M&A deals peak in H1, but value declines

There were 6,177 merger and acquisition deals in China in the first half of this year, an all-time high and up 11 percent from the level at the end of the second half of last year, but their value dropped 29 percent to $312.1 billion, a new report from global accounting firm PwC stated.

The volume of domestic strategic M&As rose by 41 percent, while private equity deals and venture capital investments were also strong, the report stated.

In the first half, there were 45 mega-deals whose value exceeded $1 billion each, down from 55 such deals in the second half of 2020. All these deals were aligned with key domestic economic themes like industrial upgrade, dual circulation and environmental, social and governance or ESG-focused investments.

The domestic strategic investors, private equity firms and venture capital firms are expected to remain robust in the second half of this year, the report stated.

Roger Liu, leader of PwC's practice relating to private equity in the Chinese mainland and Hong Kong, said the steady recovery of the Chinese domestic economy and rapid rebound from the COVID-19 pandemic drove domestic strategic M&A volumes to their highest levels since the first half of 2018.

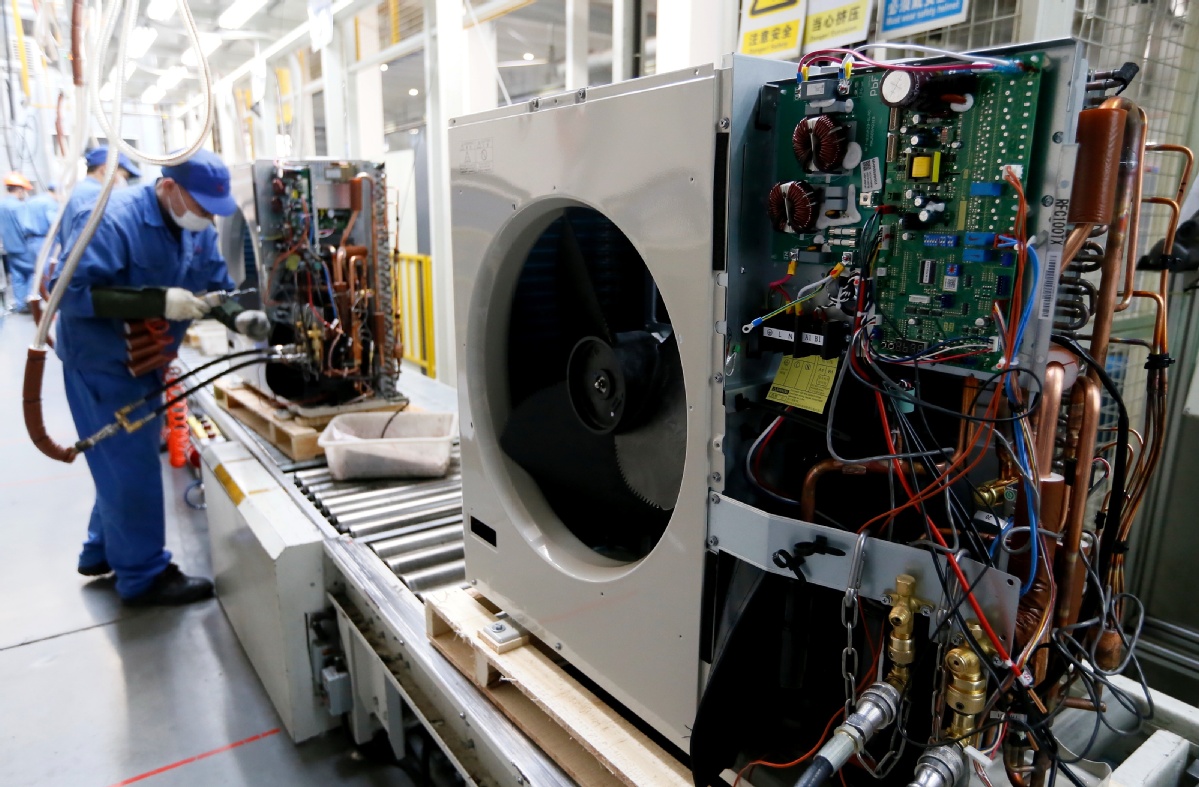

"Cross-border inbound activities, in contrast, were adversely affected by COVID-related travel restrictions. In terms of deal volume, the increase, particularly in the first quarter, was driven mainly by industrial upgrades, technology and consumer sectors," Liu said.

The second quarter of this year saw some slowing in M&A volume due to caution caused by market uncertainties. The first-half sequential decline in the value of M&A deals was due to fewer mega-deals sponsored by State-owned enterprises and the private sector, Liu said.

PE activity remained strong but fell from the record levels reached in the second half of 2020. Technology, consumer and industrial sectors continued to attract the most capital overall, the report stated.

PE-backed IPO activity continued to be very robust in the first half, with the technology-focused STAR Market of the Shanghai Stock Exchange remaining very active.

Liu noted that many companies continue to review their operating models and strategies and will need capital to reconfigure their businesses leading to transactional activity.

"The PE industry is well placed to respond to the demand for equity capital, the overall liquidity is still high and we expect activity levels to remain strong in the second half of 2021."

Moreover, outbound M&A remained in the doldrums as State-owned enterprises tended to refocus their attention back on the domestic market, the report stated.

"The effects of COVID-19 pandemic and other uncertainties around trade and geopolitical relations will continue to have an impact on both domestic and cross-border M&A activity in the second half," said Chris Chan, leader of PwC's financial services deals in the Chinese mainland and Hong Kong.

"We expect some small decline in the second half compared to the first half of 2021, albeit both domestic strategic and PE/VC activity will likely remain robust overall," Chan said.