White House, Republicans reach deal on debt limit

Tentative agreement still needs to tread difficult path in Congress

Editor's note: The White House and Republicans have reached an "agreement in principle" to raise the US debt ceiling to avert a possible default amid partisan rancor and deep global concerns. This page looks at the gains and losses for both sides and the next hurdle the government needs to clear.

The White House and Republican negotiators have reportedly reached an agreement in principle to raise the US debt limit for two years, amid a deep partisan divide and a difficult path it has to pass through Congress.

The two sides agreed to cut and cap some government spending over the same period to raise the country's $31.4 trillion debt ceiling by June 5 to avert a potentially catastrophic default, dragging the United States back from the precipice of default.

However, when the deal was announced on Saturday it was done without fanfare, in terms that reflected the bitter tenor of the negotiations and the difficult path it has to pass through Congress before the US runs out of money to pay its debts, Reuters reported.

The agreement includes spending cuts demanded by Republicans, but it is short of the reductions in the sweeping legislation passed by the Republican-led House last month, The Associated Press reported.

It came after the credit rating agency Fitch announced last week that it had placed the US AAA-rated long-term foreign-currency issuer default rating on a "negative watch "as the debt ceiling crisis unfolded.

The deal agreed to would, in effect, freeze federal spending and had the approval of President Joe Biden and the House of Representatives Speaker Kevin McCarthy, according to The New York Times, The Washington Post and Politico. The two spoke by phone on Saturday evening to resolve final sticking points, White House sources said.

Any deal still faces tough votes in the House and Senate before June 5, when the Treasury is projected to run out of money to pay its obligations. As the Treasury Department's remaining funds dwindle, investors continue preparing for what would be an unprecedented government failure to meet its financial obligations.

Passage in the House where Republicans hold a narrow majority is not a sure thing because very conservative GOP members had demanded significantly larger budget cuts in return for lifting the borrowing limit and could reject the agreement.

Biden spoke earlier on Saturday with Democratic leaders in Congress, according to media reports. He was expected to be at the presidential retreat Camp David, Maryland, until Sunday and then at his home in Wilmington, Delaware.

McCarthy told reporters on Saturday morning that negotiators had made progress toward a deal, but "are not there yet".

"I'm not fearful of this bill. Now is it everything I wanted? No, it has to pass the Senate and get signed by the president."

Deadline extended

Earlier there had been indications that negotiators were closing in on a deal. On Friday, US Treasury Secretary Janet Yellen extended the deadline for raising the federal debt limit, saying the government would default on its obligations if Congress did not increase the country's $31.4 trillion debt ceiling by June 5. Yellen had previously said a default could happen as early as June 1.

The June 1 deadline meant that on June 2 the government would be unable to pay about $25 billion in Social Security payments for the oldest recipients of payments, those 88 years old.

It was widely reported that the deal would suspend the debt limit until January 2025, allowing next year's presidential election not to be troubled by the debt ceiling issue.

However, it was unclear whether the agreement would win enough support in Congress.

The debt ceiling has been modified 102 times since World War II, according to the US Congressional Research Service.

The long standoff on raising the debt ceiling has spooked financial markets, weighing on stocks and forcing the US to pay record-high interest rates in some bond sales. A default would take a far heavier toll, economists say, probably pushing the country into recession, shaking the world economy, and leading to a rise in unemployment.

Bankers were pinning their hopes on the debt ceiling impasse being resolved without significant dislocation to markets, but warned that this is a risky strategy.

"Credit markets are pricing in a resolution in Washington, so if that is not delivered by early next week we are likely to see some volatility," Maureen O'Connor, global head of high-grade debt syndicate at Wells Fargo, told Reuters.

"That said, many investment-grade companies preempted this risk, which is why we saw such an active May calendar."

An estimated 67 million people receive Social Security benefits each month. At $1 trillion a year, the entitlement program accounts for 16 percent of the country's annual spending, making it the largest federal benefits program. Almost two-thirds of beneficiaries rely on Social Security for half of their income, and for 40 percent of recipients, the payments constitute at least 90 percent of their income, according to the National Committee to Preserve Social Security and Medicare. The average benefit for retired workers is $1,827 a month this year.

