Second economic transformation calls for greater domestic consumption

Second transformation

The second transformation of China's economy, with less dependence on real estate and export and more efforts toward expanding consumption, has taken on a new urgency.

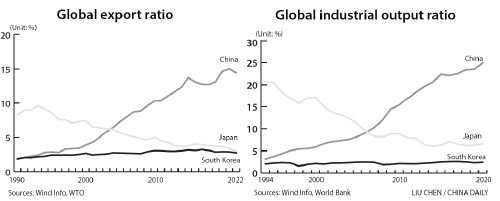

In the case of Japan and South Korea, their global industrial output ratios had declined sharply or flattened since mid-1990s, due to rising wage levels. China's wage levels are also rising rapidly, which explains for the transfer of some of its low-end manufacturing capacities to Southeast Asia and other regions.

To achieve a real economic transformation, China must improve both scale and strength of its manufacturing. It needs to increase research and development inputs and better leverage the roles of both the market and the government in accelerating industrial mergers and acquisitions.

China's manufacturing industry, with a low industrial concentration, generally relies on market-based ways to carry out mergers and acquisitions, which is less efficient and takes longer. The synergy of an effective and facilitating State can be brought to integrate industry resources in a more efficient way.

An array of measures, therefore, should be employed to optimize the institutions and mechanisms for China to become a manufacturing powerhouse to guard against falling into the trap of economic stagnation.

It must be very patient in encouraging growth and upgrading its manufacturing enterprises.

China should also uphold the principle that "housing is for living in, not for speculation".

China's society-wide net worth, according to a McKinsey study, has soared to $120 trillion in 2020 from $7 trillion in 2000, while the United States has only doubled its net worth to $90 trillion over the same period. Such rapid asset growth in China is closely related to the rapid expansion of real estate.

By the end of April, China's M2, a broad measure of money supply, which covers cash in circulation and all deposits, reached 281 trillion yuan ($39.71 trillion), twice that of the United States. This is also related to the huge scale of real estate.

The long-term upward channel of the real estate cycle has come to an end in China. It means that the transformation of China's economy from an investment-led model to a consumption-driven one is imminent. However, it takes a long time for consumption to take the place, and economic transformation is also a long-range process.

Greater efforts, therefore, will be needed to advance reform, with a key focus on shoring up residential incomes and especially expanding the proportion of middle-income groups. Only by expanding consumption can the country maintain a well-functioning domestic economy and create a new development dynamic.

It is also worth mentioning that China's overall leverage ratio is around 100 percent, which is not high compared to 144.5 percent in the United States and 260 percent in Japan. But the proportion of local government debt is relatively high and poses greater credit risk.

With revenues from the sale of land-use rights on the wane, the local governments are facing debt-repaying risks.

Therefore, it is imperative to promote the reform of State-owned enterprises, with the view of better mobilizing State-owned assets through mergers, acquisitions and restructuring and increasing local fiscal revenues through dividends and sales of listed State-owned company shares.

The scale of central government debt should be raised to ensure economic transformation while achieving stable overall economic growth.

Sustained efforts must also be pursued for wider opening-up to combat "de-Sinicization" and bringing in foreign technology and equipment in a proactive manner.

The writer is chief economist at Zhongtai Securities.

The article is a translated version of an interview between the writer and the research department of the China Finance 40 Forum, a Chinese think tank.

The views don't necessarily reflect those of China Daily.