Integration vital as global competition strengthens

Zhou Bajun writes that resistance to economic integration with the mainland is more than futile; it endangers HK's future

Hong Kong celebrates 20 years of implementing "One Country, Two Systems" principle on July 1. As the day draws near it is worth noting that three erroneous ideas concerning the groundbreaking constitutional design still exist in the special administrative region. Firstly some wish Hong Kong had not changed since the early (first five) years after the handover when the central government and the Hong Kong SAR "left each other alone"; secondly there are demands for "real universal suffrage" as a means to achieve "Hong Kong independence" and thirdly there are calls for an end to economic integration with the Chinese mainland.

To be honest the first is more a dream than anything else; while the second one is a no-go because it is separatism by some other name and the last one is wishful thinking.

The fact is some Hong Kong residents have succumbed to feelings of hostility toward the mainland and people from there since 2011. The opposition camp have used their hostility and even hatred to fan anti-mainland sentiment and target visiting mainland residents in illegal and even violent incidents. Such hostile acts only succeeded in convincing many mainland residents not to come and shop in Hong Kong for a while. But they could not stop Hong Kong from joining the mainland in opening their service trade markets to each other from June 1 last year or launching Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect.

Two factors are behind the continuous expansion of economic integration between Hong Kong and the mainland - the growing power of two economies combined as their integration continues and the intensifying competition in the outside world that forces the economic integration to deepen in response.

The initial goal of Hong Kong-mainland economic integration was free trade of goods. Hong Kong has been a free port for ages, where goods imported from the mainland have long enjoyed zero tariffs. Goods exported to the mainland from Hong Kong, meanwhile, have been basically tariff-free since Jan 1, 2006.

Service trade and goods trade are different but also connected. After achieving free trade of goods with the mainland it is only natural for Hong Kong to follow up with liberalization of service trade as well, beginning with largely free trade of services with Guangdong province since March 1, 2015. Then, 15 months later, the scope of free service trade was officially expanded to the whole mainland on June 1 last year.

When free trade of services was close to basic realization the Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect investment schemes came up on the agenda. Next will be mainland-Hong Kong bond connect, hopefully to be launched later this year.

The build-up of inner strength through economic integration with the mainland alone would not have been enough for Hong Kong to overcome the no-holds-barred obstruction by the opposition camp. The fact is that increasingly fierce competition from other regional economies and around the world in general has been an equally important motivation for even more determined economic integration with the mainland.

Hong Kong may have been the leading offshore yuan trade center for a while now but other international financial centers, particularly those in Europe and North America, are working very hard to catch up and replace Hong Kong as the top-dog in offshore yuan trade. To avoid losing its lead Hong Kong must expand mainland-oriented financing services and yuan-denominated clearing services, which depend on closer integration into the national economy.

In the 21st century China - as the second-largest economy and one of the major capital exporting countries in the world - is fully capable of establishing a global financial center comparable to New York, with Hong Kong as first in line to step into that role, followed by Shanghai some years later. However, Shanghai is not hindered by physical boundaries (import and export control) or ideological boundaries like Hong Kong is when it comes to economic connections with the Yangtze River Delta and other mainland regions. In vying for international financial center status Shanghai's main strength comes from yuan-denominated financial transactions and services, a big plus since the yuan joined a basket of major currencies known as "Special Drawing Rights". If Hong Kong fails to expand its economic integration with the mainland faster and handle the relationship between the Hong Kong dollar and yuan properly, Shanghai may stand a better chance of overtaking Hong Kong in the race to become another bona fide global financial center.

Currently economic globalization is experiencing some temporary stalling and even attempts at reversal but the situation of global economic competition being led by regional entities or city clusters has not changed. That is why the central government has decided to develop the Guangdong-Hong Kong-Macao Greater Bay Area city cluster as China's answer to existing ones around New York, San Francisco and Tokyo. It is up to Hong Kong to join the "Greater Bay Area" development campaign as a main player or a hesitant onlooker, but being the latter will bring no positive returns.

(HK Edition 05/17/2017 page8)

Today's Top News

- 'Kill Line' the hidden rule of American governance

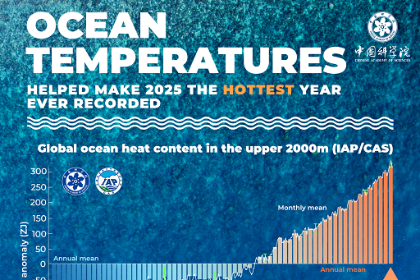

- Warming of oceans still sets records

- PBOC vows readiness on policy tools

- Investment boosts water management

- Chinese visitors to South Korea soar, topping Japan

- China, Africa launch year of people-to-people exchanges