Leak keeps pressure on Swiss banks

ZURICH, Switzerland-The "Suisse Secrets" data leak claiming to reveal how Credit Suisse handled billions of dollars in dirty money has renewed pressure on Switzerland's financial sector, which has spent years trying to clean up its image.

Switzerland's second-largest bank was rocked on Sunday by a vast investigation by dozens of media organizations into leaked data, which they said showed Credit Suisse held more than $8 billion in accounts of criminals and rights abusers.

The bank flatly rejected the "allegations and insinuations" in the investigation, coordinated by nonprofit journalism group Organized Crime and Corruption Reporting Project.

It stressed in a statement that many of the issues raised in the probe were historical, some dating back more than 70 years, and that 90 percent of the accounts in question had been closed.

The allegations, it said, "appear to be a concerted effort to discredit not only the bank, but the Swiss financial marketplace as a whole".

The investigation was only the latest blow to the scandal-plagued bank, which was rocked last year by the implosions of financial firms Greensill and Archegos.

Last month saw its chairman resign for having breached COVID-19 quarantine rules.

But it could also hit Switzerland's powerful financial sector as a whole, which for years has striven to improve its image on the international stage.

Following the Suisse Secrets investigation, the European People's Party, or EPP, the largest political group in the European Parliament, said the findings "point to massive shortcomings of Swiss banks when it comes to the prevention of money laundering".

"When the list of high-risk third countries in the area of money laundering is up for revision the next time, the European Commission needs to consider adding Switzerland to that list," said Markus Ferber, the EPP's spokesman of the EU parliament's economic and monetary affairs committee, in a statement.

Switzerland buckled to international pressure nearly a decade ago to begin weaning its powerful financial sector off banking secrecy laws that had made it so attractive to the ultra wealthy around the world.

Switzerland signed a deal with the United States in 2014 and another with the European Union a year later on exchanging bank data, making it easier to uncover ill-gotten fortunes and crack down on tax cheats.

"Efforts in the battle against money laundering have been continuously boosted and strengthened in recent years," the Swiss Bankers Association told Agence France-Presse in an email.

"Dubious money is not of interest to the Swiss financial sector, which sees its reputation and integrity as key."

While acknowledging the role banking secrecy once played in creating the Swiss banking powerhouse, Swiss daily NZZ stressed that a number of cases revealed by Suisse Secrets "would no longer be possible" under today's legislation.

A report published last October by the Swiss finance ministry found that banks had reported four times more suspected money laundering cases to authorities between 2015 and 2019 than during the preceding decade.

Agencies Via Xinhua

Today's Top News

- China to apply lower import tariff rates to unleash market potential

- China proves to be active and reliable mediator

- Three-party talks help to restore peace

- Huangyan coral reefs healthy, says report

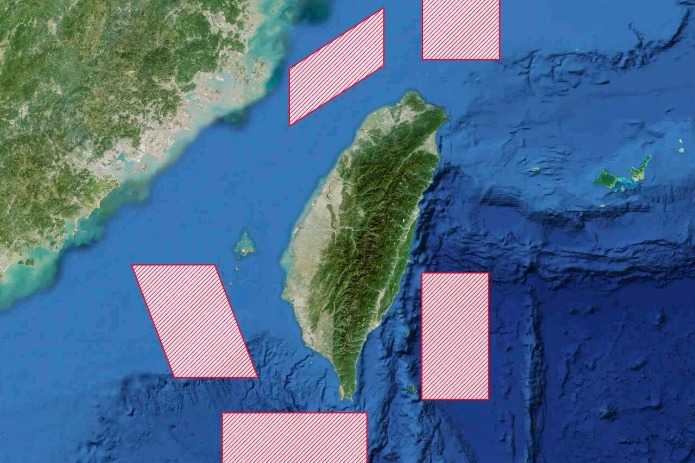

- PLA conducts major drill near Taiwan

- Washington should realize its interference in Taiwan question is a recipe it won't want to eat: China Daily editorial