Hong Kong pulls out all the stops in world IPO race

Updated: 2019-08-02 07:41

(HK Edition)

|

|||||||

Hong Kong Exchanges and Clearing is going all out to retain its crown in the global IPO rankings. As Edith Lu reports, the SAR has set its sights on attracting enterprises in the Asia Pacific to list in the city, and is looking to Shanghai's new technology-focused board to attract more investors to its fold.

What is an IPO?

An IPO (initial public offering) refers to a company's shares being offered to the public for the first time. IPO shares are coveted as windfall opportunities by retail speculators. "Hot IPOs" like Alibaba and Facebook took off like rockets in public trading. Such legendary launches drive IPO fever.

When an IPO is significantly "oversubscribed" - a situation in which demand for the new shares exceeds the number of shares issued - the chances of its share price rising in early trading are high.

Retail speculators scramble for such quick profits. That is facilitated by brokers, who offer "margin trading", in which the retail investor borrows from a broker to buy shares, creating the opportunity for higher profit volume - but while creating the risk of a financial loss greater than the investment.

The underwriter for an IPO typically underprices the shares to mitigate risk, and to pitch large pre-IPO placements to private-equity and institutional funds. The underwriter's job is to sell all the issued shares. Share valuations factor data from financial records and the price-to-earnings multiples of industry peers.

Such pre-IPO pricing has to balance market liquidity, the issuers' capital-raising needs, and the downside risk to serious investors. The intrinsic market value of the stock eventually gets established in open trading. Companies that plan an IPO usually hype publicity to generate investor excitement.

Biggest IPO miss

Hong Kong Exchanges and Clearing (HKEX) vacillated on Alibaba's IPO. It fretted about minority-shareholder rights in the dual-shareholder-class proposal. The dual-shareholder system is a mechanism favored by digital entrepreneurs to retain company control and incentivize senior management while soliciting public funds to grow.

Alibaba listed on the New York Stock Exchange (NYSE) in September 2014, and holds the record for the biggest IPO in history, at $25 billion. The shares rose 36 percent to $92.70 in opening trading, above the opening price of $68. Alibaba sold 48 million more shares to satisfy demand.

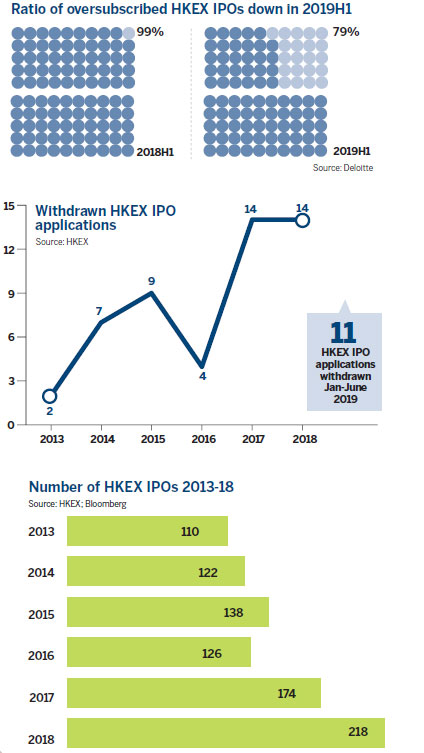

Hong Kong ranked as the No 1 IPO financial center in 2015 and 2016, when financial and real estate companies dominated the bourse. A Deloitte report shows technology companies accounted for only 10.5 percent and 6 percent of the total funds raised in the HKEX over the two years.

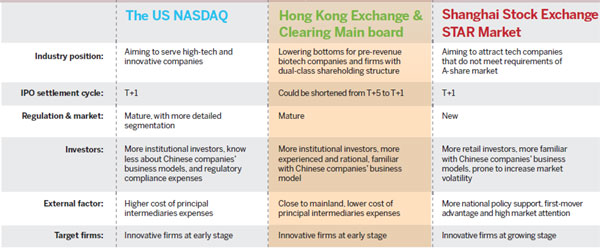

Digital tech companies are assessed for future performance, often going for an IPO with scant revenue and profits. That was a new phenomenon for risk-averse Hong Kong bankers and funds. The HKEX lost out on the hyper valuations of the digital economy to the less-inhibited London and New York financial markets.

