An issue of space

While industry insiders forecast a boom in office space in Shanghai, overabundance is not expected to be a big problem in the coming years

Spurred by the city's relentless efforts to transform itself into an international trade and financial hub, Shanghai's skyline is constantly changing with the addition of new buildings and office spaces, but experts aren't too worried about an oversupply.

Demand for office leasing hit a record high of 1.45 million square meters in 2015, nearly twice that of 2014, and this has in turn inflated average rates for grade A offices by 1.7 percent in the first quarter to 11.3 yuan ($1.69) per sq m per day, according to data compiled by Cifi Group.

However, analysts believe that this spike in grade A office rental rates will not continue as additional supply is just around the corner.

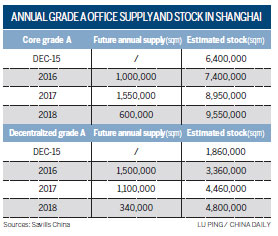

According to data from Savills China, the annual supply of Shanghai's grade A office spaces in the downtown core will reach 1 million sq m in 2016 and 1.55 million sq m in 2017, while the stock could surge from 6.4 million sq m in December 2015 to 8.95 million sq m and 9.55 million sq m in 2017 and 2018 respectively.

Analysts forecast that the decentralized areas will experience a similar growth - there will be a supply of 1.5 million sq m and 1.1 million sq m throughout 2016 and 2017, in turn driving the total stock of grade A office space to 4.46 million sq m and 4.8 million sq m in 2017 and 2018 respectively.

Furthermore, several peer-to-peer lending enterprises (P2P) have been forced to move out of premium office buildings such as Shanghai Tower after the municipal government announced measures to regulate the rampant and risky industry in the first quarter of this year.

The new regulations sent a shock wave through the city's office leasing market as a number of P2P companies vacated their premises, resulting in a rapid dip in occupancy rates across office buildings in Shanghai's core business districts.

Accounting for more than 10 percent of the financial sector's office leasing demand, P2P tenants exert considerable influence in the central business district.

According to data by Colliers International, the rental prices in Shanghai's grade A office market slid 0.5 percent to 10.3 yuan per sq m per day following this exodus.

Some industry experts believe this projected abundance of office space will have a varied impact across the city, but may ultimately encourage the healthy development of the market.

"The actual facilities, locations as well as asking prices are quite different from project to project, which means the effective supply is actually much lower than our expectations," said Albert Lau, CEO of Savills China.

Zhang Yue, office executive director of CBRE Eastern China's advisory and transaction services, said that "the limited supply of office spaces in locations such as West Nanjing Road, Jing'an, People's Square and Huaihai Road will be diluted to ease the soaring rents."

Zhang added that most of the supply can be found in decentralized areas such as Hongqiao CBD, which is expected to provide an additional 92,000 sq m of office space this year, and another 66,400 sq m in 2018.

The Hongqiao CBD's vacancy rate spiked to 21.5 percent from January to June and could continue to increase. Similarly, the former 2010 Shanghai Expo site of Qiantan is projected to have an additional 155,740 sq m in 2018 alone.

Looking ahead and past the next two years, industry experts said that Shanghai's drive to become a multifaceted hub for finance, trade, shipping, research and culture by 2040 will only attract more individuals to the city to work, in turn easing oversupply.

Compared to traditional office zones, newly developed areas often have to spend years jostling for the attention of potential tenants due to their underdeveloped facilities, infrastructure and transportation network. But they are not without benefits.

"These decentralized office areas do offer a good deal for corporations looking to buy an entire building as their regional or global headquarters," said Lau.

"Also, the large supply of office space and the stable rates in these decentralized areas make them the ideal location for companies with manufacturing divisions," he added.

Professional office developers for office spaces in decentralized areas have been advised to be proactive in planning, positioning and marketing their office buildings to potential clients.

Zhang suggested that developers strive to differentiate themselves from competitors by offering incentives such as shuttle bus services, metro stations, laundry rooms, in-building dining facilities as well as gyms.

Due to the rising population of startups as a result of the city's drive to become an global hub for technology and innovation, many entrepreneurs have chosen to set up their companies in more flexible shared office environments instead of traditional office spaces.

However, experts are not worried that such a trend will adversely impact the office rental industry.

"Before this trend took place, people were already using co-working spaces in the form of business centers," said Lau.

"I don't see how the traditional office market will be affected by the development of the shared office concept - they serve totally different clients: the former offers service to mature enterprises, while the latter is targeted at young and high-tech business startups who require more flexible environments. Besides, startups could eventually become a premium client for traditional office buildings."

wang_ying@chinadaily.com.cn

(China Daily USA 10/07/2016 page8)

Today's Top News

- Takaichi officially reelected as Japan PM at Diet

- Xi sends Chinese New Year card in return to friends in US state of Iowa

- Japanese PM Takaichi's cabinet resigns

- Iran not to abandon peaceful nuclear technology

- 2nd round of Iran-US talks held in 'constructive' atmosphere, new talks to be scheduled: Iran's FM

- The Year of the Horse: A new gallop for the Spring Festival Gala