Fed rate rise fallout feared in Latin America

BUENOS AIRES-The US Federal Reserve's move to raise interest rates to counter the United States' highest inflation in 40 years could hurt low-income countries and developing economies, Argentine economist Jorge Marchini said.

The Fed on Wednesday raised its benchmark interest rate by half a percentage point, the biggest increase in two decades.

A sharp sell-off left the Dow Jones Industrial Average more than 1,000 points lower on Thursday, wiping out the gains from Wall Street's biggest rally in two years, as worries grow that the higher interest rates will derail the economy.

"The impact is enormous" especially for a country like Argentina, which is the largest debtor to the International Monetary Fund following a record loan agreement with the global body, Marchini, an economics professor at the University of Buenos Aires, said on Wednesday.

"But above all because there is an unbalanced balance of payments and any increase in interest rates, in this case in the US, leads to significant imbalances," said Marchini, also vice-president of the Foundation for Latin American Integration.

The Fed's hike not only makes it harder and more expensive for Argentina to service the loan but also stands to undermine confidence in the country. This could potentially trigger capital flight that would directly impact the exchange rate, Marchini said.

"A rising interest rate obviously means a bigger (debt) burden," said Marchini, noting that Argentina's internal and external commitments are managed through variable rates set by the Fed rate.

"The second (imbalance) has to do with market confidence, with the repetition of a scenario that we saw in the 1980s in Latin America ... that is, capital takes refuge in stronger currencies and abandons the local currency. These two elements can alter the exchange rate, internal interest rates and also the economy in general-and that's a blow to the economy as a whole."

A similar anti-inflationary move with US interest rates in the 1980s was catastrophic for the Latin American region, Marchini said.

"While it was a circumstantial solution for the stabilization of the North American economy, it meant a great crisis in Latin America," he said.

What's more, the Fed rate increase could strain ties between developing and lower-income countries in Latin America struggling with their balance of payments problems, by sparking "a competition to devalue the currency". This could result in a "very delicate scenario with immediate impact" on their economies, he said.

The Fed's decision also comes at a time when many countries around the globe have yet to recover from the shocks of the pandemic, he noted.

Governments face "allocating more of their fiscal accounts to just pay off debt" and "more limited" access to loans if "rising rates limit the ability to obtain new credit", he said.

