California almond growers feel pinch of tariffs

A year into the US-China trade dispute, uncertainty still hovers over almond growers in California as they are looking at a second record crop to harvest next month.

The state produces almost all US commercial almonds and more than 80 percent of the global supply. Almonds are California's third-biggest revenue earner among commodities.

The almond orchards are expected to produce 2.5 billion pounds of nuts this year, up 8.7 percent from last year's 2.3 billion-pound crop, according to the US Department of Agriculture's forecast.

Despite last year's robust harvest, exports to China, the industry's third-largest overseas market, declined 33 percent from August through April over the same period of the prior year, says the latest report of the Almond Board of California.

"The shipment (to China) was down deeply in April — 1.7 million pounds versus 6.9 million pounds of last year," said Richard Waycott, president and CEO of the Almond Board of California, a nonprofit representing more than 6,000 almond growers and processors.

Since April last year, the Chinese duty on US almonds has risen from 10 percent to 50 percent after two rounds of retaliatory tariffs.

A new 10 percent tariff has recently been added on roasted, manufactured almonds in cans, while the bulk of exports, almond kernels and in-shell nuts, escape a third round tariff.

Waycott said the industry was feeling the impact of the tariffs, with fewer shipments and less contracting.

"We are hoping the trade situation will be resolved as soon as possible," he said. "Our members are doing what they can to help with the total import price, but it's very hard to do much in this situation."

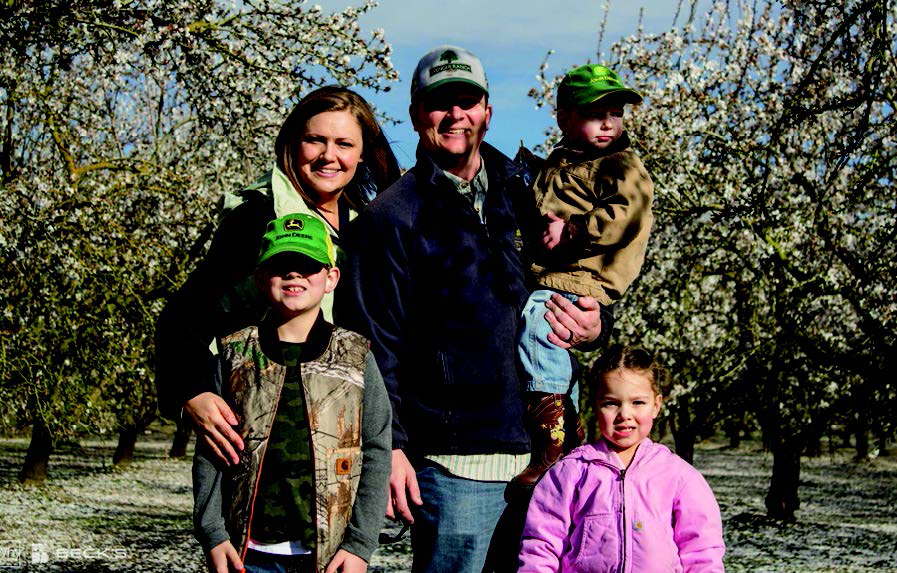

Though multiple factors caused the decline, there is no denying that the tariffs have had an impact, said Jake Wenger, vice-president of Wenger Ranch Inc in Modesto.

Harvesting of the new crop will start in July and in the first half of August, and growers are focused on irrigation and pest management to try to control the negative impact, said Wenger, who operates the family farm that grows primarily almonds and walnuts.

"It's sort of like when you are in the middle of a roller coaster, you can't just say I want to get off the ride now. You just have to remain in the seat and try to ride things out," he said.

Meanwhile, Australia has taken advantage of their free-trade agreement with China, which grants zero tariffs on almonds and other commodities since Jan 1. The country recorded a 20-fold increase in exports to China this year, according to The Lead South Australia.

"There's no doubt Australia will pick up more, when it comes to trade relations with China, but Australia's production may not meet the demand. It is the fifth- largest almond exporter, producing only 5 percent of the world's supply," said Wenger.

"When California supplies 80 percent of the world's almonds, it's not like you have a whole lot of other choices on getting that product from somewhere else," he said.

Wenger said he had "more confidence than doubt" at least in the short term as the price change was negligible, which can be attributed to a normal market shift since oversupply also led to dropped prices.

"But when you look at walnuts, it took a significant hit. The prices dropped nearly 50 percent," he said.

California supplies between 40 and 50 percent of the global market for walnuts, so importers have many other sources to buy from when there is a tariff, he said.

For Monte Vista Farming Co, which grows, shells, processes and markets almonds and almond products in Denair, California, the uncertainty about how long the retaliatory tariffs will be in place has influenced their forecast for net earnings on the farm.

The reduced shipment to China has forced the company to rent warehouses and buy additional storage bins to hold the unsold crop, Monte Vista CEO Jonathan Hoff told CALmatters, a news site on California policies, in a recent report.

The company has also reduced employees' hours at shelling facilities. The situation has put pressure on pricing, and Hoff expects the average return per acre to decline significantly, according to the report.

A recent USDA Agricultural Census shows that 91 percent of the around 6,800 California almond farms are owned and operated by families living on the land.

"If you are talking about anything impacting agriculture in California, it's impacting family farms," said Wenger.

To support farmers and ranchers affected by trade disruption with China, the Trump administration announced a second-round tariff relief package last month, which includes nut growers. How much money almond and walnut growers will receive is not known.

The first round package announced in September gave direct payment to the producers of commodities like corn, pork and soybeans, but left out fruits, nuts, vegetables and wine, primarily produced in California.

"It helps but it's not a solution. What the industry wants is free trade," said Waycott.

"As long as the tariffs are in place, you would like to see some sort of assistance, but no farmers want their business to be supported by government assistance. Nobody wants government support to get by," Wenger said.