Scourge of inflation felt around the globe

Though pain widespread, runaway prices spell hunger for most vulnerable

A telling anecdote about inflation's toll is that Walmart shoppers are opting for bottles of milk half the size of the ones they used to buy.

C. Douglas McMillon, chief executive of Walmart, said in a company earnings call on May 17 that "we see some switching from brands to private brands, and we see switching from gallons of milk to half gallons of milk".

The US Bureau of Labor Statistics reported that milk prices were 14.7 percent higher in April year over year for urban consumers; they were 13.3 percent higher year over year in March.

"Not all of (Walmart customers) can afford to absorb this, and they need our help," McMillon said. "Are we helping a family that's at the lower end of the income scale, be able to afford to feed their families during this inflationary time? And given that (pandemic) stimulus checks happened last year, there was some benefit to some of those folks that is eroding over time."

Walmart, the world's largest company by revenue, operates more than 10,000 department/grocery stores in 24 countries.

But US consumers, who are struggling with soaring gasoline and food prices and a shortage of baby formula, are not the only ones feeling the pressure.

Inflation has spread throughout the world, posing a threat to food security. Changes in interest rate policies in developed countries are also a challenge in developing countries, experts say.

In a meeting on global hunger at UN headquarters in New York on May 18, the organization's Secretary-General Antonio Guterres said the number of severely food insecure people had doubled in two years, from 135 million before the pandemic to 276 million today, with more than 500,000 experiencing famine conditions, an increase of more than 500 percent since 2016.

"These frightening figures are inextricably linked with conflict, as both cause and effect," he said. "If we do not feed people we feed conflict.

"If high fertilizer prices continue, today's crisis in grain and cooking oil could affect many other foods including rice, impacting billions of people in Asia and the Americas," Guterres said.

"But let's be clear: there is no effective solution to the food crisis without reintegrating Ukraine's food production, as well as the food and fertilizer produced by Russia and Belarus, into world markets, despite the war.

"The food crisis has no respect for borders, and no country can overcome it alone."

A UN measure of world food prices has risen more than 70 percent since mid-2020 and is near a record after the Russian-Ukraine conflict disrupted exports and supply chains, Bloomberg reported.

"Lower-income households in the UK and the US are struggling to feed themselves," Sonia Akter, an assistant professor specializing in agriculture at the Lee Kuan Yew School of Public Policy at the National University of Singapore, told bloomberg.com. Rising prices "will disproportionately affect poor people who spend a large share of their income on food", she said.

And because of concerns about their own food supplies, countries are not exporting as much as they did.

"Protectionism will definitely continue in 2022 and rise in the coming months, exacerbating food security risks for the world's most vulnerable," Akter said.

David Adamson, a senior lecturer at the Centre for Global Food and Resources at the University of Adelaide, told Bloomberg that protectionism is "the worst thing to do for food security because it prevents the markets from working to smooth things out".

Sky News published a survey showing that 27 percent of respondents in Britain aged 16 to 75 said they "skipped meals" in April. Sixty-five percent said they sought to cut costs by not turning on the heat in their homes.

Research cited by the UK Labour Party found that 250,000 families will be sent into total poverty over the next year. Inflation is at a 30-year high in Britain.

Martin Lewis, a financial expert, warned last month that unless people were fed and able to keep warm, there would be "civil unrest", the World Socialist Web Site reported.

"The government needs to get a handle on it… and they need to stop people making choices of whether they feed themselves or feed their children. And we are in that now. We used to have a relative poverty condition in this country, and we are moving to absolute poverty, and we cannot allow that to happen."

Lewis said: "(The) public mood is desperate, it's angry and … if we don't sort this, when those (energy) bill-rises come in the middle of October to £2,600 ($3,300) in the middle of winter, I worry about civil unrest."

Ireland's Finance Minister Paschal Donohoe said after heading a meeting of eurozone treasury chiefs on May 23: "High prices and disruption to food supplies are rippling across the world with very serious consequences for the most vulnerable in our societies."

Contributing to inflation in the US is a strong job market with rising wages.

"Amid historically low unemployment and record job openings, nearly 70 percent of CEOs are combating a tight labor market by increasing wages across the board," said Roger W. Ferguson Jr, vice-chairman of The Business Council and trustee of The Conference Board, in a report on May 18.

"On top of that, companies are grappling with higher input costs, which 54 percent of CEOs said they are passing along to their customers. This may contribute to cooling in consumer spending heading into the summer."

