Biden's pen unlikely to tame prices

Signing of inflation-fighting act comes with low expectations in US, experts say

WASHINGTON-With inflation raging near its highest level in four decades, US President Joe Biden on Tuesday signed into law his landmark Inflation Reduction Act. Its title raises a tantalizing question: Will the measure actually tame the price spikes that have inflicted hardships on US households?

Touting it as a "historic bill", Biden said at the White House that it will lower costs for families, combat the climate crisis, reduce the deficit, and finally make the largest corporations pay their fair share in taxes. The legislation includes a roughly $400 billion investment in fighting climate change, measures to make prescription drugs more affordable, and a 15 percent minimum tax on most corporations that make more than $1 billion a year. The legislation is expected to generate nearly $300 billion in net revenue over a decade.

However, economic analyses of the proposal suggest that the likely answer to the question households are asking is no-not anytime soon, anyway.

The legislation, which was approved by Congress last week, won't directly address some of the main drivers of surging prices.

Still, the law could save money for some people by lessening the cost of prescription drugs for the elderly, extending health insurance subsidies and reducing energy prices. It would also modestly cut the government's budget deficit, which might slightly lower inflation by the end of this decade.

'Negligible' impact

The nonpartisan Congressional Budget Office, or CBO, concluded this month that the changes would have a "negligible" impact on inflation this year and next. And the University of Pennsylvania's Penn Wharton Budget Model concluded that, over the next decade, "the impact on inflation is statistically indistinguishable from zero".

Such forecasts also undercut the arguments that some Republicans, such as House Minority Leader Kevin McCarthy have made, that the bill would "cause inflation", as McCarthy said in a speech in the House of Representatives.

At the same time, the White House has trumpeted a letter signed by more than 120 economists, including several Nobel Prize winners and former Treasury secretaries, that asserts that the law's reduction in the government's budget deficit-by an estimated $300 billion over the next decade, according to the CBO-would put "downward pressure on inflation".

In theory, lower deficits can reduce inflation. That's because reduced government spending or higher taxes, both of which help shrink the deficit, and drive down demand in the economy, thereby easing pressure on companies to raise prices.

Jason Furman, a Harvard economist who served as a top economic adviser in the administration of Barack Obama, wrote in an opinion column for The Wall Street Journal: "Deficit reduction is almost always inflation-reducing."

Yet Douglas Holtz-Eakin, who was a top economic adviser to president George W. Bush and later a director of the CBO, noted that the lower deficits won't kick in until five years from now and won't be very large over the next decade considering the size of the economy.

" $30 billion a year in a $21 trillion economy isn't going to move the needle," Holtz-Eakin said, referring to the estimated amount of deficit reduction spread over 10 years.

He also noted that Congress has recently passed other legislation to subsidize semiconductor production in the US and expand veterans' healthcare, and said that those laws will spend more than the inflation act will save.

In addition, Kent Smetters, director of the Penn Wharton Budget Model, said the law's healthcare subsidies could send inflation higher. Those subsidies would free up money for recipients to spend elsewhere, potentially increasing inflation, although Smetters said the effect would likely be very small.

Agencies - Xinhua

Today's Top News

- 'Kill Line' the hidden rule of American governance

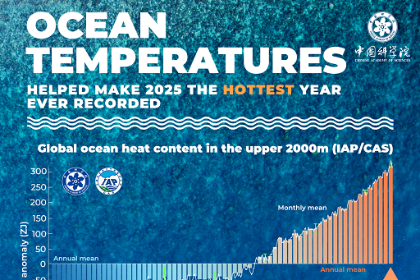

- Warming of oceans still sets records

- PBOC vows readiness on policy tools

- Investment boosts water management

- Chinese visitors to South Korea soar, topping Japan

- China, Africa launch year of people-to-people exchanges