"That check keeps me going," said a woman aged 80 who lives in New Jersey and wished to remain anonymous. She uses her Social Security payment to pay rent and "to make sure the refrigerator is full", she said.

All the 60 or so people in the apartment building in which she lives are older than 70 and depend on their monthly Social Security payment. "We count on it being put in our checking account or in the mailbox, and on time. But maybe not now. The shelves in my refrigerator would have little on them without it."

In a letter to Congress, Yellen said Social Security and Medicare recipients and veterans will be paid more than $130 billion of scheduled payments in the first two days of June.

However, she also said that during the week of June 5 Treasury is due to make an estimated $92 billion of payments and transfers, including quarterly adjustments of about $36 billion, toward Social Security and Medicare trust funds, but she wrote "our projected resources would be inadequate to satisfy all of these obligations".

Various media reports said the spending deal under discussion made progress on a two-year agreement to cap spending and raise the borrowing limit, extending it past next year's elections, and would include increases for the military and veterans.

Sticking point

One big sticking point appeared to be a Republican effort to expand existing work requirements for recipients of food stamps and other federal aid programs, a longtime Republican goal that Democrats have strongly opposed.

Biden has indicated he will not consider a GOP proposal to impose new work requirements for Medicaid, a healthcare program for low-income and disabled people. Asked on Friday if he would bow to Republican demands on work requirements, Biden said, "I don't bow to anybody," and the White House put out a statement calling proposed requirements cruel and ineffective.

Louisiana Representative Garret Graves, who has been taking part in the talks, said there was "not a chance" that Republicans may give in on the work requirements issue.

"It comes down to whether or not we're going to default on the American debt, we're going to default on seniors on Social Security or Medicare or have the Democrats continue to say we're going to prioritize welfare payments for people that are refusing to work," he said.

The Republican proposal on work requirements would save $11 billion over 10 years by raising the maximum age for existing standards that require able-bodied adults who do not live with dependents to work or attend training programs.

Current law applies those standards to recipients under the age of 50. The Republican plan would raise the age to include adults 55 and under. It would lower the number of exemptions that states can grant to some recipients subject to those requirements.

If new work requirements are in a deal Biden could lose support from progressive Democrats, making the agreement harder to pass in the narrowly divided House of Representatives. Progressive lawmakers and members of the Congressional Black Caucus have indicated they would probably vote against a bill that strengthens work requirements.

Pressure is on McCarthy from the House's conservative members not to give in to any deal, even if it means blowing past the June 5 deadline.

Also, up for discussion is rescinding some of the $80 billion Congress approved last year to expand the Internal Revenue Service, which the agency had planned to use to boost tax enforcement and modernize its technology. Republicans voted earlier this year to take back most of the money, which would increase the budget deficit because it would shrink tax revenue.

Democrats say the money is needed so the government can reverse a decade of attrition at the tax agency, hiring thousands of new auditors and directing them at high-income households and large corporations. Republicans are against the additional IRS money, saying the agency cannot be trusted and that more audits would ultimately burden small businesses and middle-income citizens.

Agencies and Xinhua contributed to this story.

Today's Top News

- China to beef up personal data protection in internet applications

- Beijing and Dar es Salaam to revitalize Tanzania-Zambia Railway

- 'Kill Line' the hidden rule of American governance

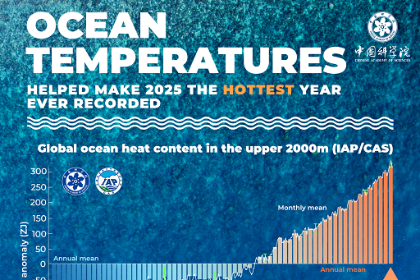

- Warming of oceans still sets records

- PBOC vows readiness on policy tools

- Investment boosts water management