Multiple factors

Joseph Gagnon, senior fellow at the Peterson Institute for International Economics in Washington and former visiting associate director of the Division of Monetary Affairs at the US Federal Reserve Board, told China Daily that current inflation "is caused by an unusual combination of both global factors and US-based factors. These include fiscal packages in response to COVID, labor disruptions from COVID, a switch from services to goods and the war in Ukraine".

US and eurozone business activity has slowed this month, with S&P Global attributing the decline in its US composite purchasing managers index output to "elevated inflationary pressures, a further deterioration in supplier delivery times and weaker demand growth".

In the US the economy is likely to cool as the Federal Reserve raises interest rates to stem inflation, said David Petrosinelli, a senior trader at InspereX.

"It's really all about a hard landing and the Fed really being boxed in the corner with only demand-side tools to help. They really need to squash demand."

Christine Lagarde, head of the European Central Bank, said on Tuesday that she foresaw the bank's deposit rate being at zero or "slightly above "by the end of September, implying an increase of at least 50 basis points from its current level as the bank also prepares to fight inflation.

Kristalina Georgieva, director of the International Monetary Fund, said on May 19 that global finance leaders may need to become more comfortable with fighting multiple bouts of inflationary pressures.

Reuters quoted Georgieva as saying that it was getting harder for central banks to bring down inflation without causing recessions, because of mounting pressures on energy and food prices from Russia's conflict with Ukraine, China dealing with COVID-19, which has weighed on manufacturing, and the need to realign supply chains to make them more resilient.

"I think what we need to start getting more comfortable with is, that may not be the last shock," she said, noting that she stopped viewing inflation as "transitory" when the Omicron COVID-19 variant took hold late last year.

Georgieva, who spoke on the sidelines of a meeting of G7 finance ministers and central bank governors in Germany, said she was "actually not too worried" about China's economy because the government has fiscal and monetary policy space to support growth.

In the US, the eurozone and other advanced economies, 60 percent of the countries have annual inflation rates above 5 percent, according to the Bank for International Settlements, The New York Times reported on April 12.

Central banks, such as the US Federal Reserve, generally target inflation at 2 percent. In emerging economies, more than half the countries have inflation rates above 7 percent, the bank said. For now, China and Japan are notable exceptions, the Times reported.

In Japan, which has dealt with deflation for decades, a government survey of consumer inflation expectations rose to 2.7 percent, the highest level since 2014.

"We may be on the cusp of a new inflationary era," the Times quoted Agustin Carstens, head of the Bank for International Settlements, as saying recently. "The forces behind high inflation could persist for some time."

Costlier energy

Eurozone inflation was up 7.5 percent in March, with higher energy prices-not significant wage increases-the main reason, the Times said.

"In the UK we are facing a very big negative impact on real incomes caused by the rise in prices of things we import, notably energy," said Andrew Bailey, governor of the Bank of England, in a speech on May 23. "We expect that to weigh heavily on demand."

The economic impact is also disproportionate.

"End-of-year rewards in the financial sector will jump 20 percent year-on-year in 2021-22, following a record period of deal-making," the UK Office for Budget Responsibility said.

"Bonuses in professional services firms, which include the likes of lawyers and accountants, will soar 31 percent."

The World Socialist Web Site said: "This is the result of a policy aimed at forcing workers to pay for the hundreds of billions in public funds handed out to big business during the pandemic and the£3 billion and counting that has been funneled by the Johnson government, with Labour's backing, to Ukraine for NATO's proxy war against Russia."

Though inflation is rising globally, it is much worse in the US, largely because of the excessive spending legislated early last year through the American Rescue Plan, Veronique de Rugy wrote for reason.com on May 19.

" (US Federal Reserve Chairman Jerome) Powell was a giddy cheerleader for the $2 trillion (pandemic stimulus), which many warned would cause inflation, especially as the Fed announced it would continue its overly accommodating monetary policy with no end in sight.

"When the chairman at the end of 2021 acknowledged that we had inflation, he still did very little about it. He didn't stop the Fed's purchase of treasuries until March 2022."

Minimal rate rises were announced well into this year, which are unlikely to be enough to tame inflation, de Rugy said.

"Stunningly, many people still believed that those who failed to see inflation coming could engineer something that has never been done successfully in the past: a soft landing."

All participants at the Federal Reserve's meeting from May 3 to 4 supported a half-percentage-point rate rise, and "most participants "judged that further such increases would "likely be appropriate" at the board's policy meetings next month and in July, according to minutes from the meeting published on Wednesday.

