Economy

Crude act glorified by a soft term

By John E. Coulter (China Daily)

Updated: 2010-11-18 07:51

|

Large Medium Small |

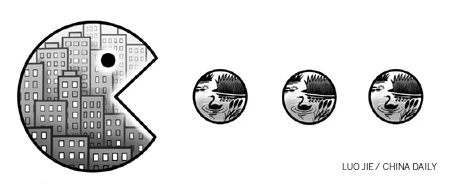

The term "quantitative easing" is new to people. The United States Federal Reserve (Fed) Chairman Ben Bernanke was pressured into taking drastic action after the US midterm election reflected the disenchantment of Americans with the Barack Obama administration. The arcane jargon means printing $600 billion of paper money to enable the government to buy its own bonds, which in turn means devaluing the US dollar against other currencies. "Quantitative easing" is supposed to soften the crudity of the act, just like "subprime" softened the crudity of toxic loans.

The Earth is a physically finite; it cannot grow. But we can transform its ores into precious metals and build buildings from common materials. We invented paper money as a medium of exchange to make the barter of these materials and services easier. Money became easier to trade in, save and carry. But money also made it easier to cheat. History teaches us compact wealth (money) is an object for greed.

Today, money can be created on computer screens. This and the inherent greed that money as compact wealth generates has given rise to a generation of financiers who think, talk and even believe in the numbers on their computer screens. It's another matter that many of the numbers are light years away from the real world.

Economics is practiced in the real world, a fact that has become alien to modern bankers. In a society revolving around Nasdaq, former non-executive chairman Bernie Madoff could take $100 million from you and return it with an extra $20 million a year later with no questions asked. But if someone had asked, he would have known that the extra 20 percent came not through bona fide wealth generation but by stealing another trusting investor.

The past several US administrations gave a free rein to "wizards" deregulating financial practices. But even traditional banking needs scrupulous supervision. Bankers discovered deposit multiplication a long time ago, and lent out a depositor's money again and again until it multiplied several times its value. Despite that, European bankers contributed to society by following strict bank reserve ratios and avoiding even conservative risks. What followed was the brashness of Wall Street as the baby boomers graduated out of the hippie era with junk bonds, leverage buyouts and the Michael Milken excesses.

Yet the 1980s didn't fully reflect how the banking industry leaders would behave in the following decades. A character in Wall Street: Money Never Sleeps puts it appropriately: "I once said, 'Greed is good'. Now it seems it's legal." The crux of the disaster that tipped over on Aug 17, 2008, was that risk-takers moved on after being rewarded sumptuously and without having to answer for their toxic lending.

This mindset became so entrenched among policymakers that when Washington tried to rein in Wall Street after Lehman Brothers went belly up to trigger the global financial crisis, it approached the same financial brains that had created the crisis in the first place to show the escape route. Not surprisingly, their solution was "we need more money". A stimulus package of almost $800 billion was hastily created, and no one has any inkling till today what that money represented in material wealth. There were more stimulants and bailouts, some not transparent.

Within months, economic forecasters were talking about signs of "recovery", though others thought it was "sluggish", or that consumer "sentiment" was low or there may even be a "double dip" recession.

China's prudent policies have put it in a relatively healthy situation. The US' unemployment woes, the "shellacking" Obama got in the midterm election and the EU's sovereign debt crisis are all good reasons to do a reality check on the economics we practice.

The Fed's announcement that it would print another $600 billion in currency notes is an open admission that the US was wrong in accusing China of having artificially devalued the yuan. When Bernanke was working on the Japanese economy some years ago, a British academic introduced the concept of "quantitative easing" as a solution. It did not work then and it can only be an act of desperation now.

When Europe got too small for all the continental powers, Europeans colonized the New World. In the first and still defining treatise on natural resources, economist David Ricardo (in 1817) pronounced water and what he called virgin land as free, because they were abundant. Two centuries later economists and their bosses gradually and grudgingly say such public goods, because of their exploitation, deserve to be taxed.

Our finite material world has always seemed boundless. When the early Apollo flights took photographs of the Earth from outer space for the first time, pioneering environmentalist Kenneth Boulding penned a poetic essay, Spaceship Earth. That was the time when the West called China "autarkic" - locked away from the global economy and the alarms raised by a book, The Limits of Growth, in 1972. But two monumental changes in the next seven years temporarily saved the global economy from The Limits of Growth prophesy.

First, China opened its doors to all the industries and environmental downsides that the West wanted to relocate to increase its profit. And second, financial markets went electronic and virtual, unhinged from any pretense that the dollar represented real goods and services to give us breathing space of a few more decades.

But by 2005, the blind pursuit of economic growth was changing to a more cautious stocktaking, and in 2007 the Chinese leadership wrote into the country's constitution a pioneering policy: Scientific Outlook on Development - the pursuit of economic and social progress by meeting the targets of building a well-off and harmonious society.

The Limits of Growth have become manifest in the global financial crisis. Its effects, however, will leave China relatively free of the deregulated financial madness and ready to play a pragmatic and scientific development role in the real world.

The author is an Australian research scholar collaborating with the Chinese government, and academic and commercial institutions.