JD Finance helps banks win 'young' credit clients

( chinadaily.com.cn )

E-commerce giant JD's financial technology arm JD Finance speeds up exporting its technological capabilities to banks by launching a package named the Big Dipper on Friday.

JD Finance claims that the package could help a bank build its online retail credit block from scratch as it is composed of a credit demand identification and matchmaking platform, a quantitative marketing system, a client identification system, a smart credit granting system, a big data risk control system, an Asset-Backed Securities cloud factory and a management platform.

"Currently, major clients for retail credit are those born after the 1980s or 1990s or even 2000s and those accustomed to the ’online’ life. However, many of them, without credit records, are not traditional clients covered by banks," said Xie Jinsheng, vice-president of JD Finance.

The population covered by the credit reference system of the People's Bank of China, the country's central bank, accounts for only 20 to 30 percent of the entire population, resulting in a huge group of people without official credit records, especially those young low-income people who are the target clients of consumer finance, according to a report published Wednesday on the WeChat account of the Tsinghua Financial Review.

Li Zhi, product manager of the fintech department of JD Finance, said that by 2017 JD Finance has accumulated the data of more than 400 million clients who use its finance service or payment system, in addition to data on e-commerce and logistics, which are the foundation of its risk-control platform.

Li added that the Big Dipper's credit demand identification and matchmaking platform will share more situations where credit is needed and will include more credit products offered by various banks.

Xie added that although retail credit has gradually turned out to be a strategically important section for medium- and small-sized banks, it would be very expensive for them to build an online retail credit system from scratch.

Xie said JD Finance hopes to help each bank using the Big Dipper lend 10 billion yuan more to retail clients and help it achieve a growth of 10 billion yuan in loan balance in three years.

By now, 30 banks including the Bank of Beijing and Bank of Jiangsu have joined an alliance, which relies on the Big Dipper to expand retail credit business, according to JD Finance.

Yang Tao, assistant to the director of the International Finance Bureau of the Chinese Academy of Social Sciences, said that technology's role in banks' transformation has been increasingly important and one possible model for fintech's future is letting fintech companies provide technological solutions, a return to being a technology firm nurturing financial institutions rather than being a financial company.

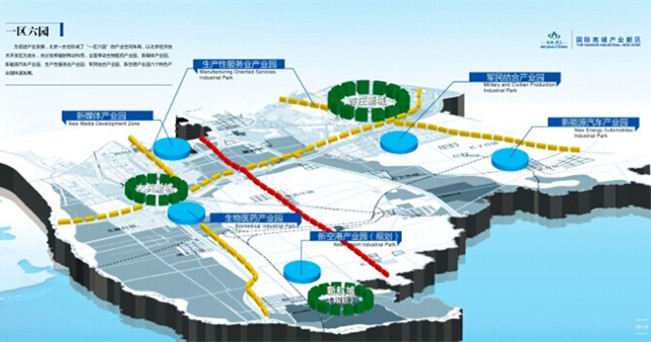

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500