In vogue - 'mining' a fortune at Huaqiangbei

Updated: 2018-03-16 06:17

By Chai Hua in Shenzhen(HK Edition)

|

|||||||

A new fad has been revving up at Shenzhen's Huaqiangbei - one of the country's most famous electronics hubs - with buyers fighting it out as they snap up Made-in-China cryptocurrency miners.

The craze for the new gadgets has seen sales going through the roof lately, vastly eclipsing those of i-Phones and other electronics paraphernalia on which Huaqiangbei made its name, with clients swarming in from all corners of the world.

Looking like a small computer mainframe, a cryptocurrency miner has a powerful processor with more than 100 professional chips, so that they can work out complex math calculations which is used to validate cryptocurrency transactions - a process called mining. When they solve a calculation, a mining fee is earned. Lured by a high return, many people start to build professional "mining farms", so the demand has surged.

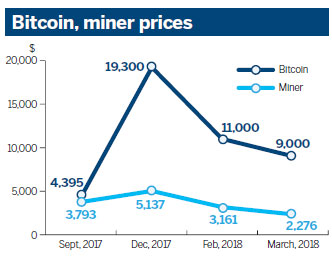

With cryptocurrency prices reaching dizzying heights last year, the demand of miners boomed, fueling a red-hot market as vendors at Huaqiang North Street jumped on the bandwagon.

Deng Lipeng, a salesman at one of the stores dealing in cryptocurrency miners, told China Daily he used to sell computers but had to quickly change course or risk being belted out of the crowd.

His shop - on the fifth floor of SEG Electronics Market - one of the largest at Huaqiangbei - suddenly found itself a hive of activity, with the once much sought after brand computers pushed to the back counters, replaced by these cryptocurrency miners.

The notorious marketplace has become one of the largest collection and distribution centers for the latest gadgets - wrapped up in boxes ready to go anytime.

Strangers to the world of cryptocurrency may have trouble making out what it all means against the background of the old traditional electronics stores. According to Deng, it's no small deal at his 20-odd square-meter store, which manages to sell up to 500 miners monthly to small and mysterious groups of customers monthly - doubling that of computer sales.

Besides, clients usually pay upfront, usually in cash, as the supply can't meet the demand.

Buyers find the Huaqiangbei market convenient as they can pick up the devices right away, while they've to wait for at least two months for delivery if they order them directly from miner companies.

"During the peak hours, I have to attend to 10 customers each hour," said Deng. "And, half of them are foreigners, including Russians, Thais, Europeans and others."

Manufacturing ability

Behind the fledgling miner business at Huaqiangbei is the rise of the city's miner manufacturing capability, and it's leading the world as the base of the gadget's production chain.

"About 90 percent of the world's cryptocurrency miners are from Shenzhen, especially Huaqiangbei," said Zheng Huajiang, who used to run a mining farm in Sichuan province and has now invested in a miner factory in the city.

"The city has covered almost all the processes in miner manufacturing, including chip design, assembling and making related electronic components," Zheng told China Daily.

Shajing - a town in Bao'an district on the outskirts of Shenzhen and just a two-hour drive from Huaqiangbei - has emerged as a national base for producing miners.

The factory of the world's largest miner company - Beijing-based Bitmain Technologies - is located in Shajing, where many mid-level factories and distributors have gathered. Some of the factories used to assemble computers and mobile phones, but about half of their production ability has now gone into the production of miners, said Zheng.

According to the entrepreneur, his factory's output has gone up from 20,000 units of miners a month in early 2017 to 100,000 units at present.

Cooling down

However, jittery about the prospect of the trade being outlawed in the country in future, cryptocurrency mining vendors at Huaqiangbei are keeping old banners and products, ready to return to the computer business or "whatever that rakes in a profit" if that happens.

Deng said he is concerned that someday selling miners would be forbidden in China, given that the government has toughened regulations over digital cryptocurrency to rein in financial risks.

Although China's top financial regulator has not directly banned producing or trading mining machines, authorities have been shutting down all virtual currency exchanges in the country since last September.

Earlier in January, the nation's top financial regulator intensified the crackdown by telling local governments to encourage bitcoin miners to cut production of the cryptocurrency, forcing many of them to quit the business.

The governor of the central bank, Zhou Xiaochuan, said at a news conference during the two sessions that the People's Bank of China opposed direct transactions between the bitcoin and the renminbi, its fiat money. Nor would it endorse use of virtual currencies for retail payments.

There are also some large mining farms that have moved part of their operations overseas where there's good demand.

As some small farms close, a number of second-hand miners have flooded the market, dragging down the prices.

"Take the newest AntMiner S9 for example. At one time, it carried a whopping price tag of 30,000 yuan ($4,742) but now, it has come down to 14,400 yuan," said Deng.

He also found buyers of miners at the SEG market have started comparing prices and bargaining. In the past, they were only worried about whether they could get one.

Bitcoin values also slumped, from a high of $19,378 in December to under $9,000 this week.

grace@chinadailyhk.com

(HK Edition 03/16/2018 page8)