TOKYO - U.S. Commerce Secretary Carlos Gutierrez said on Thursday

that U.S. legislation against China would not resolve thorny trade issues with

the Asian economic giant.

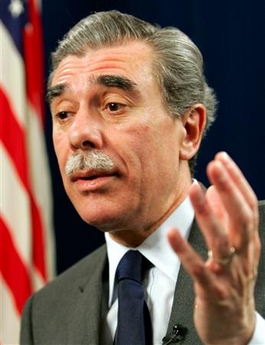

Secretary of

Commerce Carlos Gutierrez speaks during an interview in Tokyo March 30,

2006. [Reuters] |

|

|

|

U.S. lawmakers and manufacturers are becoming increasingly vocal about

Beijing's yuan policy which they say gives Chinese companies a huge unfair trade advantage.

Two U.S. senators on Tuesday proposed legislation to force the Bush

administration to get tough on China over its currency, while another pair of

senators sidelined a bill with a similar goal.

"It's about partnership and not managing trade through legislation,"

Gutierrez told Reuters in an interview during a visit to Tokyo after a trip to

China earlier in the week.

His visit to China comes ahead of high-level Sino-U.S. trade talks in

Washington on April 11, which will precede a visit by Chinese President Hu

Jintao to Washington on April 20.

Asked if there would be any concessions such as big purchases of U.S. goods

by the Chinese side ahead of the April talks, Gutierrez, said he believed one

act alone would not solve the issue.

"We want all partners to be more than a one-act situation," he said.

The newly proposed legislation by US Senate Finance Committee Chairman

Charles Grassley and Sen. Max Baucus would modify how the U.S. Treasury labels

currency regimes that it feels give countries unfair trade advantages.

The bill would make it easier to bring the authority of global institutions

like the International Monetary Fund to bear on countries that do not let

financial markets set relative currency values.

The other bill, authored by Sen. Charles Schumer and Sen. Lindsey Graham

would impose stiff tariffs on China for failing to address the yuan issue.

Schumer and Graham said they would delay a vote on their bill until September.

China ended the yuan's decade-old dollar peg last

July. The currency's exchange rate against the dollar has risen more than 3 percent since

then.