Measures to cleanse the capital market

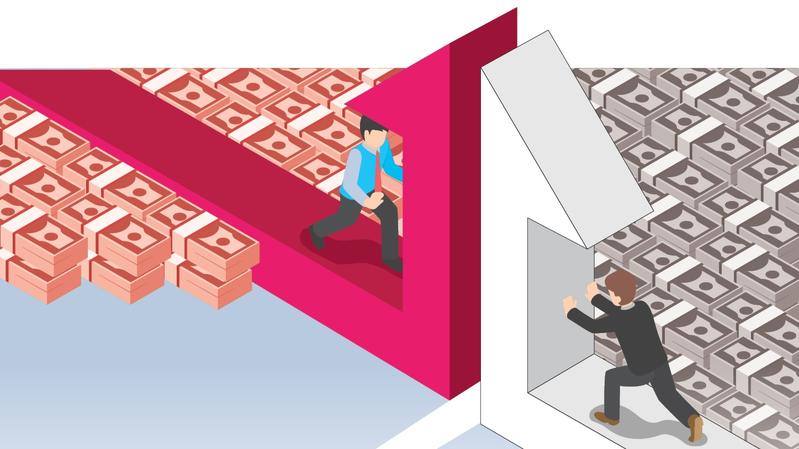

In recent years, illegal activities such as financial fraud, false disclosure, disorderly expansion of capital, insider trading and "market value management" have appeared in the capital market. At this critical time when the economy is accelerating its transformation toward high-quality development, it is imperative to strengthen capital market supervision and intensify the crackdown on securities violations.

The opinions on strictly cracking down on illegal activities related to securities, the general offices of the Communist Party of China Central Committee and the State Council jointly issued on July 6, was the first document of its kind the two departments have issued.

The document proposes the principles of institutional reform, no interference and zero-tolerance supervision. According to the document, local governments and watchdog departments are required to implement an accountability system, strengthen their supervision and law enforcement, and pay more attention to addressing financial risks and protecting investors' legal rights and interests.

Notably, the document has set two targets-the necessary judicial, law enforcement and supporting institutions should be established by 2022, and the market should have markedly enhanced credibility by 2025, as it should be transparent, open and inclusive and under the rule of law.

The document includes specific measures in three aspects: improving the construction of the capital market legal system, improving law enforcement cooperation and coordination mechanisms, and strengthening law enforcement in major cases and key areas.

In effect, therefore, the document gives local governments objectives and deadlines for meeting them.

Apparently, the policymakers have drawn lessons from the ongoing probes into some e-commerce and internet companies, and they attach great importance to promoting the construction of the legal and institutional systems related to the capital market in a bid to plug the loopholes as soon as possible to make the market more predictable and law enforcement more transparent.

The document urges public security departments, judicial authorities, market and financial watchdogs to strengthen their cooperation in reconnaissance, investigation, supervision and law enforcement. That aims to put an end to the dilemma of everybody's business is nobody's business.

Last but not least, the document highlights the urgency of concentrating on cracking major cases involving big market players, as it is crucial to clean the market environment and generate deterrence effects so as to clearly demarcate the boundaries for business behaviors.

As such, the investigations into the several big companies are by no means a gust of wind, but a new beginning for the country to modernize its capital market.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.