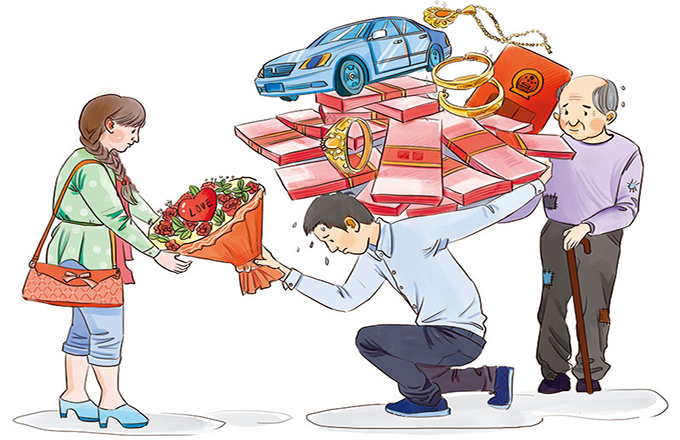

民间借贷(mínjiān jièdài): Private lending

Private lending, including widely denounced usury activities, is active in many places in China. Existing in a gray area-sometimes legal yet in many cases illegal-means the moneylenders are largely ill-supervised by the financial authorities, and indicates the financial industry is not open enough to meet the demand.

Although China has one of the world's largest banking industries, most Chinese financial institutions are State-owned, and it remains difficult and costly for private enterprises to get loans from banks.

While the central government has issued many financial policies to support small and medium-sized private enterprises, many State-owned banks are reluctant to lend money to private enterprises because of the higher risk than lending to State-owned enterprises.

This explains why private lending booms across the country.

Usury lending is not a crime according to the law. Yet lenders sometimes offer loans with interest more than four times the official bank rate, which is not protected by the law. Usury lenders usually resort to extreme means to get their money back, once the borrowers fail to return it in time.

The authorities must not sit idle in face of violence related to private lending. They must strengthen their regulation and supervision, protect the legal interests of both lenders and borrowers, and address the use of violence and blackmail.

Lawmakers should expedite the introduction of a law on private bankruptcy. The Enterprise Bankruptcy Law was passed in 2006.