HKEX wakes up

The HKEX was criticized by some local businessmen, the financial press and investment funds for lagging behind the stock exchanges of New York and London in leveraging digital-economy opportunities.

The bourse reviewed its rules, driven by the loss of Alibaba, for mainland digital companies in the IPO pipeline. It took four years of internal wrangling before the revisions were agreed upon.

Among the reforms were acceptance of dual shareholding; secondary listings for companies already listed abroad; and pre-revenue access for biotechnology companies. These reforms re-energized the HKEX, catapulting it to the top global IPO spot in 2018.

The changes have made Hong Kong a possible option for Alibaba's secondary listing. HKEX Chief Executive Charles Li Xiaojia indicated in May that the flotation, if confirmed, should "come as no surprise and is only a matter of time."

Alibaba proposed in June a one-to-eight stock split to help in the issuance of new shares - a move usually taken by companies before new shares are issued.

The highly anticipated listing of Alibaba could be a good thing for Hong Kong, reflecting that the ecosystem of technology firms in the city is becoming more mature, said Edward Au, co-head of Deloitte China's national public offering group.

Au said the development will motivate other technology firms that have listed in the US, such as JD and Baidu, to return to Hong Kong or the mainland.

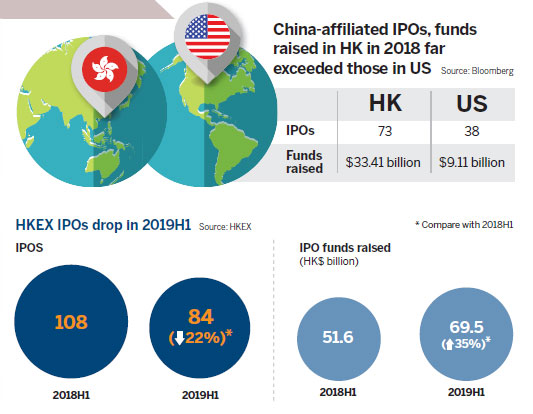

In 2018, 36 IPOs from the technology, media and telecom sector accounted for more than a quarter of the 133 IPOs on the main board. It attracted two dual-class shareholding companies - Xiaomi and Meituan-Dianping, both super-large-cap (above $1 billion) listings.

IPO fever wanes

By the end of June, Hong Kong had raised HK$69.5 billion ($8.89 billion) in IPO funds, the highest for the same period since 2015. But the number of IPOs was just 84, a sharp drop from the 108 IPOs recorded in the same period a year ago.

Macroeconomic turbulence is seen as a drag on the Hong Kong IPO market.

An IPO by logistics property developer ESR Cayman was delayed due to the uncertain climate caused by the Sino-US trade dispute and Brexit. The world's largest brewer, Anheuser-Busch InBev, also decided to shelve its planned $9.8-billion IPO of its Asia-Pacific unit.

Hong Kong is expected to be down to third place in global IPOs in the first half of 2019, lagging behind the New York Stock Exchange and the tech-heavy Nasdaq Stock Market, with the Shanghai Stock Exchange (SSE) expected to rank No 4, according to Deloitte.

The NYSE recorded three listings of over $1 billion raised, and the Nasdaq saw two such listings. The Hong Kong and Shanghai stock markets registered only one each.

The potential secondary listing of Alibaba is likely to lift the morale of the market in the second half, as the offering size may exceed $10 billion.

Au said it will provide an "impulse" for Hong Kong to reclaim its IPO crown globally, especially if market sentiment is encouraging in the second half of the year.

New Shanghai tech board

Shanghai's new technology and innovation-focused board, officially known as the STAR Market, began trading last month with the first batch of 25 companies making their debut. All the 25 stocks saw their prices more than doubled at the close of the first day of trading.

The introduction of the Shanghai STAR Market is a first step for mainland digital companies.

Deloitte estimates the number of IPO listings in the STAR market could be 90 to 110 this year, raising up to 100 billion yuan ($14.53 billion). Including its main board, the SSE could raise about 190 billion yuan in 2019.

As to concerns that the Shanghai bourse remains a "threat" to the HKEX, Li said it's not a simple competition. Li said he believes the STAR Market will energize the mainland's capital market. With more money going into the capital market, investors will also look at Hong Kong, he said.

Li said in February this year that the STAR Market, together with dual-class shareholding companies, could be included in the stock connects.

