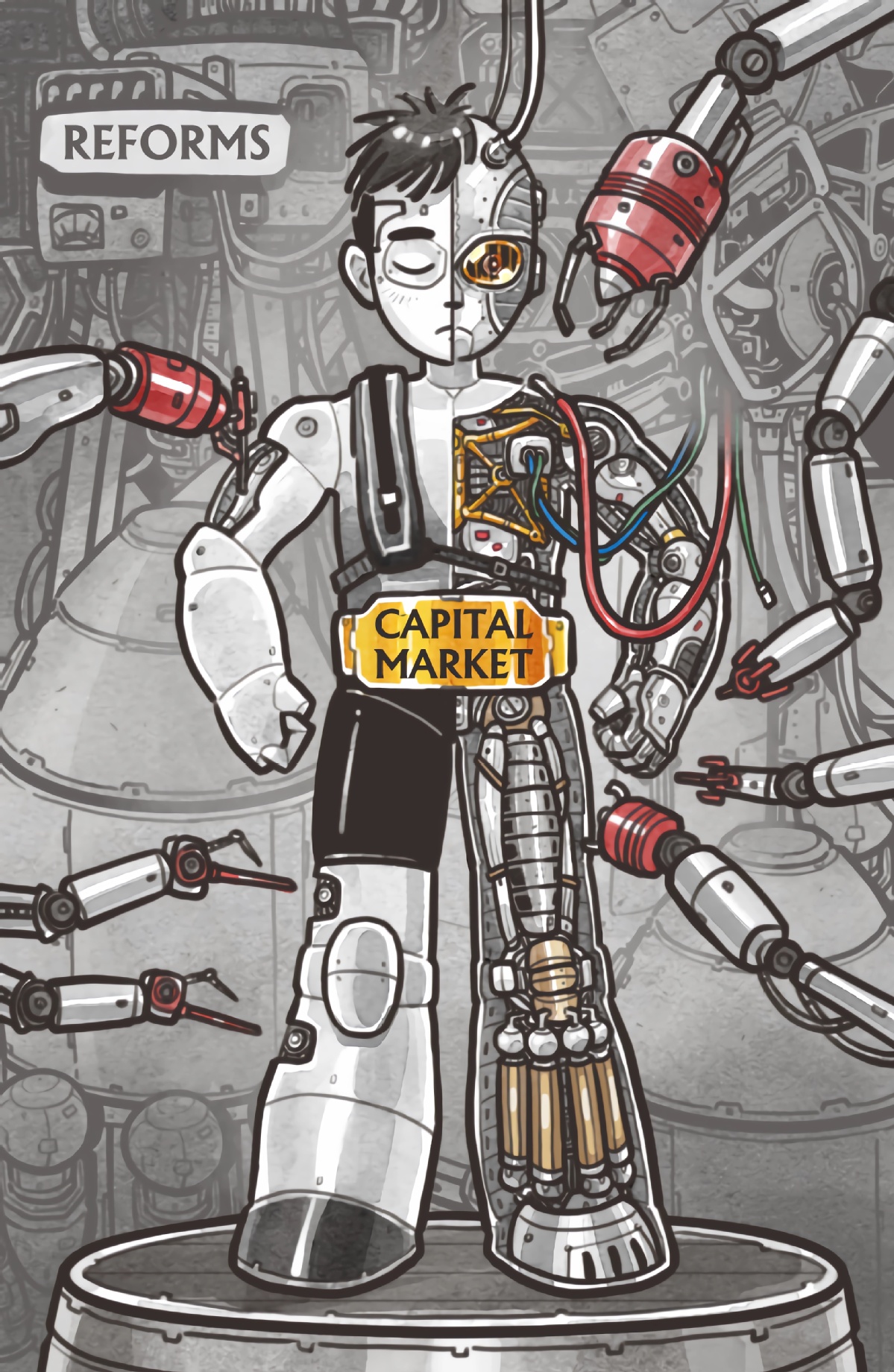

Since late July, the government began to optimize policies. In addition to the unexpected interest rate cuts by the People's Bank of China, the country's central bank, new steps were also rolled out in addressing concerns in the real estate industry and hidden debts accrued by local governments. Financial regulators also launched a series of policy measures to revitalize the capital market.

While closely watching and interpreting these policies, the market is hoping that related authorities will deliver more specific, on the ground, real-time solutions. However, market performance has remained weak due to short-term pessimism.

Short-term market fluctuations are a result of multiple time-sensitive factors, which make them difficult to anticipate. Judging from trading volume, investors are often prone to amplify short-term pessimism and ignore the impact of longer-term factors, which seems to be even more the case in the Chinese market.

With a long-term perspective in mind, it's necessary to carefully analyze some important trends in terms of China's urbanization process, handling of local governments' hidden debts and financial risks, profitability of the banking system and capital market performance.

Efforts have been made to delve into real estate markets in Northeast China, where the populations of most cities have posted negative growth rates since 2013. However, construction and transactions of housing projects remain active, and investment in the property sector could amount to a healthy portion of the region's GDP. Based on this, it's certain that China's real estate market will revert toward the mean in the future.

Despite the relatively large size of estimated local government debt, the central government debt remains at a low level. In sum, China's overall debt is manageable by global standards.

More importantly, the high savings rate of Chinese households, which are major holders of government debt, creates greater space for debt management.

In addition, the government has a large number of profitable State-owned assets, massive urban land holdings that can be liquidated in the long term, and huge foreign exchange reserves, as well as a good credit record that is sufficient.

The overall robustness of the balance sheets of large Chinese banks in the face of huge shocks is attributable to the tremendous improvement in commercial bank risk management during market-oriented reforms and the precautionary measures to guard against real estate bubbles, price volatility and property speculation.

In addition, over the past decade, the net interest margins of China's commercial banks have continued to narrow, with the return on capital declining sharply and share prices remaining modest. As things stand, net interest margins are kept at a balanced level, and the long-term downward trend may be coming to an end.

As a vital part of China's economy, the ability of listed companies to generate long-term returns is undoubted. The outstanding problem in the Chinese market lies in short-term volatility.

Many believe this is due to a lack of stable long-term capital in the Chinese market. Even for large investors, such as public institutions and insurance companies, their assessments are based on short-term performance outcomes. Furthermore, dividend payout ratios of Chinese listed companies are low. Investors can only gain from rising share prices when they can't rely on a steady return on dividends.

It is worth noting that regulators have adopted steps to extend the assessment period for institutional investors and encourage long-term investment. They have also made many pragmatic efforts to encourage dividends and buybacks by companies.

Although investors remain skeptical about short-term economic performance, and market volatility is making them nervous — it's important to remember that after every passing storm, the sun will shine again.

The writer is chief economist at Essence Securities.

The views don't necessarily reflect those of China Daily.