US credit put on negative watch by Fitch

Washington risks losing high ranking as debt crisis talks remain deadlocked

NEW YORK — Ratings agency Fitch put the United States' credit on watch for a possible downgrade on Wednesday, raising the stakes as talks over the country's debt ceiling go down to the wire, and adding to the jitters in global markets.

Fitch put the country's AAA rating, its highest rank, on a negative watch in a precursor to a possible downgrade should lawmakers fail to raise the amount that the Treasury can borrow before it runs out of money, which could happen as soon as next week.

Despite reaching the $31.4 trillion debt limit in January, discussions between the White House and congressional leaders only began on May 9, less than a month before the estimated date of a US government default on its debt obligations.

Negotiators for Democratic President Joe Biden and top congressional Republican Kevin McCarthy held what both sides called productive talks on Wednesday. But the White House and Republicans are still at odds with each other on multiple aspects of spending and revenues.

The White House blamed the Republicans for risking a devastating default that would hit "every single part of the country" as they demand "extreme" spending cuts that would hurt millions of citizens.

McCarthy said the debt ceiling standoff was "not my fault" as Republican negotiators and the White House failed to finish out talks. He warned they need more time to try to reach a budget-slashing deal with President Joe Biden.

On Thursday, the two sides are expected to resume negotiations.

"The Rating Watch Negative reflects increased political partisanship that is hindering reaching a resolution to raise or suspend the debt limit," the agency said in a statement.

The brinkmanship over the debt ceiling, failure of the US authorities to meaningfully tackle medium-term fiscal challenges that will lead to rising budget deficits and a growing debt burden signal downside risks to US creditworthiness, said Fitch.

Wall Street stocks fell again on Wednesday on rising anxiety over US debt ceiling talks as a critical deadline ended without an agreement. Treasury bills maturing around June 1, the so-called X-date when the government runs out of money, have been under pressure for weeks and came in for further selling.

"It's not entirely unexpected given the shambles that is the debt ceiling negotiations," said Tony Sycamore, an analyst at IG Markets in Sydney. "This is not a great sign."

"Fitch still expects a resolution to the debt limit before the X-date," the credit agency said in a report.

"However, we believe risks have risen that the debt limit will not be raised or suspended before the X-date and consequently that the government could begin to miss payments on some of its obligations."

Signal sounded

Fitch said the failure to reach a deal "would be a negative signal of the broader governance and willingness of the US to honor its obligations in a timely fashion", and would be unlikely to be consistent with the AAA rating.

A US Treasury spokesperson called the move a warning and said it underscored the need for a deal. The White House said it was "one more piece of evidence that default is not an option".

The "rating watch" indicates that there is a heightened probability of a rating change and the likely direction of such a change, and is different from a "rating outlook" which indicates the direction a rating is likely to move over a one- to two-year period.

In 2021, Fitch joined S&P Global Ratings and warned that political brinkmanship over the US debt limit could damage the country's otherwise top-notch credit rating.

Fitch also holds a negative view on US fiscal outturns, forecasting the US general government deficit to rise to 6.9 percent of GDP in 2024, up from 5.5 percent in 2022 and expected 6.5 percent in 2023.

A rising interest burden and growing spending on entitlements over the coming decade will keep US deficits above 7 percent of GDP on average, said Fitch.

In August 2011, S&P Global Ratings lowered the credit rating of long-term US government debt from AAA to AA+ amid a debt ceiling impasse at that time.

Agencies - Xinhua

Today's Top News

- China to beef up personal data protection in internet applications

- Beijing and Dar es Salaam to revitalize Tanzania-Zambia Railway

- 'Kill Line' the hidden rule of American governance

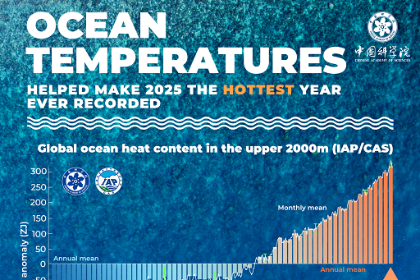

- Warming of oceans still sets records

- PBOC vows readiness on policy tools

- Investment boosts water management