Little cause for concern over inflation

Consumer price index rises 1.9 percent in June, up from 1.8 percent in May

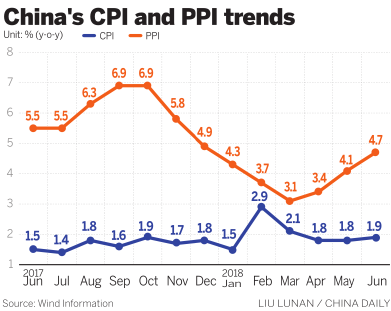

China's consumer and factory inflation in June show little indication that inflation will become a destabilizing factor in the economy despite some level of pressure from trade conflicts with the United States, according to analysts.

The consumer price index, a key indicator to gauge inflation and changes in purchasing trends, rose 1.9 percent in June, up from 1.8 percent in the previous month, according to data from the National Bureau of Statistics on Tuesday.

The indicator is within the target set by the government of consumer inflation at 3 percent this year, the same level compared to the previous year.

Producer inflation went up by 4.7 percent year-on-year, up from the 4.1 percent increase in May, official data showed, mainly driven by increases in the oil and gas, coal and manufacturing sectors.

The growth rate beat market expectations of 4.5 percent and was higher than the 4.1 percent rise in May, according to the bureau.

A higher growth rate of PPI compared to CPI indicates greater profits gained in the upstream compared to the downstream supply chain, wrote China International Capital Corporation in a note.

Inflationary pressure is expected to ease if the real estate sector continues to cool down amid tightening in the second half, putting little pressure on monetary policy if the government plans to relax a little from its current prudent stance, according to researchers with the company, as substantial pressure from inflation may prompt policymakers to tighten monetary policy.

Echoing their remarks, Jiang Chao, an analyst with Haitong Securities, said China is unlikely to have a major inflation pressure and inflation will not be a major consideration with regard to China's monetary stance.

He expected the PPI may have reached the highest level in the year and will moderate in the upcoming months.

The People's Bank of China has pledged to maintain a prudent monetary policy amid financial deleveraging moves, while putting more efforts on supporting small and medium-sized companies earlier last month.

China's CPI is likely to stay at around 2 percent in the second half, while the producer price index will fall due to a high base in the same period last year, a stable oil price and weakening demand, according to Nomura.

While ongoing trade disputes have fueled some worries about the inflation outlook and worries from expected few export orders as the trade row deepens, the impact is expected to be rather limited, according to Niu Li, an economist with the State Information Center.