Tap international capital

Deloitte expects some 200 enterprises to go public here by the end of 2019, which would raise between HK$180 billion and HK$250 billion.

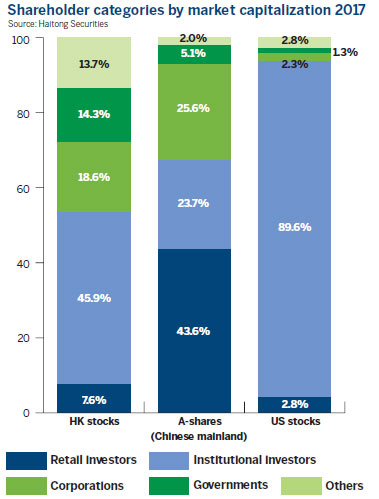

Au believes the Hong Kong market can continue to attract international investors, as the city connects strongly with both the mainland and global markets. "As long as Hong Kong can take advantage of its diversity and play a role that mainland cannot, its IPO market has no concern of being marginalized," he said.

He noted that for now, Hong Kong should strive to maintain liquidity by attracting more international capital. Once the new companies in the Shanghai STAR Market grow to a certain size, they will need more capital to expand globally. Then they could seek a secondary listing in Hong Kong to access international capital.

The HKEX wants to introduce a program for IPO cross-trading between Hong Kong and mainland, with the Primary Equity Connect. Li has been trying to attract more global enterprises and investors to Hong Kong, leveraging the mainland's excess liquidity.

But now, since Shanghai is focusing on developing its own startup IPO capacity, the HKEX says practical implementation of the two-way flows is still pending.

Asia-Pacific strategy

The HKEX's three-year plan, unveiled in February, announced facilitating international capital to China and Asia, as well as Asian capital, to global financial markets via Hong Kong.

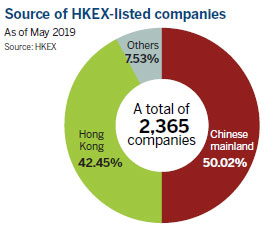

The exchange said it will further improve its listing regime to better attract Asia-Pacific enterprises, as most of the stocks traded in Hong Kong are currently from the mainland.

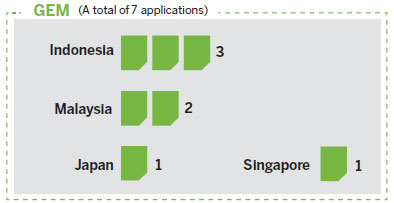

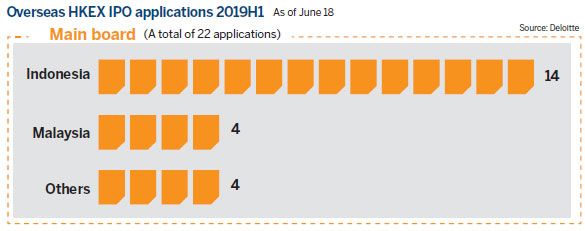

Data from Deloitte confirms the number of overseas new listings fell 36 percent for the first half in Hong Kong, mainly from companies out of Indonesia, Malaysia and Singapore. Most IPOs were from the property sector.

It is hoped that more Southeast Asian companies will consider the city for their respective IPOs, as they have business relationships with Hong Kong companies. It makes sense for them to list closer to their business contacts and customers.

Houston Huang Guobin, head of global investment banking for China at JP Morgan Chase & Co, attended the IPO promotion meeting in Vietnam, organized by HKEX years ago. He sees such events as effective channels to connect with local companies in Southeast Asia.

"Intermediaries such as investment banking and accounting bodies could introduce successful IPO cases, and share experiences with companies interested in listing in Hong Kong," Huang said.

There is also more potential for new-economy companies from Southeast Asia and India to list in Hong Kong, as technology is developing rapidly there, in the relatively less-sophisticated financial environments.

HKEX is streamlining the process of IPO listings and shortening the IPO settlement cycle. Currently, trading starts five days after the pricing and settlement of the IPO in Hong Kong - longer than it takes in New York and London.

"Our vision is to be the global markets leaders in the Asian time zone - connecting China, connecting the world," the HKEX's Li said, summarizing the bourse's long-term goal in its three-year strategic plan.

Contact the writer at

edithlu@chinadailyhk.com

(HK Edition 08/02/2019 page8)