Leshi seeking stakes in Jia's car ventures

Move to free up funds in companies owing debts to Shenzhen-traded firm

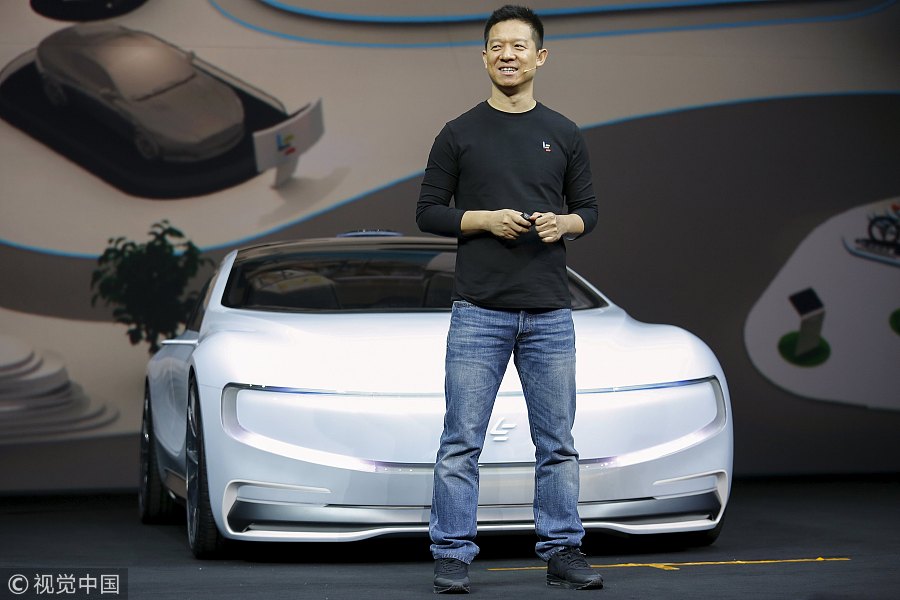

Leshi Internet Information& Technology Corp, the listed arm of Chinese internet conglomerate LeEco, told an investor briefing on Tuesday that it is seeking to acquire equity stakes in the car businesses of its largest shareholder, Jia Yueting, to ensure the units repay the outstanding debt they owe it.

The company said the move is an effort to resolve the financial strain and supply chain problems it faces, with stakes sought in Faraday Future, Lucid Motors and LeSEE, among others. The company said it will face operational difficulties if it does not receive funds to repay its own debt.

Jia and non-listed units of LeEco-involving more than 50 related parties-owed Leshi 7.53 billion yuan ($1.18 billion) as of Nov 30, 2017, according to the company. Debt-laden Jia, who has stepped down as chief executive of Leshi, remains the company's largest shareholder with a 25.67 percent stake.

However, LeEco disputed the debt amount on Monday, saying it only owes Leshi 6 billion yuan, 3 billion yuan of which it has arranged to repay soon.

Shenzhen Stock Exchange-listed Leshi is expected to resume the currently suspended trading of its shares soon. But analysts fear its stock price will inevitably plummet, saying that its profitability remains worrisome.

Leshi said it could not judge the fluctuation of the stock price once it resumes trading, and warned investors of paying attention to investment risks.

Sun Hongbin, founder and chairman of Chinese real estate developer Sunac China Holdings Ltd, was voted in as the chairman of Leshi last year. Sun said Sunac, the company's second-largest shareholder with an 8.56 percent stake, has no plan to increase its stake in Leshi.

"There is risk in doing anything, and if there is no risk there is no return … We are not able to predict the future, only to respond and adjust continuously," said Sun, who added he will spare no efforts to deal with Leshi's debt crisis.

Shen Meng, director of boutique investment bank Chanson & Co, said Sun's stance indicated that his investment in LeEco was a failure and he had given up the idea of saving Leshi within a short time frame.

Leshi said in a statement on Friday that it has scrapped a prior plan to purchase Le Vision Pictures, a filmmaking arm of LeEco, and expects a net loss in 2017.

Its net profit witnessed a decline of 446 percent in the first three quarters of 2017, compared with the same period in the previous year.

Faced with this declining performance, the company said it will adjust and optimize its management and organizational structure, and resume its main business, including distributing film and television copyright and selling internet-connected TV sets, in order to generate new revenue growth points.