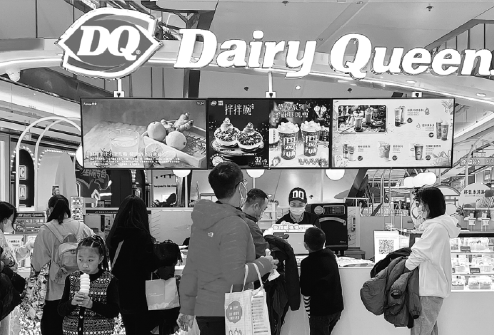

Bullish on China biz, DQ and FountainVest plan more restaurants in nation

The global leading quick-service ice cream chain Dairy Queen, or DQ, plans to open 600 new restaurants in China by 2030 after making a deal with private equity firm FountainVest Partners to further penetrate the frozen-treat sector in the country.

FountainVest, which was founded in 2007, will begin the expansion by opening 100 DQ restaurants this year with its recent acquisition of CFB Group, a franchise ownership group in China with more than 900 DQ restaurants. There are currently more than 1,100 DQ restaurants in China.

"China remains an important growth market to us and this expansion with FountainVest provides an opportunity to widen our footprint in one of the fastest-growing countries," Jean Champagne, chief operating officer at Minneapolis, Minnesota-based International Dairy Queen, said in a statement.

"The continued success of our investment in China, which includes several unique-to-China foods and treat offerings, showcases the strength of the DQ brand to fans throughout the country."

Andrew Huang, managing director at FountainVest Partners, said: "The market for frozen treats is booming in China and we predict the industry will continue a rapid growth trajectory during the next 10 years."

Alan Hsu, CEO of the CFB Group, said that adding 600 new outlets by 2030 is a realistic goal, having considered the uncertainties during the past two years amid the COVID-19 pandemic.

"We've seen immense success of DQ restaurants in China, and with our strength in digitalized operations, social media management and sub-franchisee expansion, we see endless growth opportunities for this well-loved brand," Hsu said.

CFB Group has worked with IDQ to develop and launch products unique to the Chinese market, including hard-packed ice cream, specialty novelties, light meals and artfully designed DQ cakes.

CFB Group is responsible for the stores south of the Yellow River. CFB has now operated more than 920 DQ stores in the country in more than 220 cities, according to Hsu, who was quoted by Xiao Shi Dai, a food and beverage industry information provider. Hop Hing Group Holdings Limited takes charge of the DQ business in North China.

China is the fastest-growing market for DQ and is among the top three globally in size, alongside the United States and Canada, said the brand, which owns more than 7,000 restaurants in 20 countries and regions worldwide.

For CFB, the acceleration rate is expected to be carried out through two models-direct ownership and franchises.

The directly operated stores, larger in scale, will focus on top business centers in first- and second-tier cities. Such flagship stores will cover some 100 square meters, selling ice cream, food and other retail products.

Smaller-sized stores will also be launched in lower-tier cities, serving only the brand's core products, with a service area of between 15 sq m and 30 sq m.

In addition, a new format of its brick-and-mortar stores will be rolled out, which features one restaurant with multiple brands, such as Papa John's Pizza or Brut Eatery, which are also owned by CFB, Hsu told Xiao Shi Dai.

China has become the world's largest ice cream market. According to a report released by Zero Power Intelligence Group, the ice cream market reached 147 billion yuan ($22.4 billion) in 2020, ranking No 1 in the world. Despite the impact on global food production and supply chain as a result of the pandemic, the ice cream sector has maintained growth, said the report.

Based on the research of the market share of each ice cream brand, DQ has topped the chart from 2017 to 2021, followed by Haagen-Dazs and Baskin Robbins, according to Euromonitor International, a consumer product research group.

Localization has been hailed as the secret to winning over younger consumers in the Chinese market.

Hsu told Xiao Shi Dai that the group has developed popular items since late last year, which have gone viral on Douyin, a short-video sharing platform, such as cones shaped like a torch and those holding five ice cream balls, to bolster repeated buying of their new products.

Frozen retail products with more longevity have also been rolled out in addition to freshly made ice cream to meet the surging demand brought by domestic online fresh grocery shopping platforms and household consumption upgrades.

For example, DQ's bucket-sized and cup ice cream, which expires within 12 months, has been available on JD and Tmall, and in Hema Fresh.

CFB has seen its revenue rise more than 30 percent in 2021, with single stores' revenue increasing 17 percent compared with that a year ago.

In the first two months of this year, single stores' revenue has seen a year-on-year growth of more than 20 percent with record-breaking profits at the same time.

Today's Top News

- Xi stresses transforming resource-based economy, advancing Chinese modernization

- Xi stresses developing real economy to build up national strength

- Xi urges young students to contribute to world peace

- Unified market boost for foreign investors

- Elderly people should consider new careers

- Concept of ecological civilization 'inspiring'