Xinhua - Agencies

Today's Top News

- Confidence, resolve mark China's New Year outlook: China Daily editorial

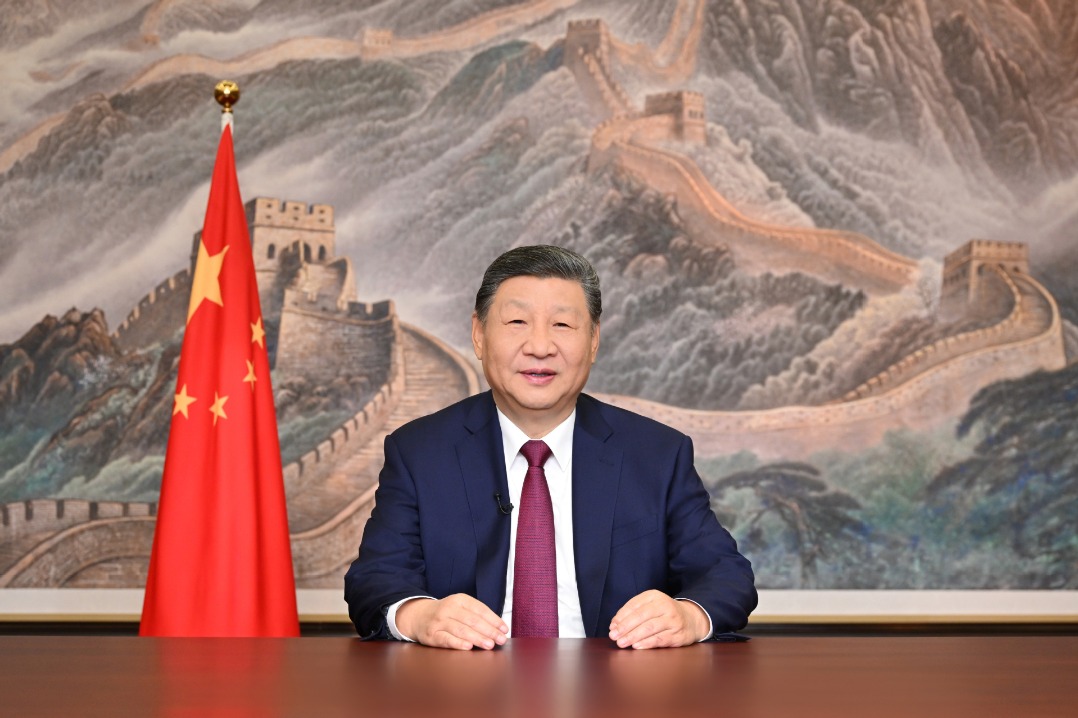

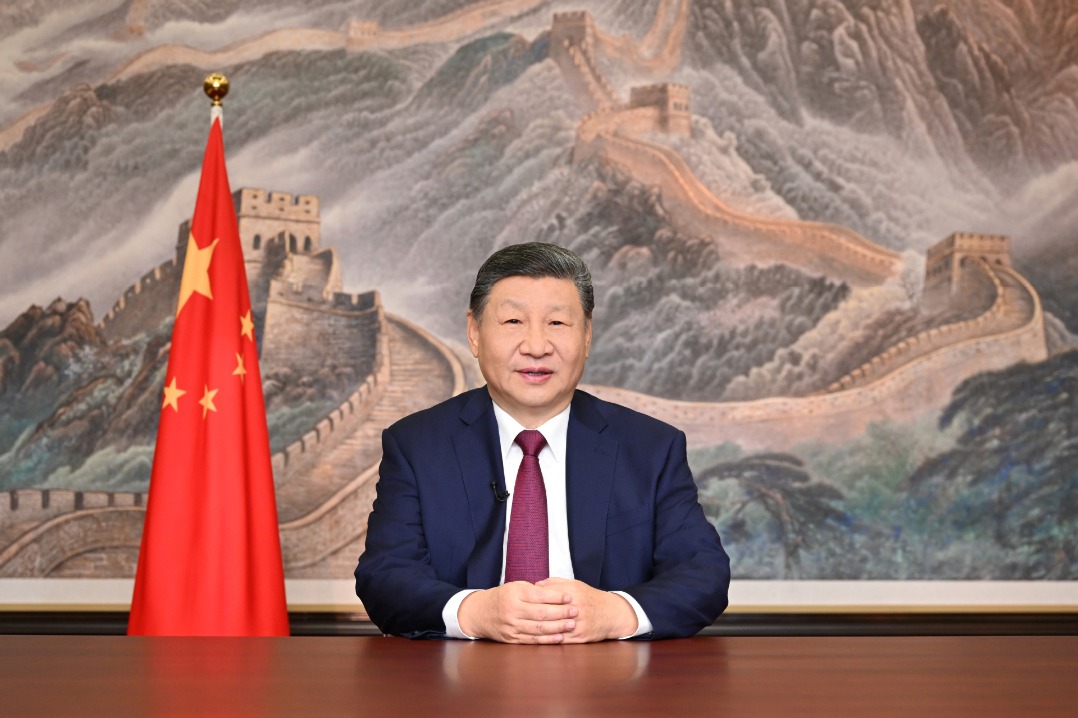

- Key quotes from President Xi's 2026 New Year Address

- Full text: Chinese President Xi Jinping's 2026 New Year message

- Poll findings indicate Taiwan people's 'strong dissatisfaction' with DPP authorities

- Xi emphasizes strong start for 15th Five-Year Plan period

- PLA drills a stern warning to 'Taiwan independence' separatist forces, external interference: spokesperson