Platform for action

| Shoppers at an upmarket mall in Beijing. The changing consumer behavior of the emerging middle class in countries including China, Indonesia and India is helping to power economic growth in the region. AFP |

Boao Forum unites global leaders to address key goals for Asia to maintain economic footing

As growth in Asia revs down, the future potential for the region to emerge as a global economic powerhouse remains as significant as ever.

A pressing concern for political, business and academic leaders gathering from April 8 in Hainan, China, for the Boao Forum for Asia (BFA) Annual Conference 2014, is how to turn that latent potential into active success.

This year's event is titled Asia's New Future: Identifying New Growth Drivers and will be held over four days. It will bring thousands of delegates - including current and former heads of state, ministers, CEOs, business executives, academics and Nobel laureates - to the island of Hainan in southern China.

For the first time in many years, the world is not banking on growth in Asia or the largest emerging economies to drive the world economy. On the contrary, most of the largest economies in the region have slowed down in recent years. The outlook for the near future remains uncertain.

China's official target for growth this year is 7.5 percent, the lowest it has been in many years. In February, China recorded an unusual trade deficit of $22.98 billion, the first since March 2013 and the largest in two years.

Indonesia, the giant of the Association of Southeast Asian Nations (ASEAN), is struggling with a crisis of confidence. The government's official expectation is for growth of 5.8 percent this year but widespread concerns about the country's fundamentals still remain.

Inflation last year climbed to 8.4 percent, double the recorded number in 2012. Economic growth fell both in 2012 and 2013 and the country's current account deficit has widened to $32.3 billion.

Meanwhile, ASEAN as a whole is moving toward greater integration with the creation of the ASEAN Economic Community, but concerns remain that truly strengthening the links between these countries might take longer than the 2015 deadline currently in place.

So the push for freer trade and greater integration has emerged as a key topic, says Fred Gibson, an associate economist at Moody's Analytics.

Japan has given its economy a shot of adrenaline, but it will have to give more to maintain momentum.

The Philippines has emerged as a growth leader both in ASEAN and the rest of Asia. A number of other countries like Vietnam and Myanmar could take a page from the Philippines' book as they start down their own paths of structural reforms, says Gibson.

Elsewhere in the region, economies are in flux while the United States is moving towards stronger growth and the US Federal Reserve starts tapering off its program of bond purchases that have poured billions of dollars of new liquidity into global markets for several years.

"All emerging markets are likely to come under a bit of pressure," says Gibson, referring to the continuous tightening of the Fed.

All these concerns will weigh on the minds and discussions of the global business, economic and policymaking elite that will be gathering along the waters of the South China Sea.

"I expect a slight lull in growth for a year or so associated with the Chinese transition and rebalancing and also for the time needed to adjust to a different monetary and interest rate environment. Then, I would expect robust growth from there," says Michael Spence, a professor at the Stern School of Business at New York University and winner of the Nobel Prize for economics in 2001. Spence will be a delegate at the event.

But there are risks. Among them are the continued and extended growth problems in advanced economies, reform inertia in India and the fact that the Japanese economy is "not fully making the transition on the structural side", adds Spence.

"When I add these up, they are not huge (risks) and I think the upside is more likely. Markets are quite pessimistic now, probably overly so in my judgment," he says.

A return to higher growth in India and the increasing size of Chinese growth along with the emergence of the middle class in China should combine with the contributions from the US economy to help drive growth.

"The main event is the Chinese consumer if the reforms go well in China," adds Spence.

Much depends on the emergence and expansion of a Chinese consumer class that could boost demand for products made around the world.

A few hundred million new and more generous consumers would be a boon to both the regional and global economies. Add to that the potential for countries like Indonesia to increase the buying power and size of its middle class and, eventually, a return to growth among other members of the G20 group of the largest emerging economies, and global growth would be back on track.

For Asia, and China in particular, taking over a much larger portion of global consumption would be like a return to its proper place in the world, says Chen Zhi Wu, a professor of finance at the Yale School of Management.

Three hundred years ago, Asia accounted for about 67 percent of the world's population and 61 percent of its GDP. By 2008, Asia's share of population was around 56 percent but only produced about 40 percent of global GDP, says Chen.

"Asia has a lot of growth potential," he says, particularly since a number of large economies including India, Indonesia, Malaysia and Pakistan have a lot of catching up to do and China's per capita GDP remains low.

