Weak demand hangs over fair

| Exhibitors arrange displays at the China Import and Export Fair in Guangzhou on April 14. The spring session of the fair opened on April 15. Provided to China Daily |

Exhibitors confident that tide will turn in the long run

Orders placed at China's largest international trade fair, running from April 15 to May 5, will likely stabilize in the shadow of recent sharp export declines.

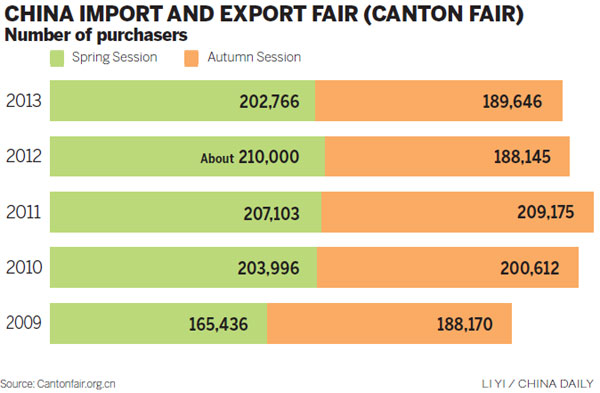

The Canton Fair, officially known as the 115th China Import and Export Fair, is expected to draw 200,000 international buyers, up from more than 180,000 in the autumn session when there was a drop in numbers, says Liu Jianjun, deputy director-general of China Foreign Trade Center at the Ministry of Commerce.

Chinese exports unexpectedly fell 6.6 percent year-on-year in March, following an 18.1 percent slide in February. Imports fell by the most in 13 months. China's official target is a 7.5 percent increase in trade this year. The biannual trade gala is generally seen as a barometer of China's economy.

There are grounds for optimism, Liu says, citing a global economic recovery and optimized product lines that helped strengthen Chinese sellers' core competencies. A weaker yuan is also considered an effective stimulus to exports but should not be counted on as a magic bullet for an economic boom over time, he says.

Liu warns several factors may add to uncertainty, including growing international trade friction and China's drifting away from lower value-added items such as textile production, which may erode its trade base in the short run.

He also mentions international economic sanctions against Russia and a rally in Taipei against the Economic Cooperation Framework Agreement between Taiwan and the mainland.

While some of the slide in exports was attributed to figures early last year being inflated by fake invoices, the general outlook fell a fourth month in a row, according to a survey by the Center for European Economic Research.

Some remain optimistic. Wang Tao, chief economist at Switherland-based global financial service company UBS AG, says China's modest export recovery remains largely intact, buoyed by an uptick in demand in the United States and Europe.

"The ongoing real appreciation of the yuan against the currencies of China's key trading partners and competitors will bring headwinds, but not enough to reverse the slightly positive gross domestic product contribution from net exports we foresee this year," she says.

Buyers have lowered expectations about signing deals at the Canton Fair, largely due to less European demand and a different sourcing model by US companies.

"We didn't see any pickup in demand among European economies, and the willingness to come for the fair remains low," says Frank Huang, general-manager of a Hong Kong-listed trading company. "Attendance of US clients may also stagnate since US firms place 80 percent of their orders through agencies."

First-quarter orders were slashed because of political turmoil in export destinations, says Gao Qiang, general-manager of Wilon International, a Jiangsu-based manufacturer of electronic machines.

"Our business in Thailand and Ukraine was hit by the ongoing strike and political upheaval. Honestly speaking, we don't expect the trend to be reversed simply by attending the exhibition," he says.

A fair regular, Gao has seen the export tides change, from when clients placed orders on an annual basis five years ago to the current three-month basis.

"The days when foreign buyers didn't bother to negotiate a price are long gone. With surging costs and heated competition in China, our margin was squeezed to just 7 percent last year from 15 percent five years ago," he says.

hewei@chinadaily.com.cn

(China Daily Africa Weekly 04/18/2014 page21)

Today's Top News

- PLA monitors US naval vessels transiting the Taiwan Strait

- Visit highlights China's importance

- China fortifies energy security as risks rise

- Taiwan separatists warned of action

- Intl students pledge to be cultural links

- Economy set to extend steady growth trajectory