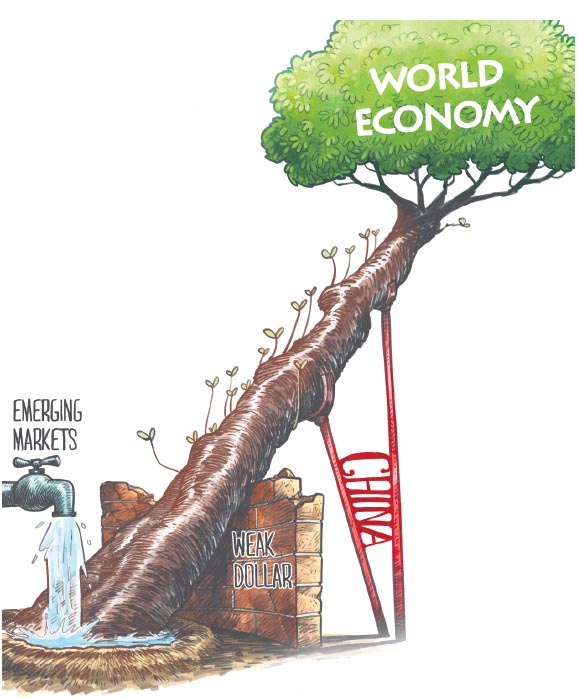

China, emerging markets, weak dollar to drive growth

The COVID-19 pandemic has provided the world with its toughest stress test in more than 80 years. Pointing to mid-single-digit growth in world GDP this year from Pictet Asset Management's economic indicators, positive base effects cannot hide the long-lasting damage caused by the pandemic.

We estimate that the fallout from COVID-19 will permanently reduce global GDP by 4 percentage points, and it will take years before the global economy can go back to pre-COVID-19 levels.

In the fight against COVID-19, better (medical) treatments are being deployed with growing possibility of effective vaccines being available in months.

Although it will take a long time to return to pre-pandemic normality, emerging markets will lead the economic recovery this year to shine, which will be attributable to two factors-the V-shape recovery in China and a weaker US dollar.

The growth gap between emerging and developed markets will widen further to the benefit of both developing world equities and debt, thanks in large part to China, the only major economy that avoided a contraction last year.

From industrial production to car sales and exports, evidence shows that most of China's primary economic activity indicators are already back at, or above, the December 2019 levels, and set to expand further.

Retail sales in China have lagged slightly but we at Pictet expect private consumption to recover gradually in the coming months.

In a year that will see healthy global growth and increased international trade, emerging market local currency bonds should also fare well. They are among the very few fixed income assets offering a yield of above 4 percent.

As the global economy recovers and as trade tensions ease, currencies in the emerging markets could rebound strongly and enhance the investment attraction. Currently, emerging market currencies are about 20 percent undervalued versus the US dollar.

Chinese renminbi-denominated debt should have a particularly strong year, benefiting from its attractive yield compared to developed-world bonds and also from the asset class' increased presence in mainstream bond benchmarks.

On the global front, a sharp sell-off in developed markets is unlikely mainly because central banks won't take any unnecessary risks in the absence of a sustained rise in inflation.

The US Federal Reserve is expected to take full measures to keep a modest policy to ensure a self-sustaining recovery.

This year doesn't promise to be a good year for the dollar. Reasons abound.

For one, the greenback's allure should fade in the face of a synchronized global economic recovery. For another, there's the prospect of a surge in the US budget deficit and continued intervention from the Fed-a fiscal and monetary expansion that will likely place further downward pressure on the currency.

As a result, the dollar will likely continue to trade well above the fundamentals and both the interest rate differential and the growth differential with the rest of the developed world have shrunk from pre-COVID-19 levels.

In terms of global outlook, we would expect fiscal stimulus to be reduced compared to 2020-not through a return to austerity policies, but because we expect fewer new measures. Central banks will likely act as "shock absorbers" by keeping rates low and maintaining stimulus.

However, liquidity conditions are still likely to deteriorate. We estimate that the total assets of major central banks will expand only $3 trillion this year. This is double the yearly average seen during the 2008 global financial crisis but significantly below last year's record $8 trillion.

The resilience of China's economy-it benefited its stock market and helped its benchmark CSI 300 Index gain nearly 30 percent in 2020-will continue to be a positive force. Chinese stocks should be among the leaders this year too.

Support will come in the form of continued stimulus from Beijing. According to estimates from the International Monetary Fund, China is likely to be the only major economy where fiscal policy will not be a significant headwind for economic growth this year.

China's economic recovery is poised to benefit Japan, whose stock market is well placed to capitalize on a revival in global trade and capital spending as the world emerges from lockdowns.

Emerging company earnings should rebound sharply and grow some 34 percent this year after an expected decline in earnings per share of 4 percent in 2020-a shallower contraction than that seen in the developed world.

Investors should expect the environment to become a greater priority this year, fueling growth in sectors like clean energy, thanks to the ambitious agenda of the new US administration and Europe's green new deal.

Across the globe, green investment will form a key part of fiscal stimulus packages, feeding into a strong and synchronized economic recovery.

Cyclical stocks that are sensitive to a recovery in capital spending, such as industrials and materials, have the brightest prospects as these industries should benefit from pent-up demand from companies that need to upgrade their technology.

These sectors offer exposure to global reflation, without the secular and environment-related headwinds that weigh on other cyclical sectors like banks and energy.

In the absence of a very strong pickup in inflation and bond yields, we think it is premature to fully rotate from growth stocks to unloved "value" companies, such as banks.

Additionally, gold should continue to rally-we forecast the gold price will hit $2,000 by the end of this year.

Continued quantitative easing by global central banks, a weaker trajectory for the dollar and real rates dipping further into negative territory should all underpin demand for gold.

Luca Paolini is chief strategist with Pictet Asset Management, a Swiss firm with $225 billion worth of assets under its management as at Sept 30, 2020.

The views don't necessarily reflect those of China Daily.