Decoding the Chinese consumer

Many top stores in European capitals employ Chinese-speaking staff and have even installed China UnionPay payment devices so Chinese can buy goods with their own domestic bank cards.

Tom Doctoroff, chief executive officer Greater China and North Asia Area director for advertising agency J. Walter Thompson, based in Shanghai, says the desire for luxury brands reflects the fact that Chinese consumers can be summed up as "ambitious".

"The Chinese are almost uniquely ambitious when it comes to buying luxury brands, even more so than the Japanese. They almost see such purchases as a declaration of intent and a down payment on their future," he says.

"It is not just young affluent professional people making such purchases but people who are still not making a lot of money."

An odd quirk of the China luxury goods market is that it is the only one in the world where men, and not women, make the most purchases despite the sometimes hysterical focus on Prada and Dolce & Gabbana handbags.

|

||||

"Luxury is seen as a tool of trust lubrication and they are therefore exchanged as gifts," he says.

But Atsmon says it is wrong for outsiders to see luxury goods as a microcosm of the China consumer market.

"You might have some luxury jewelry brand selling, for example, that has three or four stores in London and each of them makes five sales to Chinese people in a day," he says.

"That might translate to 1,000 in a year. It might be a pretty big deal for the brand and grabs all the attention but those kind of numbers are small in comparison to what hundreds of millions of Chinese consumers are doing at home."

Doctoroff, who is also the author of What Chinese Want, Culture, Communism and China's Modern Consumer, argues there are fundamental differences between Chinese and Western consumers.

"In the West we are encouraged to define ourselves as individuals. In a Confucian society like China it is not like that. Individuals don't exist outside of their responsibilities to other people, whether it be their family or friends," he says.

He argues therefore that the motivations behind purchases are often different in China than in the West.

"If you take BMW, for example, it is positioned around the world as the ultimate driving machine which is all about the pleasure and thrill an individual will get out of the motion," he says.

"In China buying a BMW would be a reflection of your own power and a status symbol. How others see you rather than your individual pleasure."

But Mike Bastin, a leading expert on Chinese brands and a researcher at Nottingham University's School of Contemporary Chinese Studies, believes the differences between Western and Chinese consumers are no longer so clear cut.

"I think there is actually more independent consumer behavior that is less dependent on either society or family pressures. Chinese consumer behavior is now much more of a hybrid between Chinese and Western culture," he says.

One intriguing aspect of the consumption market is the increasing influence of women.

|

Left: Carol Liao, partner and managing director of Boston Consulting Group, says the desire to buy better products and services marks the Chinese out from the rest. Right: Mike Bastin, a researcher at Nottingham University's School of Contemporary Chinese Studies, says there is more independent consumer behavior in China. Photos by Yong Kai / for China Daily (LEFT) and Kuang Linhua / China Daily |

According to the recent McKinsey survey, participation by women in the workforce on the mainland is 67 percent, more than the 58 percent in the US, 48 percent in Japan and just 33 percent in India. It is also far higher than the 52 percent in Hong Kong.

Liao at BCG says women often play a major role in the spending decisions of households in all markets but in China independent women are increasingly making their own mark.

"In the Western world a man might buy a diamond for a woman as gift but in China quite a high proportion of diamonds are bought by women themselves. It is not that they can't wait for diamonds to be bought for them. They may just want more," she says.

All this is taking place in an environment where a savings culture still remains dominant.

If the Chinese are such big savers, it begs the question as to what types of expenditure they are foregoing?

Atsmon at McKinsey says it varies depending on the consumer.

"It is really hard to say. Even within a single province there are a lot of differences. In Guangdong, for example, you find that in Shenzhen people do a lot of outside dining, whereas in nearby Guangzhou, people do much less of that," he says.

A major interest of Chinese companies and foreign multinationals is the gray yuan with China facing one of the severest ageing demographics in the world. By 2050, one in three will be aged over 60.

Unusually in China, the people with the real spending power now are in their 30s and 40s and within the next 30 years this is likely to translate into older people being the biggest spenders.

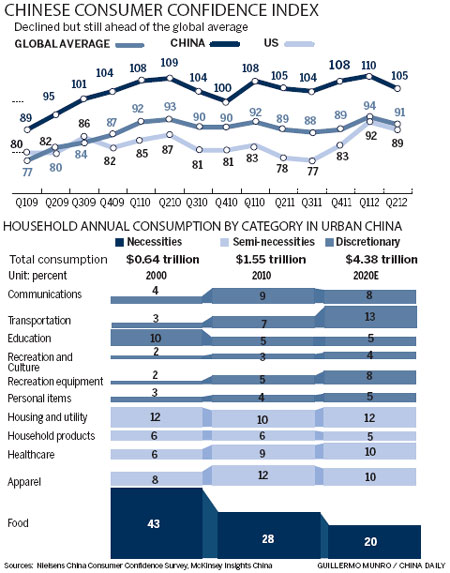

"There is going to be a lot of expenditure on healthcare and there is also going to be a focus on health food products and low fat diets. Today's major consumers are going still be the main consumers in the future but they will be obviously older," Liao at BCG says.

For now, however, the younger generation seems to be obsessed with the latest gadgets with people often queuing around the block at Apple stores when a new product has been launched.

But Atsmon at McKinsey & Co is not sure whether that makes them any different to consumers in the West, where Apple stores are often packed also.

"I would still question whether it is just a question of supply and demand. There are fewer stores and to a certain extent such products have a greater novelty so they attract more attention," he says.

With China being a new consumer market it is often difficult to detect what are the actual Chinese characteristics of behavior and those that are common to all developing markets.

Liao at BCG says Chinese people are currently only behaving in a way similar to the way consumers behaved in the markets around China 100 years ago.

"They are very much into value for money. They like brands but they are not a brand loyal. They want a bargain and they will shop around to get it. This is probably deep in the Chinese culture," she says.

Deng Zhangyu contributed to this story.

andrewmoody@chinadaily.com.cn

(China Daily 08/10/2012 page1)

Today's Top News

- Need for reshaping academic structure

- Shared Journey: Chinese new energy vehicles in Europe: competition or co-creation?

- Deep sea needs down-to-earth scientific research

- Deeper opening-up promised for steady growth

- China to rebalance growth with domestic demand boost

- Consultative suggestions provide policymakers with essential inputs to finalize five-year plan