Making HK economy 'cashless' no easy task

Updated: 2018-05-28 06:45

(HK Edition)

|

|||||||||

The city has a suite of mature payment systems. E-payment evolution here will be very different from that on the mainland.

Is it really the case that the progress toward a "cashless" society in Hong Kong is far behind that on the Chinese mainland?

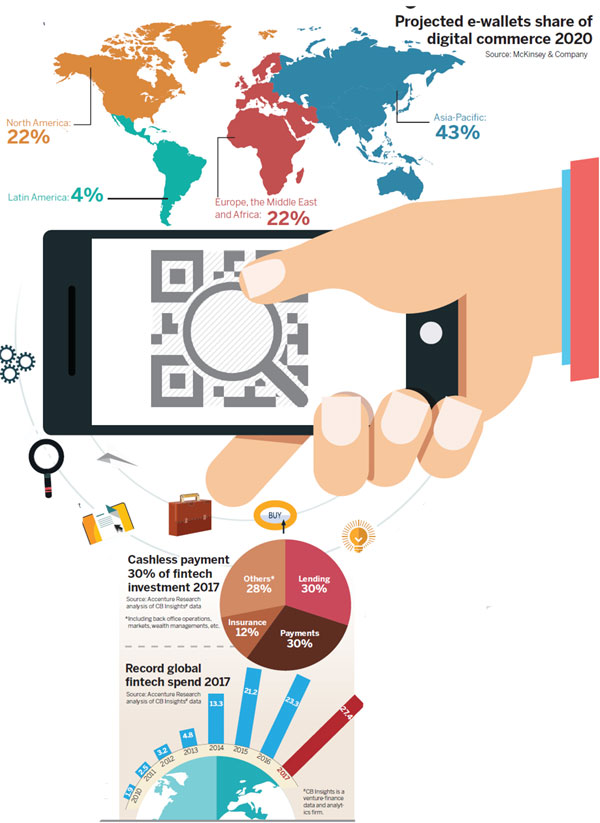

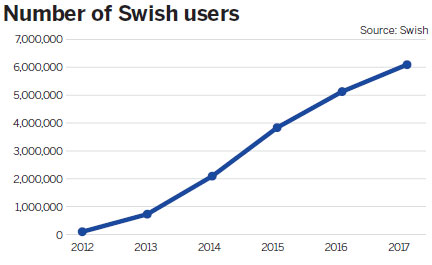

Varying electronic payment development: The electronic payment development in different economies varies. Their models and paces depend on various factors, such as their own conditions and the needs of their citizens. Electronic payment tools include credit cards, debit cards, stored value cards, mobile payment, etc. The leapfrog development of mobile payment on the mainland is something unique and rare. Thanks to technological innovations, there have been continuous enhancements to mobile-phone features, making it possible for mobile phones to become a new payment tool. The availability of smart phones at affordable prices has also allowed mainland users to opt for payment with mobile phones directly, bypassing conventional payment tools such as checks and credit cards which are yet to become popular on the mainland. Let's look at the situation in other developed economies. Take the example of Sweden, the most "cashless" society in the world, the usage of mobile payment (Swish) by its citizens is about 60 percent. This is lower than the 97 percent and 80 percent usage of credit cards and debit cards respectively. This shows that the "cashless" payment market is still dominated by conventional electronic payment tools.

Hong Kong habits: Electronic payment has been widely accepted in Hong Kong with different kinds of popular "non-cash" payment options available in the market over the past two decades or so. Hong Kong people choose the type of payment tools according to their needs wisely. They will use credit cards when making large-value payments in order to earn reward points, and Octopus cards when taking public transport or making purchases at convenience stores for speedy payments. For the recently emerged mobile payment to grow its footprint in Hong Kong's relatively mature payment ecosystem with consumers accustomed to established payment modes, its development process will definitely be very different from that on the mainland.

Lack of incentive: Another contributing factor is convenient cash withdrawal and deposit services as well as safety in using cash. Hong Kong has a high concentration of automated teller machines. There are more than 3,000 ATMs in Hong Kong. As for the mainland, the largest denomination of notes is 100 yuan. One would need dozens of notes to make a large-value payment of several thousand dollars in cash. As a result, mainland consumers turn to electronic wallets. Some also think that as the counterfeit rate in Hong Kong is only one counterfeit note in every million notes, which is a very low level in the world, it is relatively safe to use cash.

The experience in the mainland and elsewhere has provided useful reference for us. Our view is that while Hong Kong strives to foster the development of a diversified, efficient and secure electronic payment ecosystem, we should also give due regard to the habits and needs of merchants and the general public, accepting both cash and various electronic payment methods.

Tourism concern: One sector of concern is tourism. In 2016, there were some 56 million visitor arrivals, bringing revenues of over HK$290 billion. When doing business in Hong Kong, we strive to provide the greatest convenience possible for visitors from around the world. A diversified and inclusive approach means that visitors can spend in such a manner which is most suitable and convenient for them. In an extreme case of going cashless - where Hong Kong only accepts local electronic payment methods and even rejects Hong Kong dollar cash - the tens of millions of visitors coming here every year will experience great woes while trying to settle their bills. Fortunately, businesses in Hong Kong have acted swiftly, with an increasing number of shops accepting various mainland and overseas payment tools. From this development, we can see whether or not a payment tool would become popular depends on the dynamic interaction between the stakeholders in a given payment ecosystem.

(HK Edition 05/28/2018 page7)