Management services put fine touches to homestays

Novel marketing opportunities, standardization provide lifeline for emerging hospitality industry amid challenging times

Chinese homestay hospitality businesses, which have suffered from market uncertainties created by COVID-19, are looking for new ways to stay open and thrive given quarantine measures that dim their chances for survival, not to mention growth.

While 846 licensed homestay businesses closed in 2018, that number had more than tripled to 2,755 in 2020, according to business information provider Tianyancha. Homestay operators that survived in 2021 lowered average room rates to below 300 yuan ($47.19) per night to attract customers, according to homestay management services provider Yunzhanggui.

Hopes were high when Yang Changle, appointed CEO of online travel agency Tujia in February 2019, said that homestays would be a major pillar of Tujia's plans, with the goal of building Tujia into a comprehensive homestay business provider. Yang, however, stepped down from the post one year later as Tujia shut down all its directly managed homestay businesses in 20 Chinese cities in 2020 to enable the company to navigate the COVID-19 pandemic.

In late September, online travel portal Fliggy announced it would work closely with homestay reservation platform Xiaozhu in what industry insiders interpreted as an attempt to use each company's strengths to weather a tough winter for the homestay industry.

Lin Lu, founder of seven-year-old standardized homestay services management platform Keys, also had to deal with the contraction of the business, especially in urban areas. While more than 20,000 homestay operators in major Chinese cities used Keys' services prior to the pandemic, that number plummeted to 2,700 in 2021.

"The tourism and accommodation industries in China experienced intense competition in 2019, and a lot of opinions were voiced about the future of the industry. But now, those industries have been completely reshuffled, eliminating many of the players," he said.

At this tipping point, new business models or ideas are especially important. A new strategy that Lin has provided for homestays is creation of a new marketing node for offline retailing.

"Homestays can work as a new method of advertising through which immersive marketing campaigns can be launched and firsthand experiences with products provided to consumers," he said.

That is what Keys has done. In November 2019, Keys first tried the new strategy at some of its homestays by selling Palace Museum lipstick-a souvenir product of the six-century-old former imperial palace-first released in late 2018. In one month's time, nearly 4,000 lipsticks were sold at homestays that were working with Keys.

"Quite a few homestay businesses managed to survive the first few months of the pandemic in 2020 by selling lipstick," he said.

Palace Museum lipstick is made by Bloomage Biotechnology Corp Ltd, based in Jinan, Shandong province, which is a manufacturer of hyaluronic acid, a substance that has become popular for skincare. It is an artificial form of a substance that naturally occurs in the body. The next step was for Keys to enter into an agreement with Bloomage in July 2020.

Selling Bloomage products at homestays using Keys services is just part of the companies' "beauty plan". Another part is adding beauty parlor services to homestay spaces, Lin said. Keys helps upgrade the facilities, find the right cosmetologists and add beauty operations to business licenses so that homestays can provide such value-added services for guests.

The efforts have paid off, the company said. The average length of business relationships between Keys and these homestay business owners is five years. In 2021, homestay businesses saw their income jump 50 percent with the upgrades and the number of orders also rising 28 percent.

Seventeen leading Chinese homestay service providers, including Lost Villa and Cloud Retreat, have joined the "beauty plan" initiated by Keys.

It is absolutely a win-win story, Lin said. In one year, the stock price of A-share listed Bloomage more than doubled as the business relationship with homestays bloomed.

"Bloomage's stock price has been buoyed by the new story introduced to the market. Many beauty parlors have been opened this way. The initial investment was limited, and Bloomage controls all the product distribution channels," Lin said.

"I think homestays will grow into an advertising channel for more brands in the next three to five years. Brands can provide the latest products at homestays so that consumers have a first-hand experience with them. It is also easier to get feedback and make instant changes," he added.

Precise consumer insights led to the new business idea, Lin said. Since women have much greater input in the choice of accommodations than men, generally, they are the key consumers to attract, he said. Many women have higher expectations than men in domestic environments, especially in terms of brands, services and consumption.

"As women have more decision-making power over accommodations, it is logical to offer more value-added services to them," Lin said.

Added value is important not only for homestays in cities, but also for those in rural areas that are working to attract and retain customers, he said. Since many of them are located in remote areas, there may be limited recreational opportunities nearby. To address that, homestay managers should try things like organizing parent-child activities, providing pottery classes and adding state-of-the-art design elements to living spaces so that people are motivated to take pictures and upload them to the internet.

"As we position ourselves as a middle platform company by empowering many smaller businesses with our independently developed technologies, the most important thing is to continuously provide new value and new growth engines for homestay owners. The gist is to help these owners make more profit without adding to their chores," he said.

