Riot insurance demand may rise, but complications remain

Updated: 2019-11-29 07:38

By Oswald Chan in Hong Kong(HK Edition)

|

|||||||

The demand for riot and civil unrest insurance policies should go up, but the market for this business insurance segment may not flourish, given the potential difficulties of creating an adequate financial pool to support it, industry experts said.

Hong Kong businesses of all sizes sustained various kinds of damage, including broken windows, graffiti and fires, during the five-month-long violent protests.

Companies that have been targeted are those with ties to the Chinese mainland, or seen to be supporting the government policies, including the Bank of China (Hong Kong); MTR Corp, Hong Kong's rail transport company; and retailer Best Mart 360 Holdings.

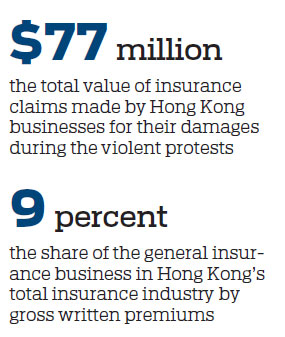

Hong Kong businesses are estimated to file HK$600 million ($76.7 million) in insurance claims relating to business damage and interruptions due to vandalism, arson and loss of business during the protests, according to the Federation of Insurers.

The amount to be claimed for a disaster is the third-highest in the city's history, overtaking the HK$325 million cost of the 2003 SARS outbreak. Losses from last year's Typhoon Mangkhut reached a record high of HK$3.1 billion, and Typhoon Hato in 2017 resulted in business losses of HK$858 million.

According to industry experts, Hong Kong businesses do not have adequate riot insurance policies or coverage although there are some rare stand-alone strike-riot and civil-commotion (SRCC) insurance policies available on the market. The main reason for the absence of coverage is that the demand for SRCC insurance has never been high enough.

Some shopping malls of major developers and the Legislative Council have purchased "property all-risk" insurance, ensuring all the fixtures located in these shopping malls and Legislative Council Complex could get coverage arising from losses due to riots and civil unrest.

However, individual shops may not buy this type of insurance, so they are exposed to all financial losses arising from physical property damage and consequential losses, such as business interruption, which could possibly force their businesses to cease.

Another example of property vulnerable to losses concerns private cars and public transportation vehicles. Although vehicle owners have bought comprehensive insurance policies, most of them exclude SRCC risks to cover property damage and loss. "We expect to see more SRCC coverage inclusion in many of the standard insurance policies gradually, while the standalone SRCC policies, being tailored to particular business needs, would take a much longer time to be popular," said Haywood Cheung, chairman of Target Insurance Co. The insurer will monitor market needs and reinsurance support available before considering developing such a product, he told China Daily.

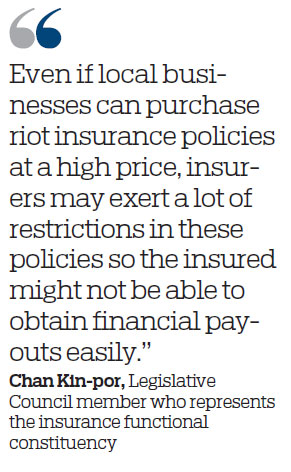

"I expect the demand for riot insurance to climb, but Hong Kong businesses may have to buy these insurance policies at a high price," warned lawmaker Chan Kin-por, who represents the insurance sector in the Legislative Council. "This is because if only high-risk businesses buy such insurance coverage, then an adequate financial pool cannot be sustained by sufficient premiums to support insurers to undertake such kind of insurance business," he said.

The general insurance business accounts for just 9 percent of the Hong Kong's total insurance industry by gross written premiums (GWPs), compared to 13 percent in 2013. Valued at HK$45.4 billion at the end of 2017, the city's general insurance business is expected to reach HK$56.8 billion by 2022, according to data from the website of Strategic Market Intelligence.

Personal accident and health insurance has the highest share of the business, accounting for a 33 percent market share of GWP, followed by other business lines such as liability (23 percent) and property (17 percent).

"Even if local businesses can purchase riot insurance policies at a high price, insurers may exert a lot of restrictions in these policies so the insured might not be able to obtain financial payouts easily," said Chan.

oswald@chinadailyhk.com

(HK Edition 11/29/2019 page7)