Op-Ed Contributors

Realty trouble in the offing

By Zheng Yongnian (China Daily)

Updated: 2010-07-24 06:46

|

Large Medium Small |

If housing prices are not checked and land issues not resolved they could threaten social stability and the national economy

Housing prices in major Chinese cities apparently increased at a slower pace in June thanks to the central government's strenuous efforts since March to cool the overheated property market. Some government departments have said the slower price rise shows the policies to rein in the property market are working.

But China's realty problems, accumulated over the years, cannot be solved in a short period. In fact, under the false appearance of "initial success" an even greater crisis is brewing, which will not only have complex implications for the national economy, but also be of far-reaching political and social significance.

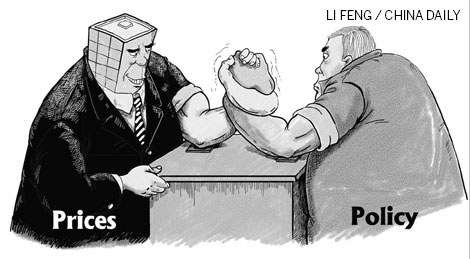

The "seesaw battle" between the central government and various vested interest groups reflect the nation is suffering from "real estate disease".

Speculators, banks and property developers all are gambling with the prospect of rising housing prices. By putting off the sale of new houses, prices have been controlled for now, while rentals have increased unexpectedly in recent months. But in many cities, such as Shanghai, Hangzhou, Shenzhen and Nanjing, banks never stopped providing loans to people buying a third house.

The real estate industry, which accounted for only a small part of China's GDP in the 1990s, has become a pillar industry in just a few years because of the machinations of vested interests.

From the economic structure's point of view, real estate is a basic industry because it involves so many upstream and downstream sectors, and the construction boom did contribute immensely to China's recovery from the global economic crisis.

So, a downturn in the housing market will not only hurt related industries, but also drain local revenues, which depend heavily on land transfer fees and the real estate.

In essence, similar to the financial industry in the United States, China's real estate sector is "too big to collapse". Therefore, it would not be an exaggeration to say that the real estate sector has hijacked the Chinese economy.

The vested interest groups actually are using all the skills at their disposal to increase housing prices. The higher the prices, the more profit property developers, banks and investors (speculators) make and the more revenue local governments can collect.