The market has also noticed Keys' value. In November 2019, Keys obtained an investment of $200,000 from Silicon Valley startup accelerator YC Combinator in China. With this, Keys has become the only Chinese homestay company to obtain venture capital money. Despite the impact of COVID-19, Keys started preparing for its series B financing in early November.

But added value is built on solid groundwork, which Lin said is based on standardized services at the very center of Keys' business model.

Glancing at online ads for homestays, it's clear that old, Western-style apartments and houses make up a large portion of the market in Shanghai. That also goes for siheyuan, the traditional courtyard residences in Beijing, or villas within walking distance of West Lake in Hangzhou, Zhejiang province.

Younger people, especially those with an overseas academic background in the arts or design, are drawn to these spaces. Many such budding entrepreneurs rent them, give them a decorative makeover with 50,000 yuan or so and sublet them as independent homestay venues.

But management companies like Keys make the argument that their standardized services and assistance to homestay operators give vacationers more peace of mind. They say having a platform to work with landlords is crucial.

Keys said that after homestay landlords download a Keys application, return it and an agreement is reached, management work is performed by the company. The company has a cleaning team, and from noon to 4 pm, housekeepers deliver clean bedding to homestays, change the sheets and clean up the house.

Keys says it also provides homestay business owners with a complete set of online tools covering the entire process from taking orders, matching available rooms and dates, delivering bedding and settling accounts.

The advantage of its highly modular approach is its standardization, which can be easily copied in other markets, said Lin.

Keys is now managing 375 homestays in Osaka, Kyoto and Nara, Japan, which have had relatively little problems with COVID-19. In September, Keys entered into an agreement with Tsinghua University to promote homestay services in Russia. Once a track record is established, such agreements may be extended to markets participating in the Belt and Road Initiative and ASEAN member states, Lin said.

"Homestays can be personalized, but their services should be standardized," he said.

Today's Top News

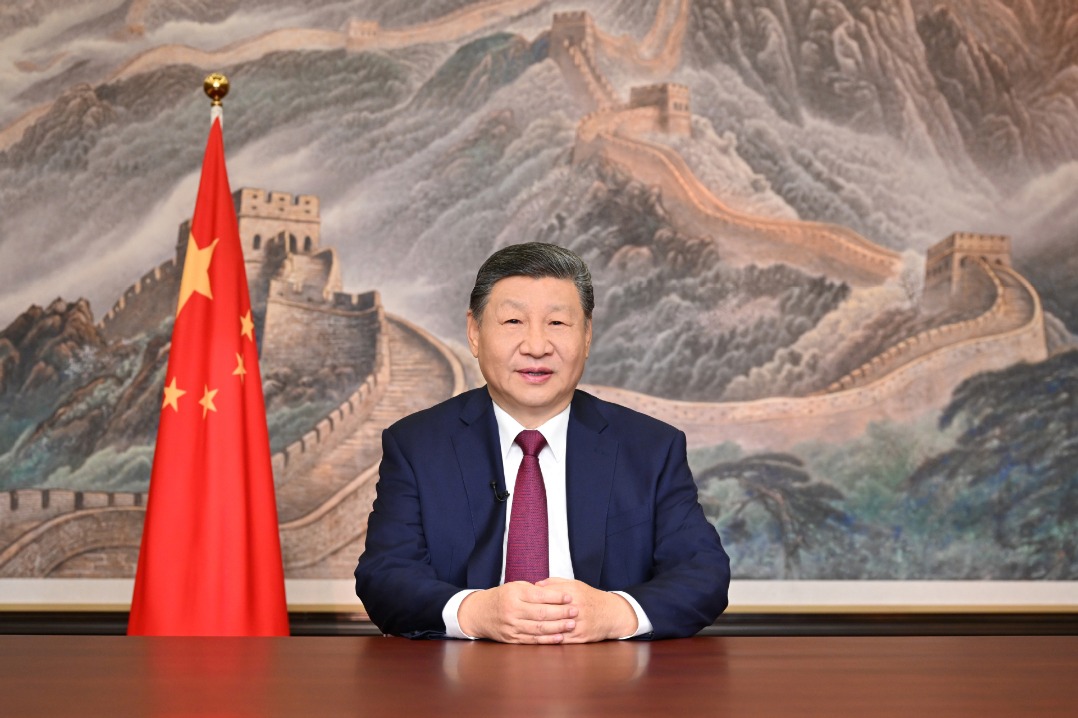

- Full text: Chinese President Xi Jinping's 2026 New Year message

- Poll findings indicate Taiwan people's 'strong dissatisfaction' with DPP authorities

- Xi emphasizes strong start for 15th Five-Year Plan period

- PLA drills a stern warning to 'Taiwan independence' separatist forces, external interference: spokesperson

- Xi, Putin exchange New Year greetings

- ROK leader's visit to help boost bilateral ties