Op-Ed Contributors

Debate: Income disparity

(China Daily)

Updated: 2010-07-19 07:56

|

Large Medium Small |

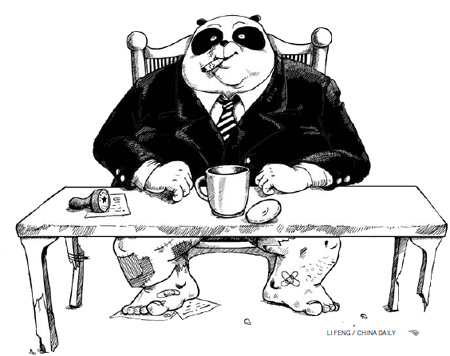

Is China a "rich country with many impoverished people"? An economist says "no" but suggests ways to better use government revenue, while a political scientist says the country could become one in the absence of a sound public finance system.

Jia Kang

Put taxpayers' money to better use

The debate over whether China is a "rich country with many impoverished people" shows the public is paying greater attention to the widening income gap and has made it important for the government to deal with the sensitive issue properly. The "rich-country, impoverished-people" contention may be baseless and illogical but it tells the government to pay special attention to social problems.

China has made great economic and social progress in the three decades of reform and opening up. The government is now "rich", according to the media, because its total financial revenue is estimated to rise to 8 trillion yuan ($1.17 trillion) this year. Such reports have evoked criticisms with many saying the government revenue collection imposes a heavy burden on enterprises and individuals. The "rich-country, impoverished-people" concept is an offshoot of such criticism, which requires a rational analysis.

First, 8 trillion yuan is an absolute number. The rational way to determine whether the financial revenue and distribution of national income is reasonable would be to look at a relative number: the proportion of the government's financial revenue in the national GDP.

The financial sector's data show the percentage of the State's financial revenue in the last three years' GDP was 27.6, 27.9 and 30. According to the International Monetary Fund, the global average is 40 percent. Even in developing countries, the average is about 35 percent, which means China's financial revenue is not high as a percentage of GDP.

Second, China is still going through rapid industrialization and urbanization, which requires plentiful infrastructure construction and huge funds for social development. At present, the proportion of China's financial deficit in GDP is about 3 percent and the proportion of outstanding national debt, about 20 percent.

Local governments, too, have huge debts, especially hidden debts. Together, the proportion of the public sector's outstanding debt in GDP is about 50 percent, compared to the national financial revenue's proportion of about 30 percent. That leaves a gap of 20 percent, and shows the financial revenue still falls far short of requirement. And when it comes to per capita financial revenue, China lags behind more than a hundred countries.

Although China's financial revenue has grown at a fast pace in recent years, we should not ignore that China has a huge population and a weak economic foundation. The challenges the government faces on the financial revenue and expenditure fronts are evident in the relatively high rate of deficit and the huge debts in recent years.

Third, the root of some people's discontent lies in the drop in people's income as a proportion of gross national income from 69.3 percent in 1996 to 57.5 percent in 2007. During the same period, the proportion of enterprises' profit to gross national income rose from 21.2 to 31.3 percent. At present, people's income is less then 10 percent of the enterprises' operation costs, whereas in developed countries it is about 50 percent.

There is no doubt that in absolute terms people's income has increased. But enterprises' profit has risen much faster. In the early stages of reform and opening up, the percentage of the government's financial revenue in GDP was more than 30, which fell to 10.3 in 1995. The percentage of the State's financial revenue in GDP has grown since then, and a part of it has been used to raise the wages of low-income groups.

Fourth, though the amount of the State financial revenue seems huge, only a small part of it comprises government expenditure. A large proportion of the amount is used as tax revenue returns and transfer payments to balance the financial gap between different regions, and to improve people's livelihood in western China.

In 2009, central financial revenue contributed 52.4 percent to the State's financial revenue when the central government's expenditure accounted for only 20.1 percent of the national fiscal expenditure. The central government's tax revenue returns and transfer payments to local authorities increased from 238.9 billion yuan in 1994 to 2.8621 trillion yuan last year as a direct result of policies to raise people's income.

Fifth, China's Gini coefficient has risen to 0.47, which reflects the huge gap between the rich and the poor. In this sense, there really are "many impoverished people" in the country. If the government wants to improve their living standards, it has to manage its financial revenue better and modify the income redistribution pattern. In other words, the authorities have to allocate more funds to help low-income groups by imposing direct taxes, such as personal income tax and real estate tax, on the people.

Sixth, the percentage of public finance in GDP is comparatively low in China. In 2007, China's public financial revenue accounted for 19.9 percent of GDP - the figures for 2008 and 2009 were 19.5 percent and 20.4 percent. All these figures are lower than the accepted international level. On the hand, the administrative cost in China is comparatively high and the efficiency of financial allocation rather low. Although a series of public finance policies and measures have been implemented in recent years, a lot still needs to be done. For one, the authorities should make government budgets more transparent. Besides, they have to reform the economic, administrative and political sectors.

During social transformation, public discontent and criticism are unavoidable. But the government should use the public anger as a call to intensify reform, strengthen management and make financial distribution more efficient.

The author is director of the Institute for Fiscal Science Research, affiliated to the Ministry of Finance.