Designer Babies

Luxury brands are looking to cash in on China's "little emperors and empresses", Matt Hodges and Yu Ran discover.

Inside the Ralph Lauren kids' clothing store at Plaza 66 on Nanjing West Road, Chen Fang, a housewife from Hubei province in her early 30s, is sifting through embroidered velvet and flutter-sleeve dresses for her four-year-old while her husband guards some shopping bags from Chanel.

"We fly to Shanghai to shop because we can't get these brands where we live," said Chen.

"I don't have a specific budget for my daughter, but I spend as much on her as I do on myself," she added. "I buy new clothes and shoes each season, mostly from luxury branded stores, to keep her looking different from the other kids."

Baby Dior set down tent poles in Shanghai in 2010 - four years after Zara opened its first kids' clothing store in the city - and a slew of top-end foreign brands have followed suit in the recent years.

Now, over one-third of the fourth floor at Plaza 66 is dedicated to foreign luxury brands for kids - Armani Junior, Moschino Baby, Young Versace - as luxury retail sales across the country have been hit by a wide-ranging clampdown on graft and gifting with public funds, compelling retailers to diversify their revenue streams.

The Chinese mainland's luxury goods market slowed from 7 percent growth in 2012 to around 2 percent in 2013, and shows for the first time a negative trend: minus 1 percent growth in 2014, according to three annual luxury studies released by Bain & Company.

Watches and menswear were particularly hit by the anti-graft campaign, with the growth momentum shifting to women's categories and fashion, it added.

The good news for retailers is that they can earn higher profits on kids' clothing because less material is used but the prices aren't much lower, said researchers at the University of International Business and Economics in Beijing.

Even Ferragamo recently launched a mini-selection of girls' shoes in two classic ladies' designs in Shanghai.

"The baby and kid luxury market is very likely to continue growing at a faster clip than the rest of the luxury market in China as a result of the recent slowdown," said Javier Calvar, COO of Albatross Global Solutions, a Hong Kong-headquartered marketing services provider.

"This is because Chinese parents would rather stop buying for themselves than for their children," he added.

Young celebrities

Back at Ralph Lauren, a sales clerk drew Chen's attention to a red velvet jacket priced 3,000 yuan ($490) that, since the airing of a reality TV show featuring famous dads and their young offspring, has gained the cachet of celebrity status.

"It's the jacket Angela Wang wore on TV," said the shop assistant, referencing a widely-viewed Ralph Lauren fashion show for kids.

Angela Wang, a.k.a. Wang Shiling, shot to fame in 2013 at the age of four while participating in the hit reality parenting program Dad! Where Are We Going? with her father, director Wang Yuelun. Her mother is television host Li Xiang.

Hunan TV acquired the rights to the popular Korean show of the same name and Wang subsequently became well-known for wearing outlandishly priced outfits in excess of 10,000 yuan, both on- and off - air.

Now China's one-child policy and growing ranks of high-net-worth individuals are dovetailing in just the right direction for the purveyors of kiddies' catwalk fashion.

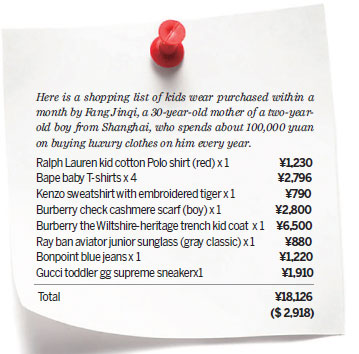

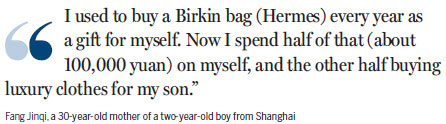

"I used to buy a Birkin bag (Hermes) every year as a gift for myself," said Fang Jinqi, a 30-year-old mother of a two-year-old boy from Shanghai. "Now I spend half of that (about 100,000 yuan) on myself, and the other half buying luxury clothes for my son."

Numbers for this niche market are hard to come by - several brands declined to discuss their revenue and growth in China - but market players may need to be savvier in the future to keep up the tempo.

Financial results from Burberry show that children's products made up just 4 percent of its revenue in the yearlong period ending March 2012, making this the smallest contributor among its product lines. However, this line of revenue jumped 287 percent from 2006 to 2012.

"Differentiation and relevance are key challenges for luxury brands in the Chinese market in general, and in the kids' market in particular," said Calvar.

According to Zhou Ting, director of the Fortune Character Research Center, which covers the luxury industry, this segment will follow the broader pattern of quality coming to match prestige as the key yardstick.

"The high-end kid's market will get larger in the future, with more luxury items being produced for their functional and applicable advantages at an acceptable price," she said. "This will also open the door for newly launched domestic kids' brands."

Back at Plaza 66, one shopkeeper at French brand Bonpoint said, "We don't see huge traffic, but our customer base is more selective. Almost everyone who comes in buys something."

Some, like Fang, are drawn by the trophy-like nature of designer clothes, others by their inescapable cutesiness or Lord Fauntleroy-like regality. Few seem put off by the three-to-six-month lifespan. Safety is another consideration.

"Those well-known brands seem to be more reliable, of better quality and softer for a child's skin," said Sun Jia from Jiaxing in neighboring East China's Zhejiang province, who was shopping for her three-year-old granddaughter

Out-of-towners

But some, like Zhou, caution against introducing notions of 'status' into children's lives at such a young age. "It can have a negative impact on their growth," she warned.

Ironically, luxury-obsessed local shoppers may not be the kids-clothing retailers' next generation of cash cows.

"Most of our customers come from other wealthy Chinese cities," said the Bonpoint clerk.

Chinese now spend over three times as much abroad as they do at home on luxury goods, according to Gain & Company. Moreover, the people of Shanghai are known for their deal-loving dispositions.

"I fly overseas every month to go shopping - Hong Kong, Japan, Singapore - and since having my son I've found that luxury kids' items are also cheaper and offer a wider selection outside China," said local shopper Fang.

"I know the clothes won't last very long, but it's worth it so my boy can wear them, take some photos, and have some nice memories to look back on when he grows up."

Not everyone heralds the Chinese market for luxury kids' fashion as being the next big thing.

"I wouldn't say this is a particularly important trend that I've picked up on, but it's an interesting one," said Rupert Hoogewerf, publisher of the Hurun Report and its annual China Rich List.

"What we have noticed is these education advisors in places like Guangzhou (of Guangdong province) who are charging parents a small fortune to prime kids before the age of six to attend the best schools as they churn out future Xi Jinpings and Barack Obamas."

Contact the writer at yuran@chinadaily.com.cn

| A young girl has her hair done ahead of a fashion show. There is a growing demand for high-end children's fashion. Photos Provided to China Daily |

| More Chinese parents choose to shop for kids at stores selling expensive clothes like Dior in Plaza 66. Gao Erqiang / China Daily |

| Angela Wang who gained fame in a reality show walks down the stage of Fall 2014 Ralph Lauren Children's Runway Show in New York. |

(China Daily USA 07/10/2015 page9)

Today's Top News

- Researchers conclude Antarctic sea survey

- Trump signs order for a global 10-percent tariff

- Orders for robots surge after Spring Festival Gala

- Technology transforming creativity

- Iran to prepare draft of possible nuclear deal with US in 2-3 days: FM

- 7 Chinese tourists drowned after vehicle sinks in Russia's Lake Baikal