Battling pressure on multiple fronts

While stabilizing industrial and supply chains, the government sought to encourage businesses to sign long-term contracts with shipping companies and persuade financial institutions to provide inclusive loans to eligible micro and small businesses involved in logistics.

Local authorities have been asked to draft more support policies for labor-intensive sectors, especially textiles, clothing, furniture, plastic products, toys and ceramics, to stabilize their businesses.

Although overseas demand for goods is likely to weaken this year, China's overall export situation will remain stable. For, whether in finished consumer products or some intermediate goods, its manufacturing sector's size, and the quality and competitive prices of its output, are hard to match in the global market, said Deng Yu, a senior researcher at Bank of Communications' Financial Research Center in Beijing.

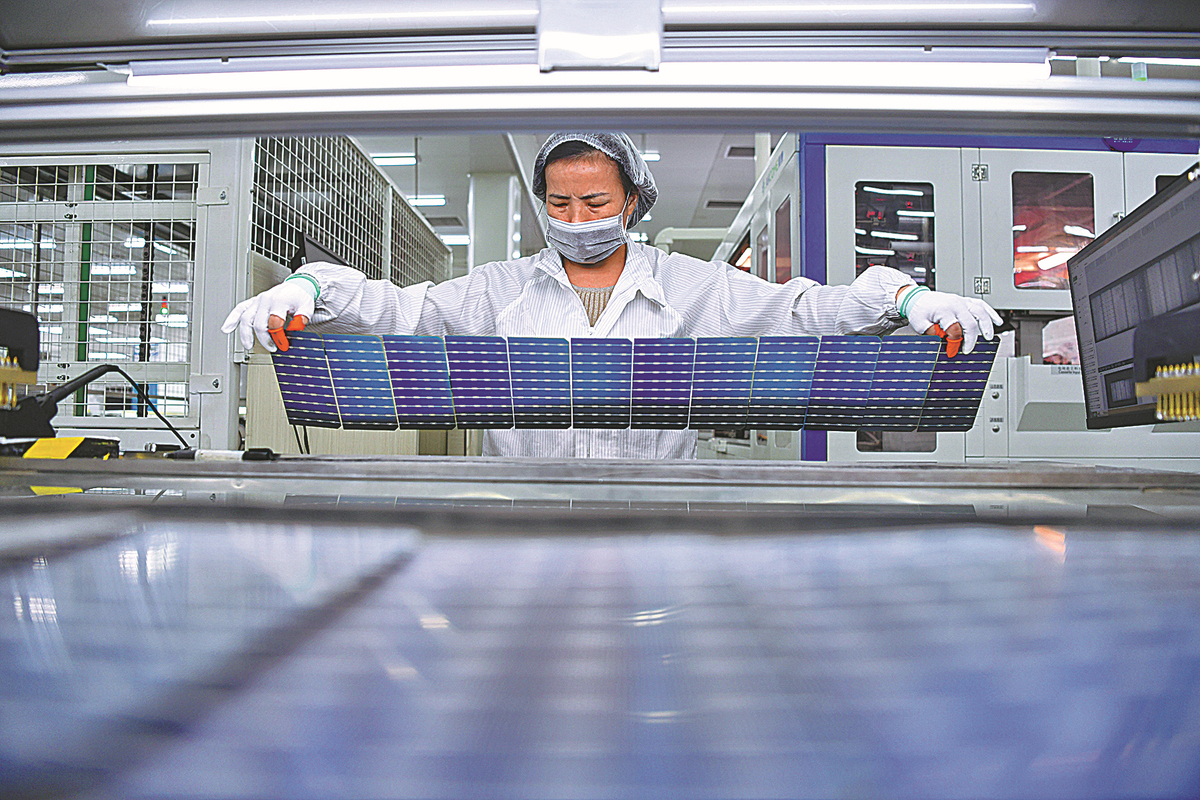

In terms of the structure of foreign trade, China now exports not only primary products but also a large number of high-tech and high value-added products like new energy vehicles, electronics, high-end trains and vessels, Deng said.

China's automakers shipped more than 2 million vehicles, including over 310,000 NEVs, to global markets in 2021, said Chen Bin, executive vice-president of the China Machinery Industry Federation in Beijing. With mature technology accumulation and well-established sales networks overseas, China's automakers will ship more NEVs with cruising power from 400 to 500 kilometers to foreign countries and regions this year, boosting trade, he said.

China's machinery manufacturing sector, pushed by its companies' continuous industrial upgrading, exported $676.5 billion worth of products last year, including clean energy equipment, construction machinery, auto parts and smartphones, jumping 33.7 percent year-on-year, according to the General Administration of Customs.

Since China's exports of stay-at-home-related products and pandemic prevention items notably dropped in the first quarter of this year, the exports of mechanical and electrical products, based on global market demand, will account for a larger share of China's exports this year, with a growth rate of 30 percent year-on-year, Chen forecast.

As China's exports are under the influence of a high growth base last year, it is difficult to maintain a high export growth rate this year, especially in the first half. Since the purchasing managers' index in many major economies has fallen, the global economy may have entered a downtrend, piling greater pressure on China's exports, said Feng Mohan, a researcher at Beijing Fost Economic Consulting Co Ltd.

So, Chinese exporters require help not only from macro policies such as exchange rates but also from supportive policies in the areas of logistics, financial services and business facilitation, he said.

Through policy assistance, the Ministry of Commerce started to work with China Export & Credit Insurance Corp in late February to give full play to export credit insurance's function in risk prevention and credit enhancement.

By stepping up the use of export credit insurance, the ministry will protect an exporter from the risk of nonpayment by a foreign buyer, and improve foreign trade companies' risk-hedging capability for two-way fluctuations in the exchange rate of the Chinese yuan to the US dollar, as part of its holistic efforts to stabilize market entities and spur foreign trade growth.

Besides pushing cross-border renminbi settlement with trading partners, it is vital for the government to accelerate the development of new business forms such as cross-border e-commerce and overseas warehouses, promoting the integration of domestic and foreign trade, as well as enhancing trade digitalization, said Chen Jia, a researcher at the International Monetary Institute of Beijing-based Renmin University of China.

Hu Dongmei, general manager of Dalian, Liaoning province-based Dayang Group Co Ltd, a large-scale exporter of made-to-measure suits with more than 4,500 employees, said the company's production plan until September has been scheduled, thanks to resumption of work in its pillar markets, including the US, Canada, Japan and the Netherlands.

Hu said the company plans to export products worth $180 million to $200 million this year, while deploying more resources to expand its domestic market and online sales channels, in order to seek new growth points and reduce the impact of surging material and shipping costs on its overall financial performance.