Costs spark fears of wave of British bankruptcies

A rush of bankruptcies has been forecast among businesses in the United Kingdom, with experts warning that supply chain issues and surging costs will bring a flood of corporate distress.

According to data from the Office for National Statistics, more than 137,000 businesses in the UK shut down in the first three months of the year, which is an increase of nearly a quarter from the same period in 2021.

The Daily Telegraph reported that specialists in insolvency expect the situation to get worse, with more companies likely needing to restructure as the government's COVID-19 business support policies come to an end.

Demand for bankruptcy specialists was reduced during the pandemic as unprecedented government support kept businesses afloat.

However, the government's pandemic loan program is due to end later this month, and experts have warned that struggling businesses may face deeper hardship.

One insolvency specialist said 6,000 fewer companies and around 7,000 fewer individuals had entered an insolvency process during the last two years compared to 2018 and 2019.

Christina Fitzgerald, president of insolvency and restructuring trade body R3, said there is a potential backlog of cases.

"The drop in insolvencies over the pandemic period has meant that training budgets have been scaled back so there are fewer people at the junior end of the profession than there might have been if this hadn't happened, and a number of our members are finding staff recruitment a challenge," Fitzgerald said.

Andrew Bailey, governor of the Bank of England, recently warned that inflation could soon reach a 40-year high, and cautioned that this may bring a recession.

Observers said businesses are suffering due to supply chain issues, labor shortages and rapidly rising energy prices, and that the most vulnerable sectors are retail, hospitality and construction, which have already seen a spike in failures recorded.

Glen Flannery, a restructuring and insolvency partner at CMS, said the number of bankruptcies has been "trending upward across the board" as pandemic-related government support has been withdrawn.

The Bank of England noted that a third of small companies in the UK were highly indebted after taking advantage of the temporarily lenient lending requirements during the pandemic.

Simon Bonney, managing director at restructuring company Quantuma, told The Telegraph "there is a storm coming", noting that small and medium-sized enterprises were especially vulnerable.

Today's Top News

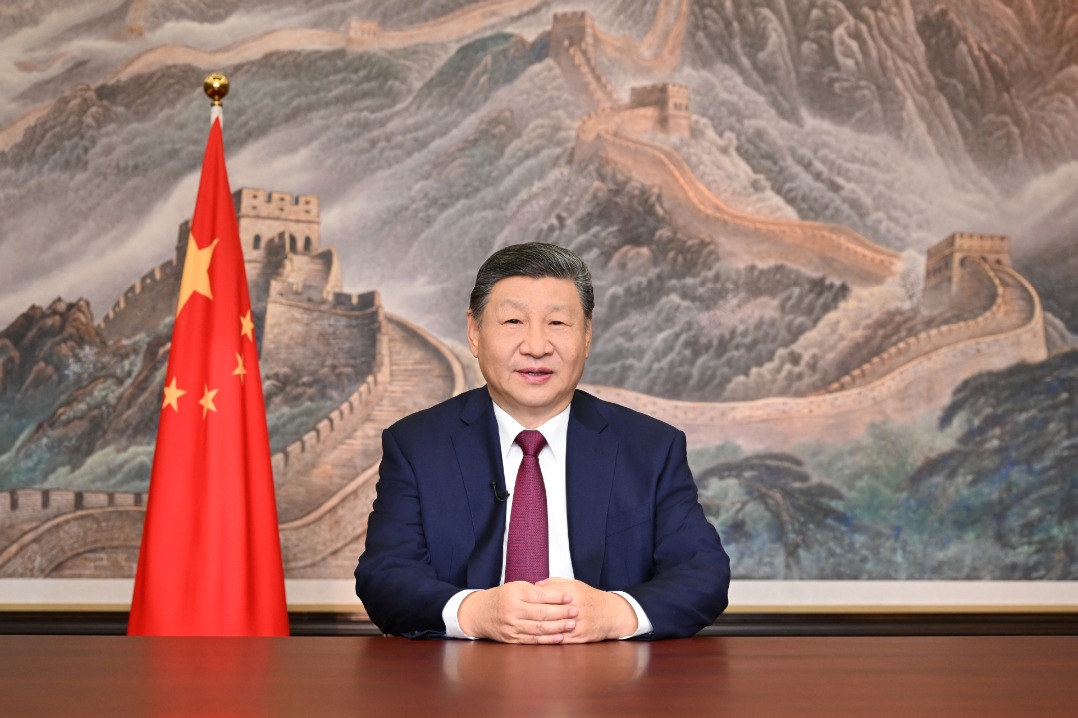

- New Year's address inspiring for all

- Xi congratulates Science and Technology Daily on its 40th anniversary

- Xi congratulates Guy Parmelin on assuming Swiss presidency

- China Daily launches 'China Bound'

- Manufacturing rebounds in December

- PLA wraps up military drills around Taiwan