Structural changes in world economic landscape

The latest official figures showed China's GDP increased by 6.1 percent year on year last year, moving toward 100 trillion yuan ($14.32 trillion). And its GDP per capita exceeded the threshold of $10,000 in 2019.

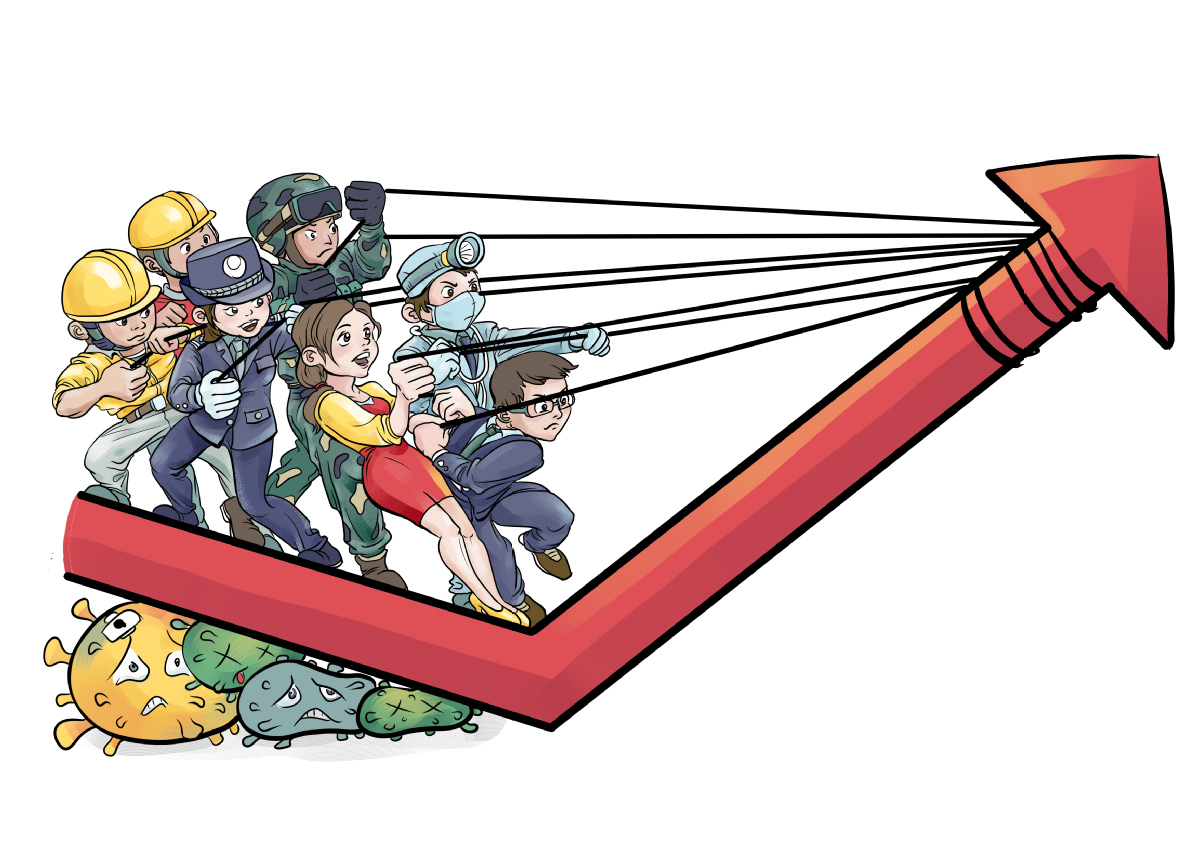

Despite certain negative influences on the short-term growth of the Chinese economy the novel coronavirus outbreak will not affect the nation's long-term outlook. Though the GDP growth of the first quarter will be under pressure thanks to reduced demand, especially that in the service industry and delayed production and operation.

Some project a 0.2-0.5 percentage point reduction in full-year growth. But the International Monetary Fund expects the impact of the epidemic on Chinese economy to be temporary, especially given China's large fiscal space to maneuver, and its latest growth forecast for the Chinese economy this year is 6 percent.

Most expectations are for a growth rate of more than 5.5 percent even with the outbreak. The Chinese economy will bounce back in the second half of the year as the virus is contained. The epidemic is just an episode and it will come to an end.

Structural changes are expected in the world's economic strength landscape in the next 15 years. These will be mainly reflected in developing countries catching up, even exceeding developed countries economically, Asia's economic power surpassing that of North America, and China's overtaking of the United States as the largest economy. Significant as it is, this sort of prediction has its own limits.

Developing and emerging countries began to outstrip developed economies in the 1990s, with a growth rate of 3.62 versus 2.75 percent in 1990-99 and 5.69 versus 1.91 percent in 2000-18. The International Monetary Fund forecasts an average growth rate of 4.77 percent for emerging and developing economies and 1.66 percent for developed economies in 2019-24.

Actually developing and emerging countries already eclipsed the developed ones in economic power measured in purchasing power parity terms as early as in 2008. The GDP of emerging and developing economies will count 77.88 percent of developed countries by 2024 and the ratio of developing and emerging countries' GDP to the world economy will increase to 43.78 in 2024 from 39.73 percent in 2018. The emerging and developing countries are destined to surpass the developed economies in the upcoming 15 years, even with the most conservative estimate, for the first time since World War II.

On a regional basis Asia will overstep North America in 2024 and become the strongest regional economy in the world. While North America and Europe will rank second and third and Latin America, the Middle East and Africa lag behind.

In the next five years, the United States will remain as the strongest economy. But the gap between China and the US is narrowing, while India is quickly catching up with Germany and is forecast to account for 96.28 percent of Germany's GDP in 2024.Although the US will be surpassed by China in the next 15 years, the overall economic strength of the US is hard to be shaken and challenged.

Although reasonable, these projections have serious limitations. For instance, they are made assuming that the volatility in each economy's growth is quite low and the possibility of economic crisis and stalled growth is ignored. Yet scholars find that the actual average GDP growth rate of middle income countries is 0.9 percentage point higher than that of the high income countries in 1960-2014 but they still could not escape the middle income trap due to higher economic volatility. In fact, the developing economies will fall into long term downturn because of economic crisis or inappropriate policies even if they step over the middle income trap. The key for developing countries is not maintaining a high growth rate but economic stability.

Besides, indicators including per capita GDP are equally important and a country's economic strength should be viewed comprehensively. Developing and emerging countries could not rival developed countries in per capita GDP. In addition, GDP and per capita GDP, GDP based on PPP in particular, ones of the most important indicators of economic strength, have significantly overstated the strength of developing countries. For instance, small countries could not be deemed as economic power thanks to underdeveloped manufacturing even though their per capita GDP could be extremely high. For large countries structural indicators such as the manufacturing power and scientific and technological innovation capability, should be taken into full consideration. From this perspective, China greatly lags behind the US despite a larger GDP.

At the very least, it could take China many years to catch up with the US' influence. Take the US' passing of the UK as an example, the US only leapfrogged the UK's influence after WWII although its GDP has begun to rank the first as early as in the 1890s. Which means, it takes roughly 50 years extra to become a superpower with the biggest GDP. Thus it seems quite unnecessary for the US to worry about being overtaken by China.

The author is an associate researcher of the Institute of World Economics and Politics, Chinese Academy of Social Sciences. The views don't necessarily represent those of China Daily.