Indexes augur well for China

| A consumer chooses fruits at a supermarket in Handan, Hebei province. The consumer price index rebounded to a four-month high of 2.5 percent in May from a year earlier, the National Bureau of Statistics said on June 10. Hao Qunying / China Daily |

Easing producer prices in May to spur increased demand for industrial goods

China's consumer inflation climbed from an 18-month low in April to usual levels in May, while factory price deflation eased, indicating that the sluggish economy is slowly stabilizing.

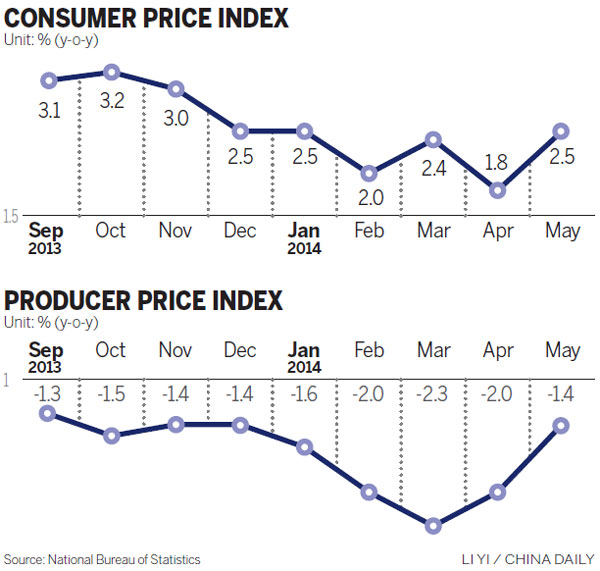

The consumer price index, the main gauge of inflation, rebounded to a four-month high of 2.5 percent in May from a year earlier, quickening from a worrying 1.8 percent rise in April, the National Bureau of Statistics said on June 10.

On a month-on-month basis, consumer prices rose 0.1 percent, ending the previous two straight months of decline, but are still lower than the 1 percent month-on-month gain recorded in January, the NBS said.

Subdued inflation levels are considered good for consumers and when an economy is in an expansion cycle, economists often welcome lower inflation. But when an economy enters a downward cycle, as China now is, low inflation often raises deflation concerns. Falling prices encourage consumers to put off spending and companies to delay investment, both of which act as brakes on growth.

Yu Qiumei, an analyst with the NBS, said the CPI growth was mainly fueled by higher food prices, particularly a 20 percent surge in the cost of fruits.

Food prices rose 4.1 percent over a year earlier, pulling the overall CPI up 1.35 percentage points, according to NBS. Unlike developed economies, food prices account for a bulk of the CPI in China.

Another key indicator that gauges the factory gate price, the producer price index, narrowed its decline by falling 1.4 percent in May from a year earlier, versus a 2 percent fall in April.

It is the 27th consecutive month of decline for the indicator, a fact that is particularly painful for upstream industrial manufacturers.

Kuang Xianming, director of the Research Center for Economy at the China Institute for Reform and Development, however, said that there are a lot of positives in the CPI data.

"A notable change is that the CPI has reversed the month-on-month decline recorded for the previous two months, signaling that the endogenous power of economic growth is increasing," he said.

"It's also a reflection of improving demand. The reserve requirement ratio cuts announced by the central bank will help unleash more demand," Kuang said.

Prices for housekeeping, processing and maintenance services jumped 7.1 percent and those for tourism surged 8.1 percent year-on-year, much higher than the average growth rate.

Kuang deemed these figures a good sign for the whole economy as they reflected the "continuous upgrading of the consumption structure."

The latest CPI and PPI data also confirmed a series of positive changes since May. Other encouraging data include faster export growth and rising Purchasing Managers Index readings.

Exports jumped by 7 percent in May from a year earlier, outpacing the 0.9 percent increase in April and 6.6 percent drop in March, pointing to an improved external demand.

Both official and private PMI for manufacturing sector saw a rise in May from April, indicating renewed vigor in the sector.

Analysts expect other key economic indictors in May, including industrial output, retail sales and fixed-asset investment that are due to be released on June 13, to further confirm the recovery trend.

However, they also expect the weak improvement might not be substantial enough to persuade policymakers to adopt wider range of stimulus measures to prop up the economy.

Premier Li Keqiang had in a recent meeting asked local government leaders to take more proactive measures to keep their economies in the pink of health. He said while the government does not put GDP above everything else, "it does not mean that we don't want a reasonable economic growth rate".

The central bank responded to that call by announcing a "targeted easing" policy on June 9. It will cut reserve requirements for some lenders by 0.5 percentage point from June 16, especially those that support agriculture and small businesses.

The targeted easing is a compromise among different government agencies, as the central bank has fended off calls from other agencies to cut interest rates to spur the economy, citing additional liquidity would only add to ballooning debt and prop up industries plagued by overcapacity, The Wall Street Journal reported on June 9.

The latest inflation data could give proponents of cross-board reserve requirement cut a fresh ground to argue, citing the current moderate inflation would provide sufficient room for the central bank to loosen its monetary policy without risking CPI to rebound above 3.5 percent, the upper limit the government can tolerate.

Consumer price increases "won't impact the scale and pace of the ongoing mini-stimulus," said Lu Ting, head of Greater China economics at Bank of America Corp. Lu forecast that inflation will be "around" 2.5 percent for the next several months.

Xinhua contributed to this story.

(China Daily Africa Weekly 06/13/2014 page21)

Today's Top News

- Chinese courts conclude trials of two criminal gangs from northern Myanmar

- China, Germany vital for a changing world

- Xi urges good start to 15th Five-Year Plan period

- Li: Partnership with Germany can help boost global growth

- Around 5% seen as likely GDP target

- Sixth round of Sino-US trade talks expected