Tariff threat echoes in US hardwood heartland

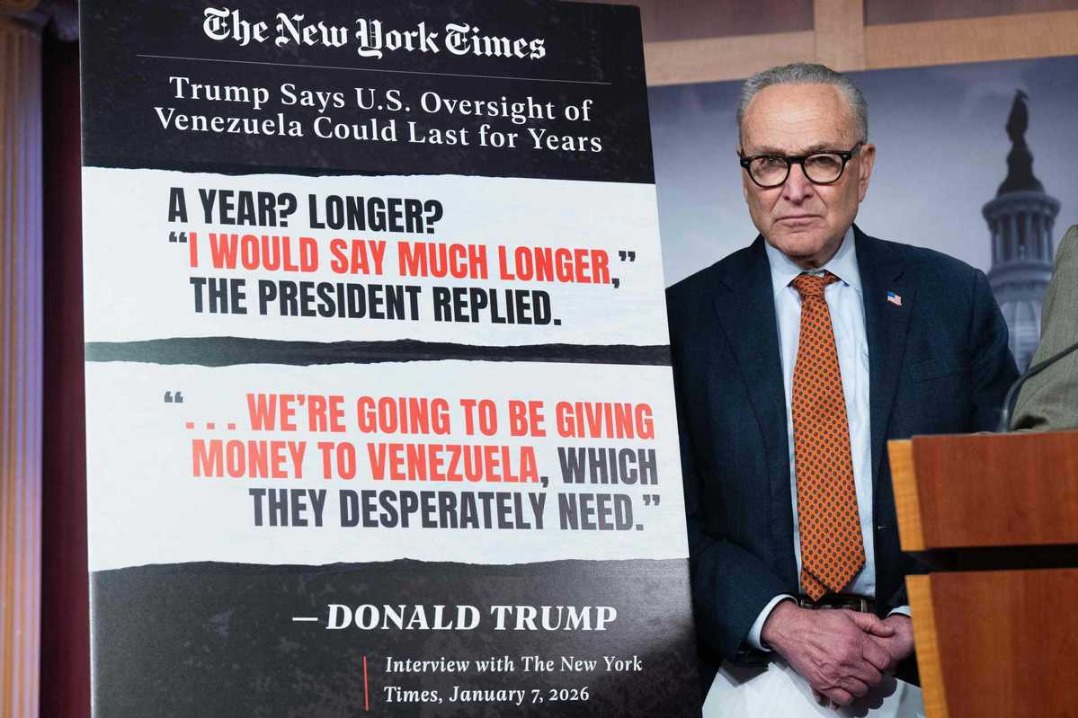

In Virginia, prospect of a retaliatory 25 percent tariff by China has chopped into a promising export business

"Wood Has No Borders'' reads the sign on one of the buildings at Blue Ridge Lumber Co in Fishersville, Virginia.

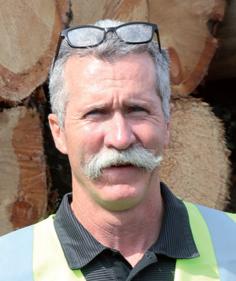

"We sell all over the world, and the world needs our hardwood," said Tom Sheets, president of Blue Ridge.

On the company's lot, large logs are piled next to stacks of finished lumber and boards waiting to be shipped. But not to China.

"We were on pace to do about $30 million in sales this year with about $7 million in sales to China," Sheets said. But sales to China "literally stopped overnight" when the country said it would impose a 25 percent tariff on imported US hardwoods.

On Aug 3, China threatened to impose tariffs on $60 billion worth of US goods, including a 25 percent tariff on hardwoods. The move was a response to the Trump administration's threat to raise the proposed tariff rate on an additional $200 billion worth of Chinese goods to 25 percent from 10 percent.

Michael Snow, executive director of the Sterling, Virginia-based American Hardwood Export Council, said the US exported $2.6 billion of hardwood lumber overseas in 2017, and approximately $1.5 billion went to China. American companies exported $854 million of hardwood logs to foreign countries, with $563 million going to China.

"One out of four boards in a US sawmill is headed to China," said Snow. "This could be, I don't want to say 'catastrophic,' but very, very painful for the industry."

Hardwoods like cherry, maple and oak are found in areas mainly east of the Mississippi River in Virginia, West Virginia, Pennsylvania, the Carolinas and the Midwest. Many American hardwood species are of high quality and found in abundance only in the US.

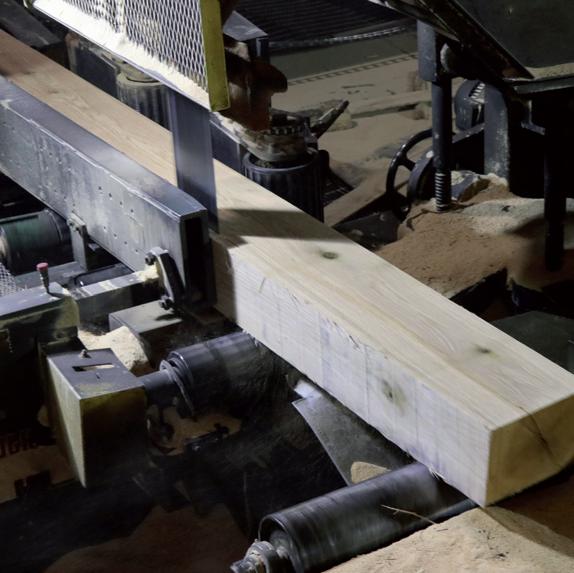

US hardwood-manufacturing companies are predominately family owned and a provider of good-paying jobs in rural areas of the country, like Fishersville, population 7,642.Employees at the Blue Ridge Lumber Co in Fishersville, Virginia, oversee a group of machines that turn logs into lumber.

