Op-Ed Contributors

Normalize monetary policy

By Louis Kuijs (China Daily)

Updated: 2010-12-10 08:00

|

Large Medium Small |

In China, price shocks tend to be more easily absorbed than in many other countries because of robust productivity and wage growth, and core inflation is low to start with because of the rapid productivity growth in industry. Nonetheless, with inflation expectations having risen substantially and the labor market less loose than it used to be, macroeconomic policy will need to play an important role in limiting the spillover of food prices into other prices and wages.

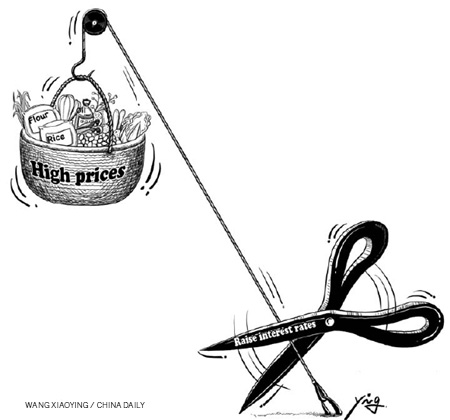

The risks of inflation and the need to manage inflation expectations strengthen the case for normalizing the monetary stance. Indeed, with little spare capacity in China's economy, respectable growth prospects, and concerns about too rapid housing price increases, this normalization will need to be a central objective of macroeconomic policy.

Thus, after the spectacular increase in monetary aggregates since the end of 2008, monetary growth will before long need to come down to rates broadly similar to nominal growth.

Moreover, relying more on interest rates and less on quantitative instruments such as credit controls would help reduce the underlying pressures on asset prices and reduce distortions. In October, People's Bank of China raised benchmark interest rates by 25 basis points. But they are still much lower than before the crisis and they will have to go up more.

Concerns about the impact of financial capital inflows are overdone and are no good reason not to increase interest rates. Thanks to China's largely effective capital controls, the amount of net financial inflows (called "hot money" in China) is actually very low compared to domestic credit creation. Also, the overwhelming majority of the increase in foreign reserves is not from net financial capital flows but from current account surpluses and net foreign direct investment.

However, the inflation outlook does not seem problematic enough to warrant surpressing overall inflation by administrative measures or postponing needed price adjustments. High inflation is distortive and not helpful. However, in rapidly growing countries like China, relative prices need to change to facilitate changes in the economic structure. In most emerging markets moderate inflation - of 4-5 percent - is not seen as a major problem.

Constraining inflation to be very low could hinder helpful relative price changes. For instance, China needs to increase administrative prices for resources and utilities - especially energy and water - to help adjust the structure of the economy. And, higher prices for agricultural products and higher migrant wages can help boost rural incomes and reduce urban-rural inequality, thus helping to improve the primary income distribution.

It would be really unfortunate if such desirable developments were suppressed because of concerns about moderate inflation. Thus, somewhat higher tolerance to modest inflation could help bring about some of the structural reform and change that the government is aiming for.

The author is a senior economist at World Bank Office in Beijing.