"Asia can continue to grow for some years to come by taking advantage of both the trade and investment-friendly international order and the opportunities afforded by new technologies," Chen says.

"Urbanization, healthcare, financial services, leisure, entertainment and innovation are among the key drivers of future growth in Asia," he says. "The large population countries like India, Indonesia and China still have some distance to go in their urbanization process, offering growth opportunities for many industries and for the service sector. Health demand and care for the aged populations are also huge."

But achieving this promise of growth will require structural reforms that facilitate the reboot of economic activity.

Speaking in February, after a G20 meeting in Sydney when ambitious growth targets were set for the group, Indonesian Finance Minister Chatib Basri said emerging markets must tackle their own structural issues.

His own country, Basri said, has a current account deficit that needs to be addressed before a return to significant economic expansion.

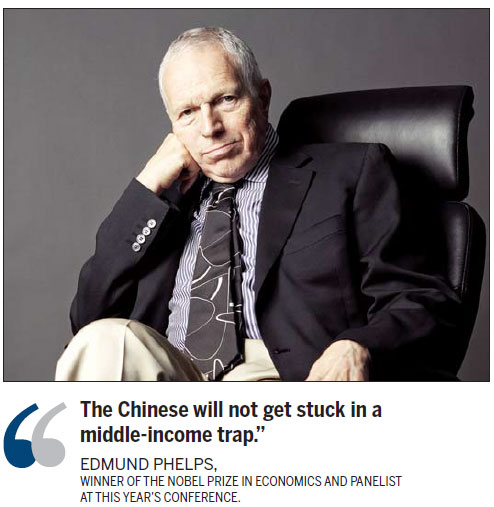

"At present, the principal drivers (of growth) have been relocation of labor to more productive uses, and the diffusion of superior technologies from pioneering companies to less-advanced companies," says Edmund Phelps, winner of the 2006 Nobel Prize in economics and professor of economics at Columbia University in New York. Phelps is also a panelist at this year's BFA conference.

"The danger is that these policies suffer 'diminishing returns' as countries run out of misallocations of labor and run out of backward companies," he says.

Phelps believes that even with the many challenges looming for the region, the prospects in the longer term are generally good.

A key focus for the professor is the middle-income trap, which is a threat to developing economies around the world. This is when fast-growing economies reach a certain level of income thanks to, for example, relatively cheap labor or plenty of natural resources, but then get stuck at that level.

Countries like Brazil and South Africa fell into this particular trap for decades, with GDP per capita failing to go above about $12,000. Countries often get stuck at those relatively low levels of GDP per capita when they fail to upgrade their economic advantages and cannot compete in global markets.

China's GDP per capita has risen rapidly in the past two decades to climb past the $6,000 mark in 2012 from just $314 in 1990. The middle-income trap is a key concern for economists, business executives and policymakers.

"The Chinese will not get stuck in a middle-income trap," says Phelps. "I have come to realize that the Chinese already show a fair amount of innovativeness, not just the entrepreneurship for which they are already well known."

Other emerging countries, he added, are in much greater danger. Russia, Venezuela and Tunisia, to name three, immediately jump to mind, he adds.

But while this particular pitfall is one that can stall growth, it is also one that can be avoided with some planning and thought. Canada is an example of a successful country that has managed to avoid falling into the trap. Mexico is currently working hard to get out of it. Avoiding the middle-income trap will be a key requirement for Asian countries to grow past the early stages.

A key focus for much of the discussion and debate over the next few days will be on avoiding this trap but, principally, on how to get regional economies in a position to grow in a strong and sustainable fashion. This is not necessarily an easy thing to do but requires a careful balancing, says the forum's secretary general Zhou Wenzhong.

"On one hand, Asia must improve the economic structure or the growth will stop. On the other hand, adjusting the structure requires a steady-growing economy," he says.

Karl Wilson in Sydney contributed to this story.

For China Daily Asia Weekly

(China Daily Africa Weekly 04/04/2014 page14)

Today's Top News

- PLA monitors US naval vessels transiting the Taiwan Strait

- Visit highlights China's importance

- China fortifies energy security as risks rise

- Taiwan separatists warned of action

- Intl students pledge to be cultural links

- Economy set to extend steady growth trajectory