Karen Dynan, a nonresident senior fellow at the Peterson Institute for International Economics and a professor at Harvard University, told China Daily: "Central banks in many countries are going to need to tighten monetary policy to bring inflation back to acceptable levels. This will reduce economic activity in their own countries and also soften demand for exports from their trading partners. Another channel of spillover is through higher global interest rates."

Spillover effects

If the US raises rates and that leads global rates to rise more generally, it may make it tough for lower-income countries to make payments on their outstanding debt, said Dynan, a former assistant secretary for economic policy and chief economist at the US Treasury Department.

"Most countries took on more debt during the pandemic but have been able to manage this debt well because of low-interest rates. Higher interest rates as a result of monetary policy tightening could represent a big change in the debt-related challenges being faced by lower-income countries."

Zhang Jun, China's permanent representative to the United Nations, said in a UN Security Council meeting on May 19 on global food security that "a certain country should adopt responsible monetary policies, taking into full account the spillover effects of its own interest rate adjustments, in order to avoid adding to the debt service burden of developing countries concerned, thus weakening their food purchasing power".

Mohamed El-Erian, chief economic adviser for the financial services company Allianz, said in an interview with MSNBC that inflation is not a problem that has a quick or easy solution.

"We face two alternatives, neither of which are very pleasant," in terms of the Federal Reserve's options. Inflation is "yet another great unequalizer", El-Erian said, because of how unevenly it affects people across different levels of society.

"What is here is a cost-of-living crisis; it's a threat of famine in the most fragile African countries."

Yifan Xu in Washington and agencies contributed to this story.

Today's Top News

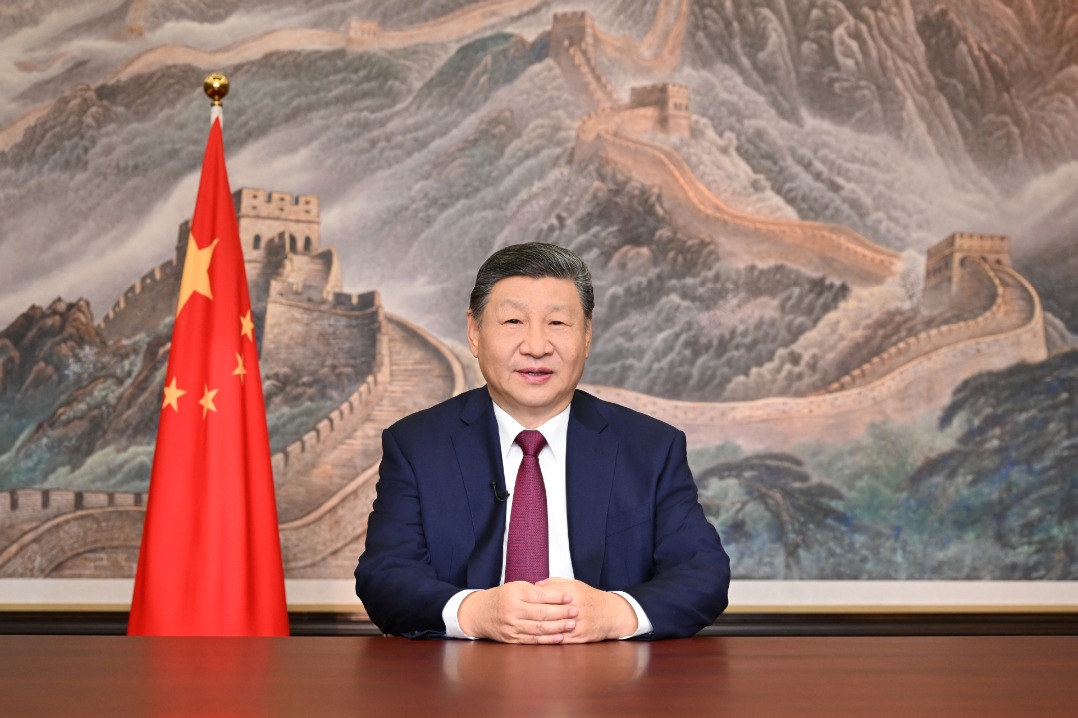

- New Year's address inspiring for all

- Xi congratulates Science and Technology Daily on its 40th anniversary

- Xi congratulates Guy Parmelin on assuming Swiss presidency

- China Daily launches 'China Bound'

- Manufacturing rebounds in December

- PLA wraps up military drills around Taiwan