Universal pension scheme (UPS)

Updated: 2018-02-12 07:00

(HK Edition)

|

|||||||||

Yes

UPS ensures dignified living

The government has just published the latest poverty statistics for Hong Kong. The numbers have reached a record high in recent years; about one million people live in poverty.

Further analysis of the poverty figures indicates that the increasing number of elderly people with low or no income, especially single or elderly couples, constitutes a substantial proportion of the increase. Thus the key to reducing poverty is to provide sufficient income for elderly people in Hong Kong.

Ensuring basic income for all elderly people should be agreed by all the major stakeholders in Hong Kong, including the government. We suggest that providing a universal pension scheme (UPS), that is giving all elderly people a basic income without any means testing, is the most effective way of tackling the issue of elderly poverty. A universal pension is a simple and effective way to ensure all elderly people have enough income. The beauty of this system is that no elderly people will be left out because of the stigma or lack of knowledge in applying for other assistance. It helps save the administrative cost of means-testing and also avoids disincentives on saving or employment for the elderly.

The government has insisted that providing income protection to elderly people should be achieved by means-tested income support. One rationale is that many of the so-called poor elderly people have considerable savings - hence current poverty statistics may have exaggerated the problem. As the argument goes, the income-support system should only focus on the "needy". Accordingly, the new old-age support system reform proposed by the government, namely the Higher Old Age Living Allowance (OALA), will give elderly people about HK$3,500 a month but is accessible to those who have assets valued at less than HK$144,000 (singleton) or HK$218,000 (elderly couple) only.

However, is it really true that elderly people having assets more than several hundred thousand really do not need the same level of protection as the recipient of Higher OALA? The experience of many social workers tells us most elderly people need a considerable amount of basic saving for a rainy day.

Instead of maintaining basic living by using up all their savings and then applying for government assistance, elderly people will tend to limit spending to preserve their nest egg. During the current debate on a universal pension, critics typically quote some very famous elderly rich people, such as Li Ka-shing, to demonstrate that not all elderly people really need the income from a universal pension. We do not deny that the income from universal pension may be peanuts to some rich people, but is it cost-effective to design and implement a means-testing system just to screen out a small number of people who may anyway be very unlikely to apply for the cash allowance? As a matter of fact, more than 10 percent of eligible elderly people do not apply for the non-means-tested Old Age Allowance (fruit money) from the government, which means the government does not need a means-testing system for barring rich elderly people from the proposed universal pension.

Another strong criticism of the universal pension system is the financial sustainability of giving all elderly people a cash allowance. However, even leaving the existing system intact, its financial sustainability is still questionable as it is financed by general revenue. By contrast, the financing mechanism of the universal pension proposal has factored in financial sustainability. Whether it is from the MPF contributions or from a designated tax, the system is financially sustainable for the next 50 years according to actuarial projections.

When it comes to pension design, people usually indulge in ideological debate, such as whether pensions should be welfare or a right, and how much respect should be given to elderly people. Notwithstanding the meaning of such discussion, a UPS should be supported as it offers a pragmatic solution to many of the problems of our current old-age support system. It involves low administrative work and cost. It is stigma-free while being able to provide stable income to those "in-between" classes who dare not spend their savings while retired. It is also more financially sustainable and helps build social cohesion in society.

I believe a universal pension is the best feasible way to provide income protection for elderly people in Hong Kong.

No

HK's tax regime can't support UPS

It is not a good idea for Hong Kong to adopt a pay-as-you-go universal pension scheme.

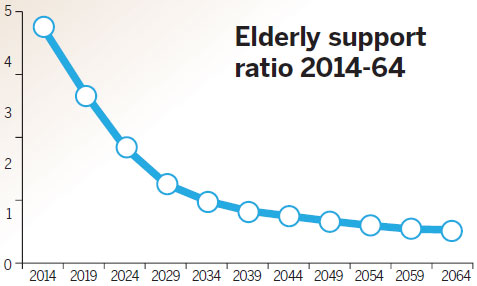

The main feature of such schemes is that the current working population would be taxed and the proceeds used to pay people who have retired. Few if any of the tax proceeds would be saved. That means the amount of money the retired receive depends critically on the population structure - the support ratio for the elderly, or the ratio of the number of working adults divided by the number of retirees. Hong Kong's population structure is one of the most extreme in the world. Life expectancy is among the highest globally but the city's total fertility rate - the number of children an average woman bears in her lifetime - is one of the lowest. That means there will be more and more old people over time, but less and less working adults. The accompanying shows projected support ratios (population aged 15 to 64 divided by population aged 65 or above) over time, based on Census and Statistics Department data.

Hong Kong's situation is very similar to that of Japan. Both have very high life expectancies and low birth rates. But Japan reached this extreme demographic structure a couple of decades earlier than Hong Kong. So today's Japan can be regarded as Hong Kong's future. In the early 1990s, Japan's government debt was close to 50 or 60 percent of GDP but now it is about 230 percent. Much of the reason is the difficulties of supporting the large number of retirees.

Quite a few European countries have also run up huge budget deficits because of population aging. In fact it is fair to say a significant part of the euro crisis is due to the budget deficits created by the aging population.

As we can see, the support ratio will worsen over time. That means either contributions by working people must rise continuously or benefits received by retirees have to fall over time to balance the budget.

Financing payments through government loans would not really solve the problem as this amounts to imposing a greater and greater burden on future generations. In places where the population structure is not so extreme, perhaps a universal pension scheme would work better, but this is not the case for Hong Kong. In short, the universal scheme is a bad deal.

The Mandatory Provident Fund scheme does not suffer from this problem because people save for their own retirement. There is no intergenerational transfer. So population structure does not matter here. It is not hard to show that the implicit rate of return for the universal scheme is generally lower than that of the MPF. However, the MPF has to be supplemented by special welfare support for low-income people. A welfare scheme with a means test can be introduced. In fact, the universal scheme is a form of welfare without a means test. The limited resources available would be shared by rich retirees who don't need the money.

A good retirement protection scheme should be sustainable and won't induce huge budget deficits. There should be enough money to support some basic living standards for the retirees. There is no free lunch. The amount one has upon retirement depends on how much people contribute when young. The implicit rate of return should be decent enough.

The MPF is sustainable and can provide the main source of basic income for retirement. People are different. It is not appropriate to use one scheme to fit all.

The original design of the MPF, however, has a serious flaw that has to be corrected. Choices for the fund managers were made by employers, not employees. This brings some moral hazard issues, resulting in higher management fees and less satisfactory investment returns. I pointed this out some 20 years ago in a book of mine. The experience of the MPF shows this is exactly true. Now the government has taken some modest steps to rectify this problem.

Moreover, people should plan on saving and investing more on their own when they are young. Also, retirement is not just about money. Society should be prepared that there will be high demand for medical care and personal care in future as population aging goes on.

There are indeed interest groups who have acted very politically but not necessarily rationally to push for a universal pension scheme. Sometimes they refuse to acknowledge the unsustainability of the scheme. They are also not very good in making quantitative financial projections of retirement schemes. Some politicians who understand very little of the implications of various retirement schemes just want to hijack whatever they like in order to take advantage of populist sentiments in society.

(HK Edition 02/12/2018 page7)