By Wang Yifei and Wang Lu Updated: 2015-12-14

Listed enterprises of "new fourth board" of Shenzhen Stock Exchange incubation base settled in Karamay, Xinjiang Uygur autonomous region, on Nov 30, Karamay Daily reported.

The base will supply one-stop financial services to those enterprises in Karamay and in an even wider area listed in the new fourth board of the Shenzhen Stock Exchange. They will no longer have to make a long journey to Shenzhen for necessary formalities.

The term "new fourth board" first appeared in 2012. It aims to solve small and medium-sized enterprises' problems of financing. Regional equity markets are allowed to have an OTC capital market test.

The "new fourth board" is a platform to help SMEs take the first step into capital markets. It is a good choice because it has threshold terms lower than those of the "new three board" but nevertheless offers more financial services and intellectual capital, said Lin Tianyang.

It is reported that 31 regional equity markets have been set up in China up to 2015. The Shenzhen Qianhai Equity Trading Center has one of the largest financing scales among them. The center has 7,000 listed companies, 20 industrial clusters, and financing of more than 8.9 billion yuan ($1.38 billion). So far, nine enterprises in Xinjiang have joined the center, but none of them are from Karamay.

Xu Jianhui, vice mayor of Karamay, Wang Jun, Karamay district party secretary, Dang Wenju, deputy director of the municipal finance bureau, Cheng Yuandong, vice president of the City's federation of Industry and Commerce, and other leaders attended the inaugural ceremony.

|

|

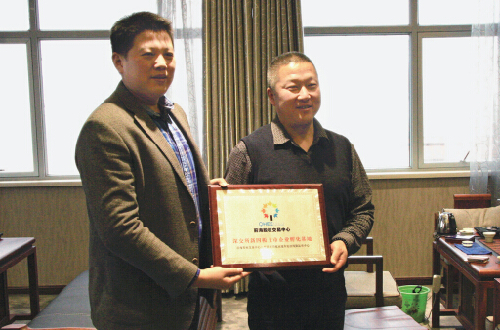

Lin Tianyang, director of the Karamay Jie Sheng Peking university entrepreneur training center, receives a plaque from Lin Tianyang, vice president of the new fourth board (regional equity exchange) of the Shenzhen stock exchange on Nov 30. [Photo/epaper.kelamayi.com] |

Edited by Peter Nordlinger