Queen Elizabeth II, Prince Charles face taxing questions

(AFP)

Updated: 2006-10-25 10:11

LONDON - Senior British royals face questions over their financial affairs

after an influential parliamentary committee asked the government why their

estates benefit from major tax exemptions.

The Duchy of Lancaster, in north-west England, is said to be worth 310

million pounds (462 million euros, 580 million dollars) and provides income for

Queen Elizabeth II.

|

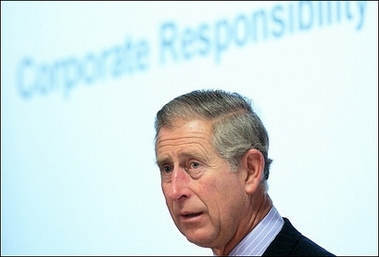

Britain's Prince Charles delivers a

speech at a Corporate Social Responsibility Summit at the Treasury

building in central London. Senior British royals face questions over

their financial affairs after an influential parliamentary committee asked

the government why their estates benefit from major tax exemptions.

[AFP]

|

The Duchy of Cornwall, in south-west England, is the main source of income

for her son and heir to the throne Prince Charles, and earnt him nearly 12

million pounds in 2004.

Both estates act as effective property companies but do not pay corporation

or capital gains tax.

Now lawmaker Edward Leigh, from the main opposition -- and traditionally

pro-monarchy -- Conservatives and chair of the Public Accounts Committee, has

written to tne finance ministry to question this.

Last year, the committee probed why the money Charles earned from the Duchy

of Cornwall had jumped 300 percent in the last decade.

It also issued a report asking The Treasury to justify both estates'

"favourable" tax position.

The Treasury replied and now the committee is calling for a "fuller

explanation", with Leigh asking whether "there is anything about the status" of

the duchies which puts them outside the tax regimes.

Both the queen and Charles pay income tax on money which they receive from

the duchies.

A spokeswoman for Charles's household, Clarence House, said that the Duchy of

Cornwall's accounts were already subject to "rigorous scrutiny" by the Treasury

and an independent auditor.

She said he did not pay corporation tax because he already paid income tax

and was not entitled to any capital gains.

The queen announced in 1992 that she would begin paying income tax, the same

12 months she described as an "annus horribilis" after a devastating fire at her

Windsor Castle home west of London and the breakdown of three of her children's

marriages.

|