Blue Ridge purchases logs from the local area and surrounding states and employs about 180 workers.

Sheets said the average hourly worker at Blue Ridge earns about $35,000 annually. "Truck drivers will get $55,000-$60,000 (a year)," he said. "I also have technical people such as lumber graders that earn around $50,000."

Walking into one of Blue Ridge's mills reveals a noisy, hot and dusty workplace where men wearing safety goggles and hard hats guide logs through a series of whirring machines that strip off the bark and then cut the logs into lumber.

"It takes a special person to work here," said Sheets. "They need to get used to the conditions and physically be able to do it."

Blue Ridge was started in 1980 and sold to an investor in New York in 2001. "We still treat it like it's a family-run company," said Sheets.

Three years ago, Sheets diversified his customer base. "We have the advantage of saying if we can't ship to China, then let's ship somewhere else," he said. "If we don't ship anything to China the rest of this year, we will still be in business."

About 175 miles south of Fishersville in Galax, population just under 7,000, is family owned Boss Lumber Corp. In 2006, Miguel Jimenez's family in Spain invested about $50 million to convert a shuttered furniture plant in the rural town into a hardwood lumber and log facility.

Boss Lumber employs 20 people. Jimenez, the plant's general manager, had planned to expand the plant and nearly double the workforce. Then came China's tariff threat. Boss Lumber exports more than 90 percent of its hardwood, about 10 percent to China.

"It will probably be easier for us to adjust (to China's tariffs) because it's just 10 percent of our business," Jimenez said. "But for companies that send a lot more into China, it will be difficult. I am hearing reports of importers canceling orders that are already in the water. The uncertainty (from the tariff threat) is almost as bad as the tariffs themselves,'' he said.

About 13 miles north of Boss Lumber in the community of Hillsville, population about 2,600, Lee Daugherty is general manager of the Turman Group. It operates sawmills and a flooring plant at several sites in Virginia and employs about 500. The company also owns about 25,000 acres of forest, yet still purchases trees from others.

He said overseas sales are about 50 percent of his company's total sales, and China is about 20-30 percent of the foreign sales. If China imposes tariffs, layoffs may be a "possibility" for the company, he said.

"Customers (in China) are saying if the tariffs come in, we have to pay the 25 percent, and some are saying we will split it with you," Daugherty said. "We have stopped shipping to China. There is not enough of a margin to cover 25 percent or even 12.5 percent."

Hardwood trade between the US and China began around 2005 and has been expanding significantly since 2011, according to Joseph McNeel, director of the Appalachian Hardwood Center at West Virginia University.

He said that China's export of finished products made from American hardwoods has diminished while internal consumption has grown and is a byproduct of the country's rapidly expanding middle class: "They are looking at servicing their new middle class by focusing on creating products that it desires.''

If China imposes the tariff, Sheets of Blue Ridge said the country will discover that it won't be easy to replace American hardwoods.

"China needs tempered hardwoods for certain looks and characteristics," he said. "China can get some of that from Europe but not much. We are a reliable supplier for them – far better than Europe, and we do it at a good price with good quality."

As for a tariff's impact on jobs at Blue Ridge, Ken Wilkinson, a 31-year-old employee at the company, said he isn't concerned about his job security. "We sell globally. If one market slows down, usually another will pick up," he said.

Wilkinson also acknowledged that his job and those of his fellow workers are important to Fishersville. "Hardwoods are very important, and wood products are still the largest industry in the state," he said.

Chris Bingaman's company, Bingaman & Son Lumber, is celebrating its 50th anniversary this year. The company employs about 250 workers at five locations in rural Pennsylvania.

About 30 percent of the company's sales are overseas, with China accounting for about 40 percent of that total. Bingaman said his company began to notice a slowdown in orders from China about six months ago before the tariff dispute started. "We saw inventories building in China, but that may have been due to a slowing economy over there," he said.

If China imposes the 25 percent tariff, Bingaman doesn't anticipate layoffs.

"We can absorb it into other areas so we won't have to resort to layoffs," he said. "We will also look to other markets (like Malaysia and Vietnam).''

"We may be able to ship more to Canada, which could then send it to China" as a way to work around the tariffs, he said.

Circumventing the tariffs through exporting US hardwoods to other nations is always a possibility, said Snow of the American Hardwood Export Council.

"It will be difficult, as the paperwork for sending products into other countries (like Canada and Vietnam) is different than it is in China," said Snow. "Then there is the added shipping cost."

China may find it difficult to replace American hardwoods.

"We have a lot of species that don't exist anywhere else," said Snow. "High-end commercial buildings in China like to use US cherry and walnut."

"It's going to be hard for them (China) to duplicate what they are getting from us," added McNeel of the Appalachian Hardwood Center.

"There has been good growth in Vietnam, Mexico and the Middle East, but it's not enough to offset China," Snow said.

As for the trade spat between the US and China, Sheets of Blue Ridge said that he's generally supportive of Trump's moves, but he added: "I hope our industry doesn't just become a friendly casualty in this dispute. That's my one fear – we will lose some jobs and companies, and in the end nothing has changed (regarding trade)."

Bingaman said he basically backs the president but would like to hear more about his goals.

"Explain to me the purpose behind the tariffs and the long-term view. What do you expect to get out of this? I don't know what the end game will be and the outcome for the US," he said.

Contact the writer at paulwelitzkin@chinadailyusa.com