Macao's proposed 'Nasdaq' complementary exchange

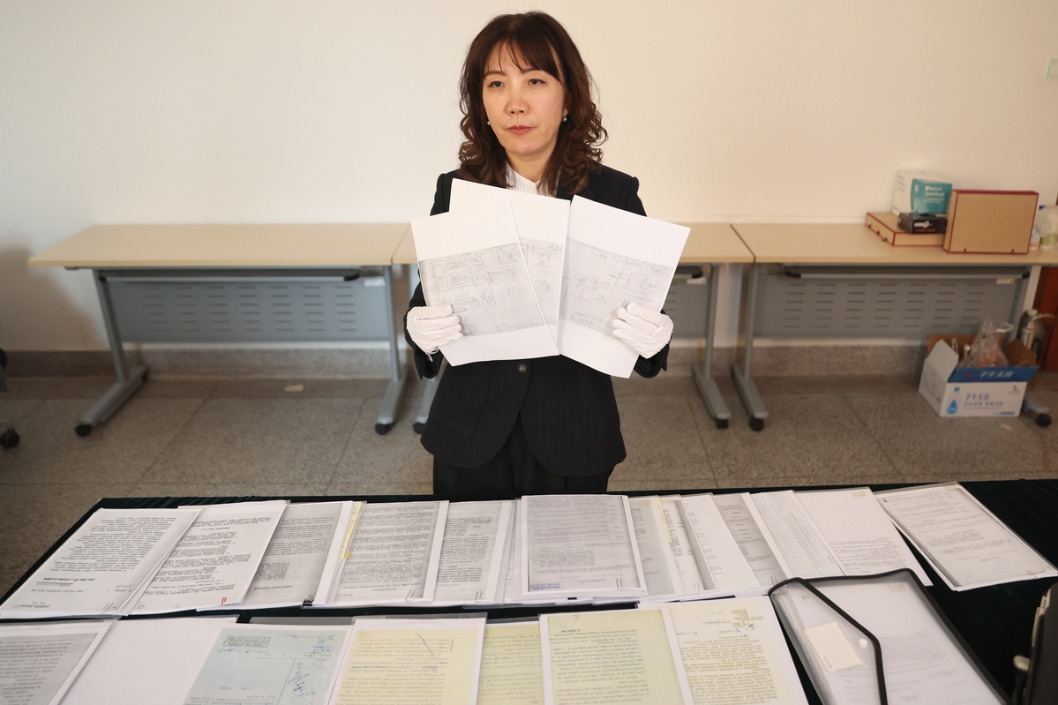

The monetary authority of Macao has announced that a feasibility study on building an offshore renminbi securities market in the special administrative region is being conducted by an international consultancy firm. The Beijing News comments:

He Xiaojun, director of the Guangdong Financial Supervision and Administration Bureau, said at the eighth Lingnan Forum on Saturday that a plan to build a Macao securities exchange has been submitted to the central government with the aim of establishing it as the Nasdaq of the renminbi offshore financial market.

Such a move would be complementary rather than competitive.

Building a renminbi offshore market in Macao would be conducive not only to the development of Macao, but also the internationalization process of the renminbi.

According to the Bank for International Settlements' statistics, the offshore renminbi's daily transaction volume is $284 billion, which ranks eighth among the global transaction currencies, and more than 60 countries and regions have incorporated the renminbi into their foreign exchange reserves.

Hong Kong is the world's largest renminbi offshore business center and has the world's biggest offshore renminbi capital pool that accounts for 70 percent of the total global offshore renminbi.

Macao's financial development still lags behind Hong Kong in terms of financial infrastructure, financial talent and capital scale. Therefore, Macao's renminbi offshore market construction should focus on differentiated development taking advantage of its own advantages.

The Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area issued in February envisions Macao playing the role of a communication platform between China and the Portuguese-speaking countries. If Macao establishes a renminbi offshore market, the renminbi's transaction scope will be expanded on a large-scale, which would further facilitate the renminbi's internationalization.

In the short term, Macao's proposed offshore renminbi stock exchange should focus on the renminbi bond market. In the future, it should concentrate on enterprises from Portuguese-speaking countries, which is remarkably different from the market positioning of the Hong Kong Exchanges and Clearing Market.

Macao's securities market and the financial markets in Hong Kong and the mainland will therefore not be competitors, but complementary and joint development partners.