Consumer inflation stays within target in 2017

CPI growth 'could reach 3% in February'

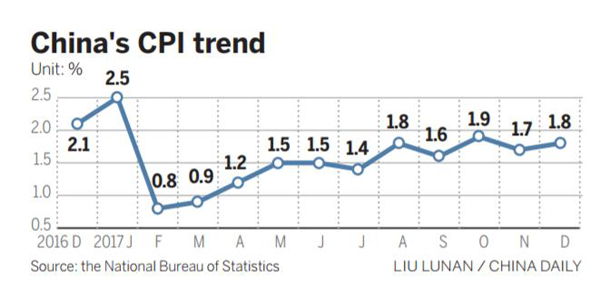

China's consumer inflation increased by 1.6 percent last year, lower than the yearly control target of 3 percent. Analysts said it will moderately rise by over 2 percent this year, but will not trigger any major monetary policy adjustment.

The Consumer Price Index accelerated to 1.8 percent in December, the National Bureau of Statistics announced on its website.

Weakening food prices are a major contributor to the fall in CPI inflation last month, Sheng Guoqing, a senior statistician of the NBS, said in a statement. Non-food price rises are the main cause of the overall growth, he said.

Whole-year CPI growth came in at 2 percent in 2016, according to the NBS. China set the control target of 3 percent last year.

Looking ahead, the consumer inflation rate could surge in February, in which the Spring Festival falls, analysts said. The seven-day holiday for the festival generally boosts consumption and consumer prices.

Zhu Jianfang, chief economist at CITIC Securities, said CPI growth could reach 3 percent in February and the whole-year reading could rise to 2.5 percent this year.

Huatai Securities forecast in a research note that average CPI growth could be around 2.5 percent this year. If international oil prices rose to about $75 a barrel, China's inflation could reach 3 percent, it said.

"The expected high CPI reading in February could have a short-term impact on monetary policymaking and the financial market," Zhu said.

But for the whole year, moderate CPI growth will not have a major bearing on the current monetary policy stance, said Yan Ling, analyst with China Merchants Securities. Yan forecast whole-year CPI growth of 2.3 percent.

Monetary policy will become neutral this year, analysts said.

"This year's (financial) regulatory focus will be on prevention of risks and cutting leverage," according to a Haitong Securities research note.

China's Producer Price Index, which gauges factory-gate prices and is a major indicator of business health, rose 4.9 percent from a year earlier in December, compared with 5.8 percent in November. It is the slowest growth in 13 months.

The PPI decline is attributable to the weakening price growth in such sectors as oil and gas exploration, ferrous and non-ferrous metals, and coal mining and washing, which had bolstered the strong growth of PPI in previous months.

For the whole of 2017, PPI rose by 6.3 percent, compared with a drop of 1.4 percent for 2016, reversing the trend of continual PPI decline since 2012.

Wang Yanfei contributed to this story.